本周,日央行加息 + 特朗普就职冲击日股?美银:坏消息大多已被消化

本周,日本股市面临日央行加息和特朗普就职的双重压力。美银分析师认为,坏消息大多已被消化,投资者可能多虑。报告指出,美国长期国债利率上升、日央行加息预期和特朗普政策的不确定性是主要压力,但这些因素已基本被市场定价。即使市场出现回调,由于日本股市估值不高,预计不会显著下跌,反而可能在回调后恢复。美银还提到,美国长期利率的急剧上升已暂停,减轻了日本股市的压力。

本周,日本股市面临日央行加息 + 特朗普就职的双重压力,但美银认为,坏消息大多已被消化,投资者可能多虑了。

1 月 17 日,美银日本投资策略分析师 Masashi Akutsu 及其团队发布报告称,今年以来,日本股市面临着三重压力:

1.美国长期国债利率的急剧上升、

2.日本央行 1 月加息预期重新升温、

3.特朗普政策的不确定性等多重阻力。

但是,美银认为,美国利率和日央行加息已基本被定价,特朗普政府的政策是最大的不确定性。

美银进一步解释道,在特朗普政府正式宣布前,特朗普政策,尤其是关税政策无法完全定价,这意味着存在市场修正的风险。但是,即便市场出现回调,由于日本股市估值不高,因此除非关税的广度超出预期,否则日本股市可能不会出现显著下跌,并有望在回调后恢复。

此外,美银还表示,日本股市是否会在这些风险解除后立即起飞尚不确定,在最乐观情况下,所有坏消息将于本周完全计入。并且,即使日股市场发生修正,1 月至 3 月期间也可能转向上升,主要由以下因素推动:第三季度日股公司强劲的盈利表现、3 月春季劳动谈判中达成的大幅加薪协议、全年业绩发布前的公司改革。

美国长期利率的急剧上升已经暂停

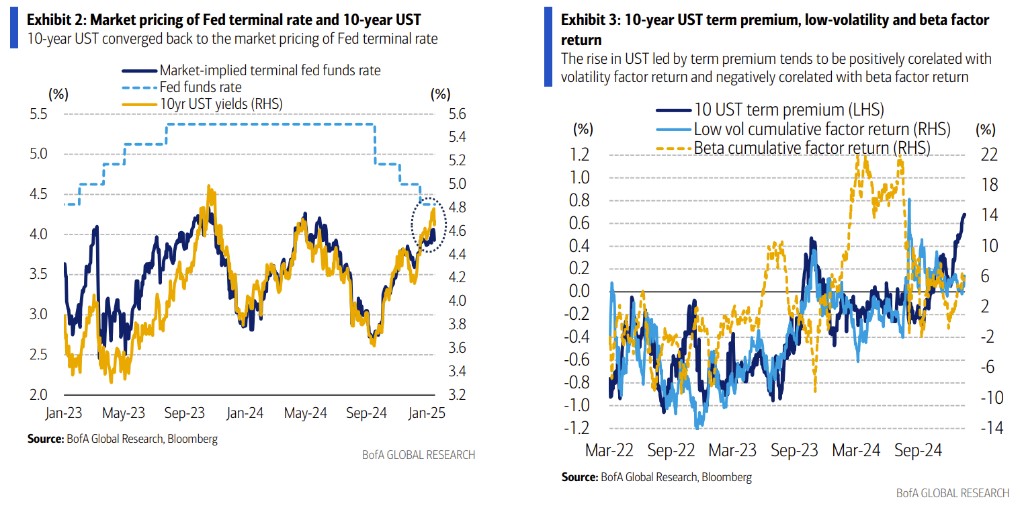

美银强调,美国长期利率的急剧上升似乎已经停止,这将减少日本股市面临的压力。

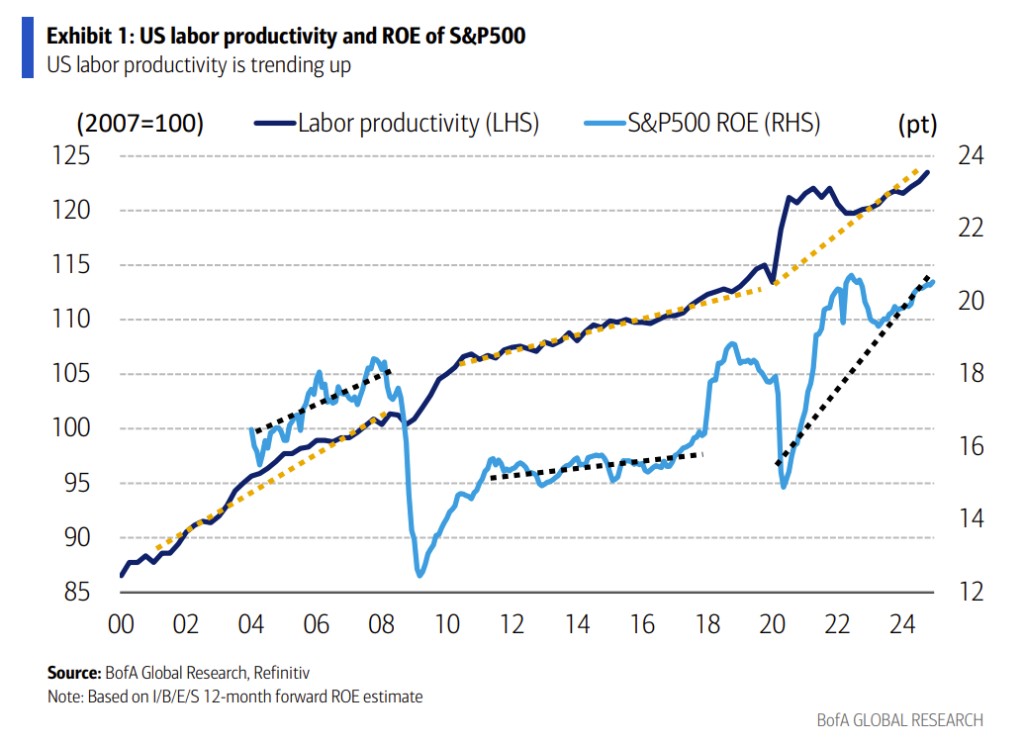

美银表示,由于美国 2024 年 12 月的 CPI 放缓,美国利率上升的趋势暂时中止了,尽管美国经济表现依然强劲,但物价的逐步稳定已将市场的注意力转向生产率的上升。

美银表补充道,美国长期利率的急剧上升主要由期限溢价推动,但这一趋势并不能单纯以市场对美联储降息预期的调整来解释。当期限溢价上升且金融条件收紧时,先前上涨的股票和高贝塔值股票通常会被抛售,而低波动的防御性股票成为避险资产。

目前来看,市场情绪似乎正在缓和,风险规避情绪有所放松。这表明市场可能在前期剧烈波动后进入了短暂的平稳阶段。

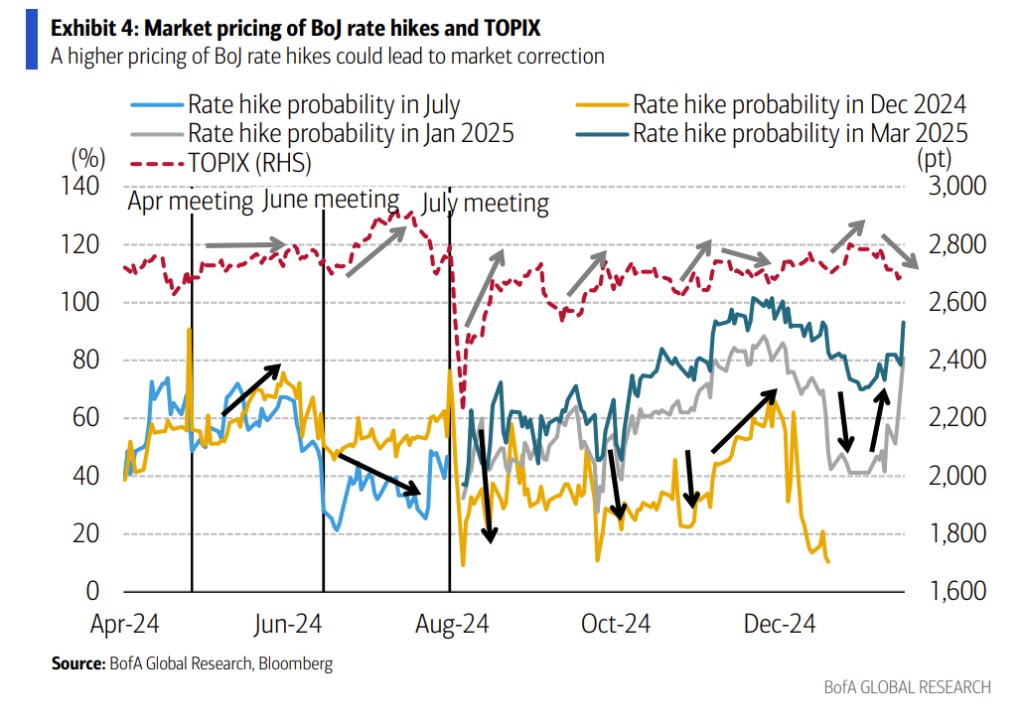

日本央行 1 月加息预期重新升温

随着日本央行副行长冰见野良和行长植田和男于 1 月 14 日、15 日讲话,市场对日本央行 1 月加息的预期从 40% 飙升至 80% 以上。

分析认为,日本央行可能会选择在 1 月加息以避免与美联储降息的时间重叠。

美银表示,如果日本央行 1 月加息,日本股市也不太可能如 2024 年 7 也那样剧烈下跌,因为当时日股暴跌主要是由于美国就业数据显著恶化和日元套利交易的结束,而如今,美国的就业数据呈现相反趋势,且未出现日元套利交易的积累。

因此,美银强调,即使 1 月日本央行加息,市场也可能出现 “所有坏消息已被消化” 的情形。

特朗普政策是最大的不确定性

最后,美银指出,日本股市主要的不确定性来源于 1 月 20 日特朗普就职后的政策,尤其是关税政策,因为在特朗普政府正式宣布前,市场对潜在关税的定价仍然不足,这意味着存在市场修正的风险。

但是,即便市场出现回调,由于日本股市估值不高,因此美银认为,除非关税的广度超出预期,否则日本股市可能不会出现显著下跌,并有望在回调后恢复。

风险提示及免责条款

市场有风险,投资需谨慎。本文不构成个人投资建议,也未考虑到个别用户特殊的投资目标、财务状况或需要。用户应考虑本文中的任何意见、观点或结论是否符合其特定状况。据此投资,责任自负。