After next week, a large amount of tariff news will flood the screens, but Citigroup advises investors to "temporarily ignore" it

Citigroup believes that Trump's tariffs are "loud thunder but little rain," meaning that initial rhetoric may be intense, but actual implementation will be more moderate. However, the possibility of a reversal in the dollar's upward trend is low, and it will likely remain in a higher range than in 2023-2024 in the first quarter or even the first half of 2025. Under a hawkish tariff policy, the dollar index may retest the highs of 2022

As Trump's inauguration on January 20 approaches, a large amount of tariff news is expected to flood the headlines, but Citigroup believes that Trump's tariffs will be "loud but little rain," and the likelihood of a reversal in the dollar's upward trend is low.

In a report on January 14, Citigroup warned that the news headlines in the coming weeks may be filled with noise, and advised against overinterpreting recent media reports on "tariff" policies. Ultimately, it will be Trump's actual policy actions, rather than external predictions, that will determine the dollar's trend.

The market generally expects Trump's tariff policy to be "loud but little rain," meaning that initial rhetoric may be intense, but actual implementation will be more moderate. Citigroup anticipates that tariffs will be gradual, and will serve as a tool for negotiating trade agreements, with extreme tariff levels, as hinted by Trump, unlikely to be seen.

Regarding the impact on the dollar, Citigroup expects that the likelihood of completely reversing the dollar's upward trend from the previous months in the near term is low, and forecasts that the dollar will remain in a higher range in the first quarter or even the first half of 2025 compared to 2023-2024.

"Loud but little rain," no need to overly focus on media noise

The market generally expects Trump's tariff policy to be "loud but little rain," meaning that initial rhetoric may be intense, but actual implementation will be more moderate. This is reflected in the current overvaluation of the dollar and its consistency with historical patterns, as well as the commodity market pricing, which only suggests a 50% chance of implementing a 10% broad tariff.

The report points out that there are two factions within the Trump administration regarding tariff policy, and Trump himself may remain neutral:

One faction (represented by Bessent, Hassett, and Miran) favors a gradual tariff policy to maintain market stability. The other faction (represented by Peter Navarro, Jamieson Greer, and JD Vance) leans towards a tougher trade policy, emphasizing the need to address the U.S. current account deficit to protect workers' interests.

Ideologically, Trump supports a tougher trade policy but is also concerned about the stability of financial markets, so he may seek a balance between tough rhetoric and gradual implementation. Trump's initial statements will still be very hawkish, as part of his negotiation strategy. He is unlikely to start the negotiation process from a "gradual tariff" position; rather, his initial comments may appear hawkish relative to market expectations.

The report warns investors not to overinterpret recent media reports on "tariff" policies:

This information mainly comes from officials who favor market stability (such as Miran), but Trump himself has not publicly supported similar policies. Given that Trump typically starts negotiations from a tough stance, initial policy signals may be more hawkish than market expectations, and investors need to pay attention to Trump's direct statements.

The report emphasizes that the news headlines in the coming weeks may be filled with noise, but ultimately, it will be Trump's actual policy actions, rather than external predictions, that will determine the dollar's trend. Investors are advised to remain cautious until policies become clearer, avoiding being distracted by short-term news in their trading decisions.

Three Possible Trends of the Dollar After Trump's Ascendancy

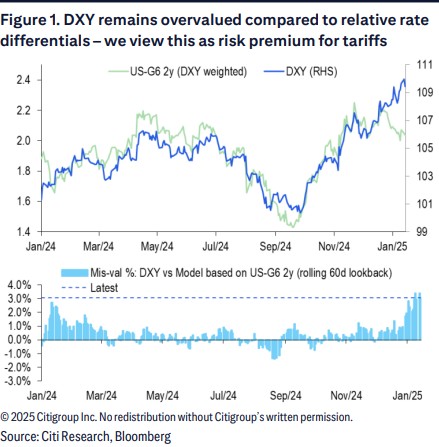

The current market has partially priced in the risk premium of "moderate tariffs," with the dollar index being overvalued by about 3% relative to the interest rate differentials between the U.S. and G6 countries. This overvaluation primarily stems from market expectations regarding tariffs, rather than the impact of Trump's other policies (such as fiscal stimulus or deregulation).

Citigroup's report provides a detailed analysis of three potential tariff policies that the Trump administration may adopt and their potential impacts on the dollar:

Base Scenario (Scenario 1): If Trump initially adopts a tough stance on tariffs, the dollar may rise another 1-2%. It is recommended to take profits on long dollar positions at this time.

Moderate Policy Scenario (Scenario 2): If Trump shifts to a gradual moderate tariff policy advocated by Bessent, Hassett, and Miran, the dollar may weaken, and it is advised to buy high-volatility currencies (such as the Australian dollar AUD).

Aggressive Policy Scenario (Scenario 3): If Trump imposes tariffs on Canada, Mexico, or other countries through the "International Emergency Economic Powers Act" (IEEPA) without negotiation, the dollar may surge significantly, and the DXY may retest the highs of 2022, with a potential increase of 5%.

Historical data shows that during Trump's first term, the dollar remained overvalued, but to a lesser extent. Citigroup expects that the likelihood of a complete reversal of the dollar's gains over the past few months is low in the near term, and anticipates that the dollar will remain in a higher range than in 2023-2024 during the first quarter or even the first half of 2025