The era of "Trump 2.0" has begun! Frenzied trading faces a major test, where will U.S. stocks, the dollar, and Bitcoin go?

As Trump returns to the White House on January 20, the market faces a test. The stock market, the dollar, and Bitcoin saw significant increases after Trump's election, but as investors questioned the Federal Reserve's policies, the S&P 500 index gave back most of its gains. Experts are concerned that the new government's trade policies could trigger a more prolonged trade war, impacting economic prospects. Small-cap stocks performed strongly after the election, but enthusiasm quickly faded, with many companies facing pressure from higher interest rates

According to Zhitong Finance APP, Donald Trump won the U.S. presidential election last November, immediately triggering a market rebound, with U.S. stocks, the dollar, and Bitcoin soaring. As Trump returns to the White House on January 20, these trades face a test.

The reversal first appeared in the stock market. As investors began to question the Federal Reserve's interest rate cut prospects and the impact of the new U.S. government's policy proposals on the stock market, the S&P 500 index retraced most of the gains brought by the "Trump effect." The U.S. Treasury yield curve, after initially flattening, has also steepened sharply since the end of November last year. Meanwhile, Bitcoin and the dollar maintained their upward momentum.

With Trump taking office, the real test of these bets is just beginning. Tariffs pose the biggest risk, as there are concerns that these policies could lead to a trade war that is more prolonged and unpredictable than during Trump's first term. Wall Street professionals worry that actions against illegal immigration will impact the U.S. economy. Experts are also concerned about escalating geopolitical tensions, as Trump has targeted some of America's traditional allies, including Canada, Mexico, and Europe.

Andrew Hollenhorst, Chief U.S. Economist at Citigroup, stated at the 2025 outlook conference: "Forecasting is a euphemism for guessing, but we must make assumptions about these policies as they will affect the economic outlook."

Here are the hot trades that traders are paying attention to:

U.S. Stocks

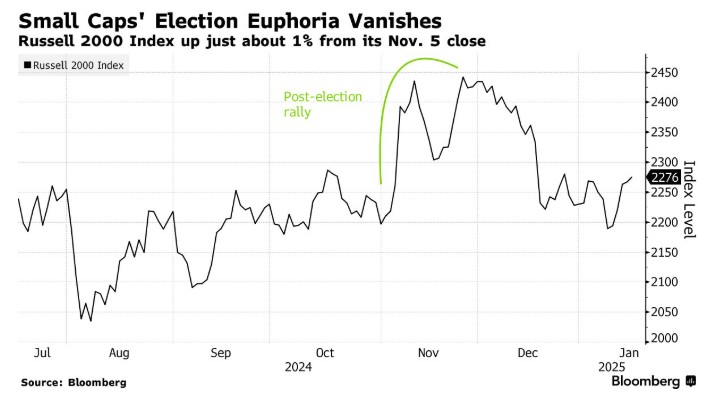

Investor enthusiasm for Trump's victory quickly manifested in some sluggish areas of the stock market, such as small-cap companies. The Russell 2000 index rose 5.8% the day after the election, marking the highest single-day gain in two years. The logic is simple: the trade protectionist policies of the new Trump administration will benefit those groups that typically generate most of their income domestically in the U.S.

However, the enthusiasm quickly faded. From November 5 to November 25, the index surged 8%, only to retrace most of those gains in the following weeks.

Steve Sosnick, Chief Strategist at Interactive Brokers, said: "Many of these companies are barely profitable or completely unprofitable; they rely on financing to maintain operations, and higher interest rates will hurt that situation."

The Russell 2000 index is up only about 1% from its closing price on November 5.

Trump's promise to ease regulations on banks also led to a frenzy in bank stocks post-election. From November 5 to November 25, the KBW Bank Index rose nearly 14%, reaching a 52-week high. However, the index has since lost momentum.

Due to Trump's proactive stance on oil and gas production, energy company stocks were also favored after the election. The S&P 500 Energy Index rose 3.5% on November 6, marking the largest single-day gain in a year, and accumulated a 6.5% increase from election day to November 22. However, since then, the index has been volatile, declining by 3.2% due to concerns over oversupply, tariffs, and economic growth However, stocks related to cryptocurrencies have basically maintained their upward trend. The same goes for Tesla, whose stock price has risen 70% since Trump's victory, as investors bet that CEO Elon Musk's close relationship with Trump will help the company achieve its ambition of manufacturing fully autonomous vehicles.

US Dollar

Perhaps the purest Trump trade before the election is to go long on the dollar, as high tariffs and loose fiscal policies could lead to inflation.

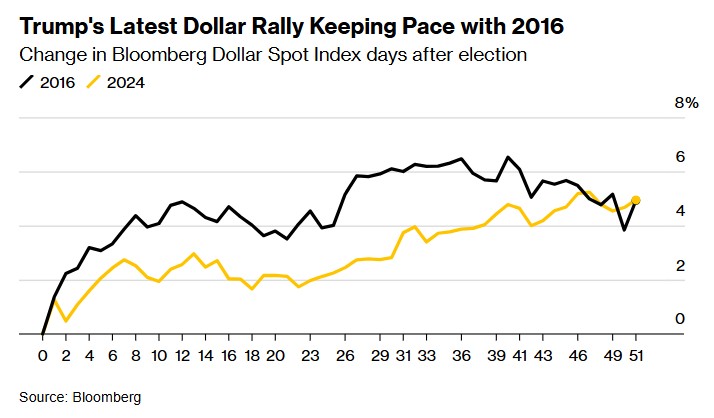

In the 10 weeks since election day, the Bloomberg Dollar Index has risen by 5%, similar to the increase after Trump's victory in 2016. Meanwhile, global currencies have weakened, with currencies including the euro and the Canadian dollar seen as facing risks from Trump's economic policies.

The dollar's rise after Trump's victory is similar to that in 2016.

Wall Street has basically anticipated this. Analysts at JP Morgan, led by Meera Chandan, predict that if Trump wins, the euro could fall to parity, while Barclays Capital forex strategist Skylar Montgomery Koning suggests that the Canadian dollar could drop to its lowest level since the pandemic. Chandan and her team now expect the euro to fall below parity against the dollar this quarter.

Chandan recently stated, "I think tariffs have not yet been fully reflected in prices."

Most emerging market currencies weakened after Trump's victory. Since election day, the MSCI index has fallen by 2.2%, with the South African rand and European currencies leading the decline.

The Mexican peso was the most favored currency for traders to short before the election, and since the election, the peso has depreciated by 3.4% against the dollar, actually performing better than most of the 31 major currencies tracked by Bloomberg. The peso has remained relatively strong because traders have delayed the timeline for Fed rate cuts, which will also make Mexican policymakers more cautious.

Yield Curve Steepening

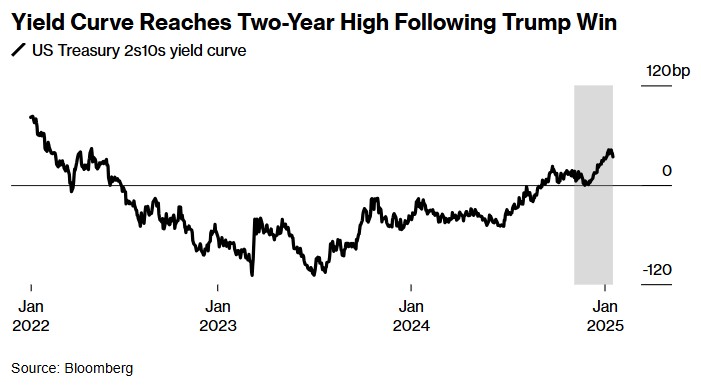

Trump's victory—let alone a Republican landslide—is expected to steepen the yield curve, as the market believes Trump's policy proposals will exacerbate inflation and put pressure on US long-term Treasury bonds. This has largely been the case, with the gap between the 10-year and 2-year US Treasury yields widening to about 34 basis points, close to the highest level since early 2022, while long-term US Treasuries plummeted on the eve of Trump's inauguration.

After Trump's victory, the yield spread between 2-year and 10-year US Treasuries rose to a two-year high.

Neil Sutherland, a portfolio manager at Schroders Investment Management, stated, "We are starting to see the curve steepen. The Fed has cut rates by 100 basis points, while long-term bond yields are rising." The U.S. economy remains resilient, and the uncertainty surrounding Trump's policies has also put pressure on short-term yields. Swap traders currently expect the Federal Reserve to cut interest rates less than twice this year, with each cut being 25 basis points. Before the election, they anticipated about six rate cuts.

Sutherland stated, "Currently, the sentiment in the U.S. Treasury market is very negative, and there is actually a risk of declining yields."

Cryptocurrency

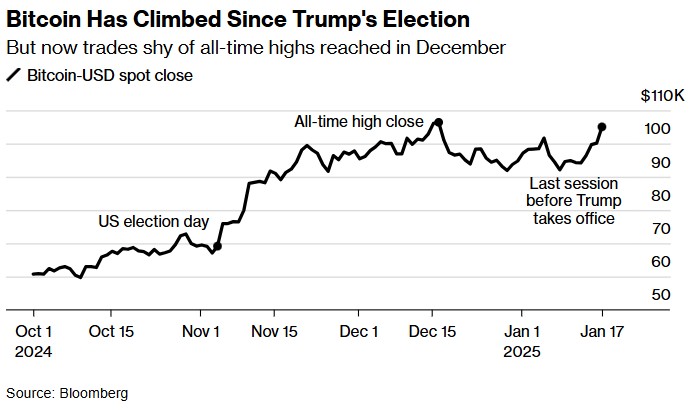

Trump has previously expressed skepticism about cryptocurrencies, calling Bitcoin "a scam," but he has now completely changed his stance and received strong support from the cryptocurrency industry. Reports indicate that Trump plans to issue an executive order prioritizing cryptocurrency as a policy issue and allowing industry insiders to have a voice in the new administration. It is also reported that Trump may relax regulations and establish a strategic reserve for Bitcoin.

Bitcoin surged after Trump's victory

Since the election, crypto assets have soared, with Bitcoin reaching an all-time high in mid-December last year, rising about 50% from its price on November 5. The Bloomberg Galaxy Crypto Index rose 11% the day after the election vote and subsequently increased by 29%.

As of the time of writing, Bitcoin has fallen to $101,381.7 per coin, down 3.40% for the day