Looking up to $800! Morgan Stanley raises Tesla's target price, with the most optimistic expectation doubling the increase

Morgan Stanley analysts reiterated that Tesla remains the "top pick," raising the target price by 7.5% to $430, emphasizing the potential of Tesla's autonomous driving technology and embodied intelligence (EAI) to drive stock price, stating that Tesla's overall potential market scope will further expand, covering "many areas that are still not included in the company's buy-side or sell-side financial models."

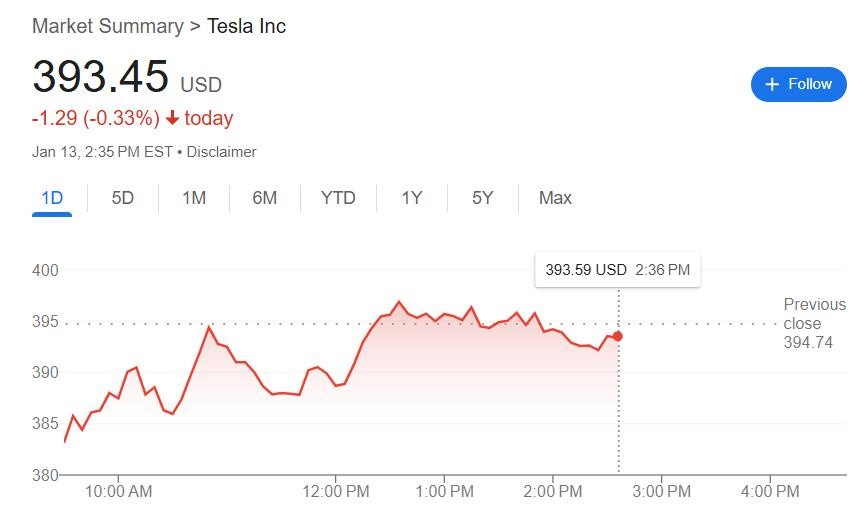

As of last Friday, Tesla's stock price has dropped nearly 18% from its record high set nearly four weeks ago on December 17 of last year. However, analysts at Morgan Stanley have raised their target price for Tesla in their latest report, remaining bullish on the company.

In the report, led by Adam Jonas, Morgan Stanley analysts reiterated that Tesla remains their "Top Pick." They raised the target price from $400 to $430, an increase of 7.5%. The new target price implies that Tesla's stock price is expected to rise about 9% from last Friday's closing.

Morgan Stanley analysts maintained their pessimistic scenario expectation price of $200 for Tesla. They even optimistically projected that in a bull market scenario, Tesla's stock price could rise to $800. The expected price of $800 means that Tesla would nearly double from last Friday's closing.

The target price and optimistic expectations from Morgan Stanley analysts stem from their confidence in Tesla's autonomous driving technology and the prospects of embodied artificial intelligence (EAI) technology that integrates artificial intelligence (AI) into physical entities like robots.

Their report stated:

"As interest in autonomous vehicles continues to grow, we have conducted the most extensive restructuring and expansion of Tesla's mobility (robotaxi) model since its initial release in 2015. While the automotive (business) remains important, we believe AI is the driving force behind the $800 bull market correction case."

"In a competitive and geopolitically complex environment, investors are increasingly recognizing the importance of EAI. We believe that Tesla's recent stock price increase has begun to underestimate the expanding 'surface area' between Tesla and physical AI, including the company's natural advantages in data collection, robotics, energy storage, AI/computing, manufacturing, and supporting infrastructure, including the benefits of other companies under CEO Elon Musk (such as SpaceX, xAI, etc.)."

The report stated that Morgan Stanley analysts still believe that 2025 will be a year when the market's appreciation for Tesla's unique skill set can further reflect in valuation multiples, offsetting the significant challenges known in the electric vehicle market for the fiscal year 2025. Looking ahead to the performance in fiscal year 2025 and beyond, these analysts expect Tesla's overall total addressable market (TAM) range to further expand, covering "many areas that are still not included in the company's buy-side or sell-side financial models."

Therefore, these analysts have revisited and expanded the assumptions in Morgan Stanley's network services and Tesla Mobility (autonomous ride-sharing) models, providing investors with a framework to help assess these existing and emerging AI industries. They believe that Tesla has "already established a substantial competitive advantage" in these sectors.

Analysts pointed out that Tesla's leadership in autonomous driving stems from expertise in multiple areas, including data collection, energy storage, robotics, and artificial intelligence. In Morgan Stanley's latest aggregated classification model, the valuation of Tesla's autonomous ride-sharing business is $90 per share. This business has an EBITDA margin of 29% and is expected to have 7.5 million vehicles by 2040, generating $1.46 in revenue per mileAnother important growth engine viewed by Morgan Stanley is Tesla's network services, including software, supercharging, and the Full Self-Driving (FSD) subscription. Morgan Stanley estimates that this business is valued at $168 per share and will contribute nearly 60% of Tesla's EBITDA by 2040.

Following the release of the above report from Morgan Stanley, Tesla's stock price initially fell 3.7% on Monday, tracking the broader market, but later erased most of the losses. At one point during the U.S. midday trading, the stock slightly turned positive, reaching a daily high with an intraday increase of over 0.7%, before slightly turning negative again, potentially closing down for two consecutive trading days.