Morgan Stanley's Wilson: Interest rates and the dollar remain the biggest drivers of U.S. stocks

Wilson stated that the strengthening of the US dollar has a significant impact on individual stocks, and companies with lower exposure to overseas sales and lower sensitivity to the strengthening dollar have begun to outperform relatively; the 10-year US Treasury yield in the range of 4.00%-4.50% is the most comfortable range for US stocks, and once the yield falls to this range, US stocks will rebound significantly

Morgan Stanley's chief U.S. equity strategist Michael Wilson recently reiterated his "bullish" stance, stating that interest rates and the dollar remain the biggest drivers of U.S. stocks. Among them, a stronger dollar has a significant impact on individual stocks, and if the 10-year Treasury yield breaks above 4.50%, the sensitivity of stocks to interest rates may increase.

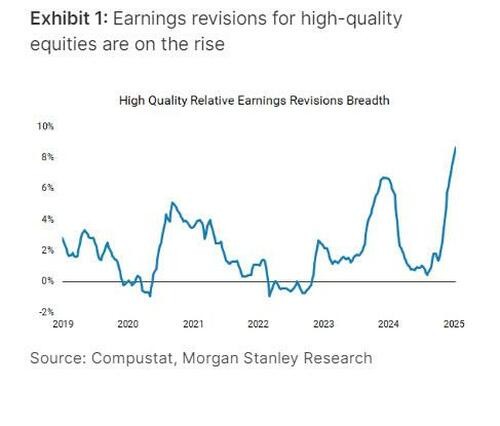

Wilson was once a well-known bear, but since the end of last year, he has shifted to a completely bullish outlook for U.S. stocks in 2025. Since December of last year, the two-way trading risk in U.S. stocks has been greater than in the previous three months, and high-quality stocks are leading the way, with improved earnings expectations, although market breadth has deteriorated. In his latest report, Wilson pointed out that these changes are closely related to rising long-term rates and a stronger dollar.

He stated, "Companies with lower exposure to overseas sales and lower sensitivity to a stronger dollar have begun to outperform; the 10-year Treasury yield in the 4.00%-4.50% range is the most comfortable range for U.S. stocks, and once yields fall into that range, U.S. stocks will rebound significantly."

Wilson noted that before last year's election, he believed that a Trump victory or a Republican sweep would be beneficial for the stock market but detrimental for the bond market, potentially stimulating "animal spirits" similar to the 2016 1.0 period, leading to more favorable growth and business policy expectations. However, due to the current U.S. fiscal situation being vastly different from that time, the market's reaction to inflation expectations has also changed:

"Concerns about 'how to finance the ongoing fiscal deficit' have intensified, leading to the recent rise in interest rates being primarily driven by an increase in term premiums rather than higher growth expectations."

High-Quality Stocks Become Market Favorites

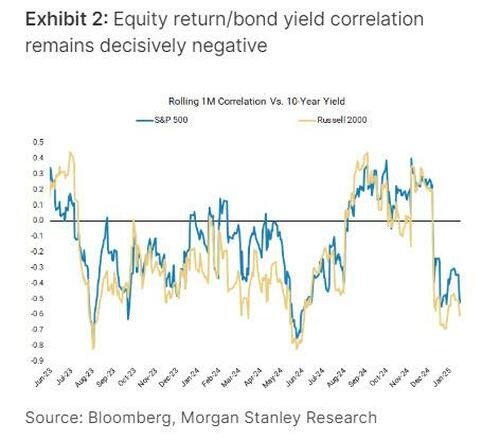

Wilson stated that in early December last year, they believed the 10-year Treasury yield in the 4.00%-4.50% range was the "optimal range" for stock price-to-earnings ratios. If it breaks above 4.50%, the sensitivity of stocks to interest rates may increase. When interest rates broke this level in December, stock price-to-earnings ratios indeed compressed, and the correlation between stock yields and bond yields clearly turned negative.

Moreover, importantly, interest rate sensitivity is bidirectional. Following last week's weaker-than-expected CPI report, the stock market rebounded significantly as interest rates fell, and the correlation between stock yields and yields again decreased, which also supports Wilson's latest view on U.S. stocks:

"The direction of the index (beta) is primarily determined by the level and direction of long-term interest rates and term premiums. The negative correlation between stocks and yields may persist until the 10-year bond yield falls below 4.50% and/or term premiums continue to decline."Therefore, Wilson stated that he remains optimistic about high-quality stocks that show relatively strong earnings expectation revision momentum across various industries, such as financials, media and entertainment, and consumer services sectors, rather than the consumer goods sector.

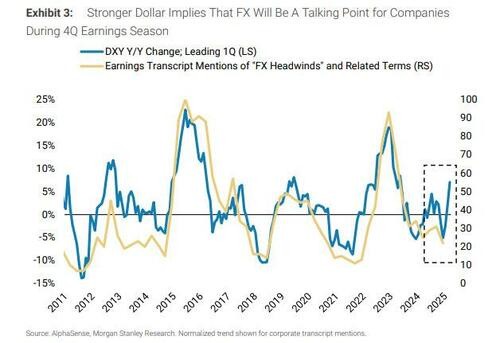

Dollar Movement Affects Individual Stock Performance

Wilson believes that the macro factor that may drive individual stock performance is the dollar. They pointed out in the report that the impact of a strong dollar on overall index earnings may be small, but it has a much larger effect at the individual stock level, as the overseas sales risk of index constituents varies significantly.

Wilson noted that since the dollar began to rise last October, the stocks rated "overweight" by Morgan Stanley, particularly those with lower overseas sales exposure and lower sensitivity to a strong dollar, have started to outperform. He also expects:

"As the U.S. earnings season approaches, this leading trend will continue."