欧股创新高背后:资金从美股向欧股轮动

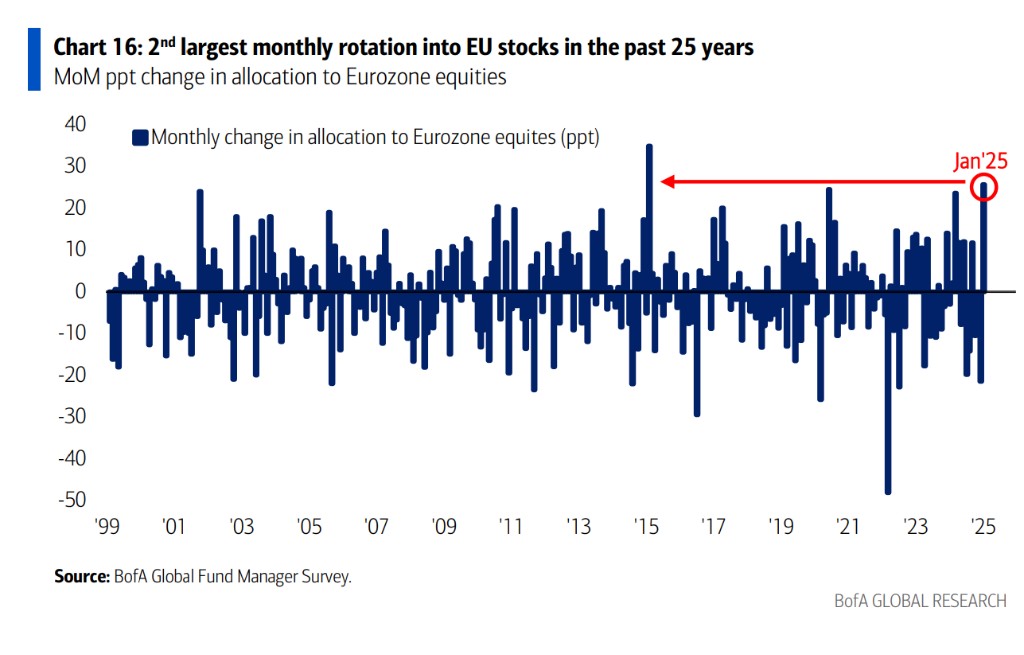

美银基金经理调查显示,1 月份对欧洲股票配置出现了过去二十五年中的第二大增幅,从美股向欧股的轮换大幅增加,使得对欧股的配置从 22% 的低配飙升至 1% 超配,而对美股的配置从 12 月份创纪录的 36% 超配降至 19% 超配。

欧洲股市在 2024 年创下相对于美国最糟糕的年份之一后,本月却意外受到青睐。

1 月 22 日,欧股突破了 2024 年 9 月 27 日创下的历史高点,续创新高。截至发稿,欧洲股票综合指数 STOXX 600 上涨 0.73%。医疗保健和工业股是涨幅最大的股票,而诺和诺德对该指数的单一提振幅度最大。

美银在 1 月 21 日发布的题为《让欧洲再次伟大》的报告中指出,但如果 1 月份对特朗普关税和无序债券的担忧毫无根据,那么资产配置将保持风险偏好,落后风险资产将迎头赶上。该行基金经理调查显示,资金出现了从美股到欧股的轮动,对欧洲股票配置出现了过去二十五年中的第二大增幅。

美国总统特朗普的关税威胁并没有显著影响投资者情绪。市场开始认为,关税或许不会像担心的那么糟糕。

市场认为,关税不应该像担心的那么糟糕

美银基金经理调查显示,1 月份对欧洲股票配置出现了过去二十五年中的第二大增幅,从美股向欧股的轮换大幅增加,使得对欧股的配置从 22% 的低配飙升至 1% 超配,而对美股的配置从 12 月份创纪录的 36% 超配降至 19% 超配。

“欧洲目前是一个不错的选择,也是因为我们将有一些重要的触发因素,比如下个月的德国大选,” Kairos Partners 的投资组合经理 Alberto Tocchio 表示:

“关税是短期内另一个值得关注的话题,但市场认为它不应该像担心的那么糟糕。”

AllianceBernstein 分析师 Thorsten Winkelmann 认为,并非所有欧洲公司都会受到同等程度的冲击。具有强大定价能力、本地化运营、优化供应链以及在利基市场占据主导地位的公司,将更能抵抗潜在的负面影响。

“一些欧洲公司在美国开展业务,甚至可能从美国关税中受益,尤其是在工业领域。”

例如 Diploma 和 Beijer Ref,由于在美国拥有本地业务和供应商,因此不太容易受到美国关税的影响。再例如瑞典跨国集团 Atlas Copco,该公司为制造、采矿和建筑行业提供工具、设备和服务,由于收入来源多元化,且在全球拥有广泛的业务网络,因此不易受到单一区域经济挑战的影响。

此外,虽然关税会大大提高成本,但这些成本通常会转嫁给客户,并非每家欧洲公司都会立即遭受需求损失。影响将取决于许多因素,包括公司的竞争地位和定价能力。

欧洲股市估值优势凸显

周三上涨的主要推动力是科技和医疗股的强劲表现。其中,医疗板块上涨了 1%,由诺和诺德的股价上涨 2.3% 所推动。此外,阿迪达斯股价飙升 6.3%,并发布了超出预期的四季度初步财报,强调了假期销售和盈利的良好表现。

针对美股的投资者情绪,AJ Bell 的投资总监 Russ Mould 指出,由于缺乏明确的关税计划,市场在一定程度上已经做好了应对坏消息的准备。

而对于近期欧洲股市的强劲表现,许多投资者开始积极购买欧洲股票,尤其是在美国股市估值逐步上升的情况下,寻求更加平价的投资机会也成为一个主要驱动因素。

随着市场对欧洲股市的关注增加,欧洲央行的货币政策也受到了广泛讨论。行长克里斯蒂娜·拉加德在达沃斯会议上表示,利率降低已成为一种趋势。目前市场预计,下周的降息几乎是板上钉钉。