Ackman 为何重仓次贷 “毒瘤”:两房?

美国的 “两房”——房利美和房地美在美股整体下跌的背景下大幅上涨,前者涨超 36%,后者涨超 33%。这一涨幅源于投资者比尔·阿克曼的推文,暗示两家公司可能在特朗普政府的支持下进行改革,预计 2026 年左右再次上市。阿克曼曾准确预测多次市场危机,并在 2014 年就指出两房被显著低估,当前的信心重燃可能会影响市场走向。

美国 “两房”,罕见大涨

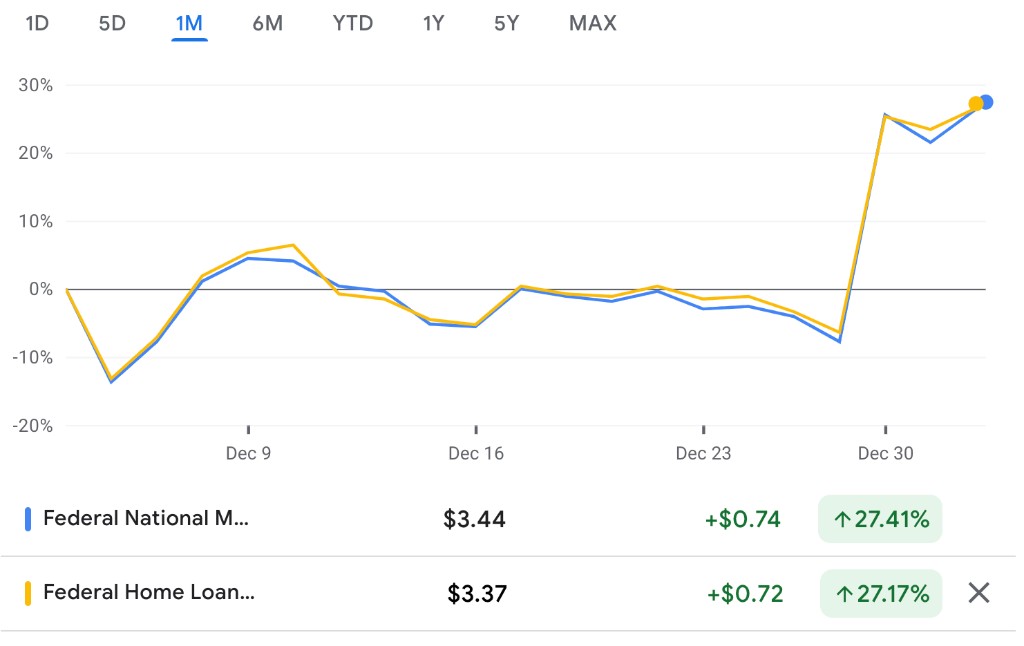

2024 年倒数第二个交易日,美股三大股指集体下跌。但在这样的市场背景下,美国的 “两房”——房利美(Fannie Mae)和房地美(Freddie Mac)却迎来了神奇的暴涨,前者涨超 36%,后者涨超 33%。

这样的暴涨来自华尔街传奇投资者比尔·阿克曼(Bill Ackman)的一则推文:

“两家公司将可能在特朗普政府 2.0 的支持下实施改革,最终有望脱离联邦政府监管,预计将于 2026 年左右再次公开上市。”

Ackman 的传奇投资历史不必多言,其曾准确押注 2007 年的美国次贷危机、2020 年的美股崩盘、以及 2022 年的美联储激进加息,在华尔街享有 “Baby Buffett” 的名号。本次 Ackman 对两房的发声,再度点燃了投资者的信心。

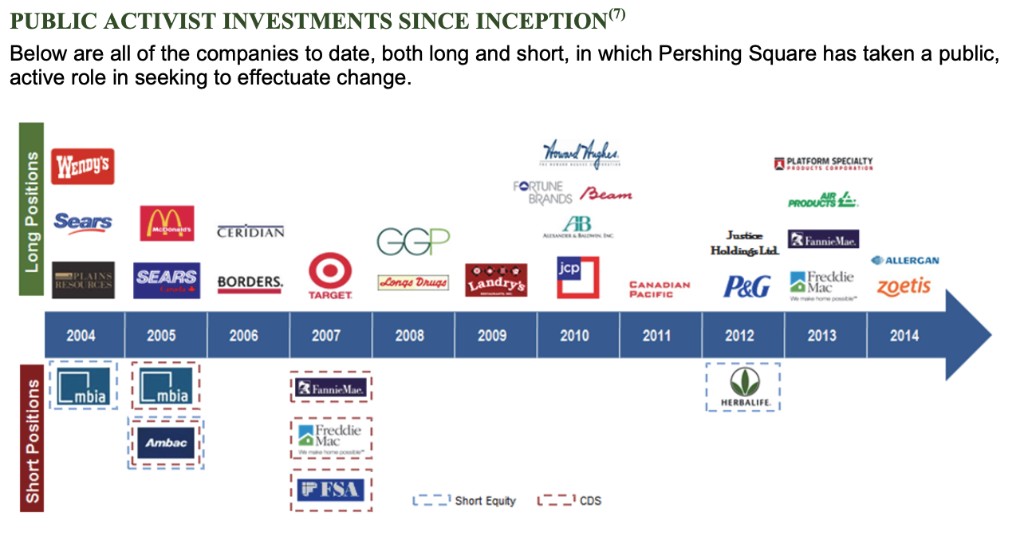

事实上,早在 2014 年,Ackman 就指出两房美存在 “显著低估”,其所管理的潘兴广场对冲基金就已经持有两房,分别持有房利美 1.156 亿股、房地美 6350 万股。

但是过去近十年,两家公司股价一直在低位震荡,从未有过像样的 “牛市”,这是为何?

如今,他如此笃定两房即将完成私有化并上市,是基于什么逻辑?

私有化后,对市场又会有怎样的影响?

“两房”,华尔街的古老叙事

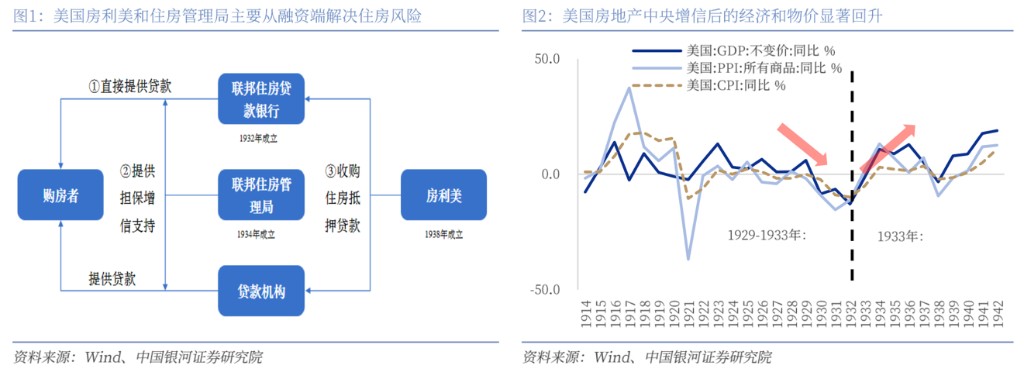

“两房” 中的 “大房”——房利美,最早成立于 1938 年,由美国政府注资设立,目的是由中央信用提供流动性支持,托底居民资产负债表。

运作方式上,房利美通过从私人贷款机构购买贷款,并将其重新包装为抵押贷款支持证券,并以国家信用为背书,缓解了市场对信用风险的担忧,避免经济陷入螺旋式下降的循环。当国家信用开始托底后,美国经济开始逐步走出低谷。

1970 年,为避免房利美一家独大,联邦政府又成立了 “二房”——房地美。

之后,房利美和房地美陆续改制为股份公司,分别于 1970 年、1989 年在纽交所上市。除优先股外,房利美和房地美在市场上流通的普通股分别约为 11.4 亿股和 6.5 亿股。在 2007 年美国次贷危机发生前的 10 年间,“两房” 股价长期稳定在 50-70 美元,并进行定期分红,受到投资者积极追捧。

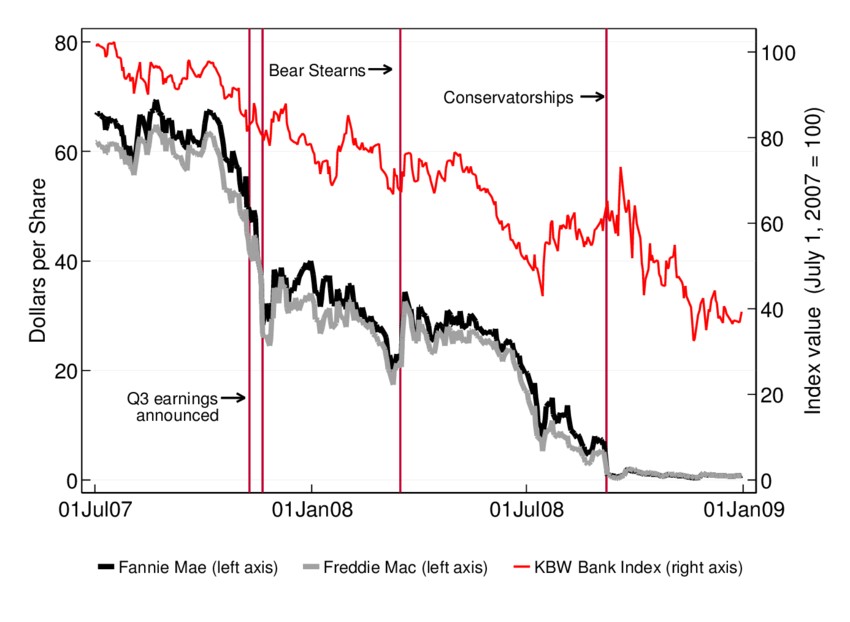

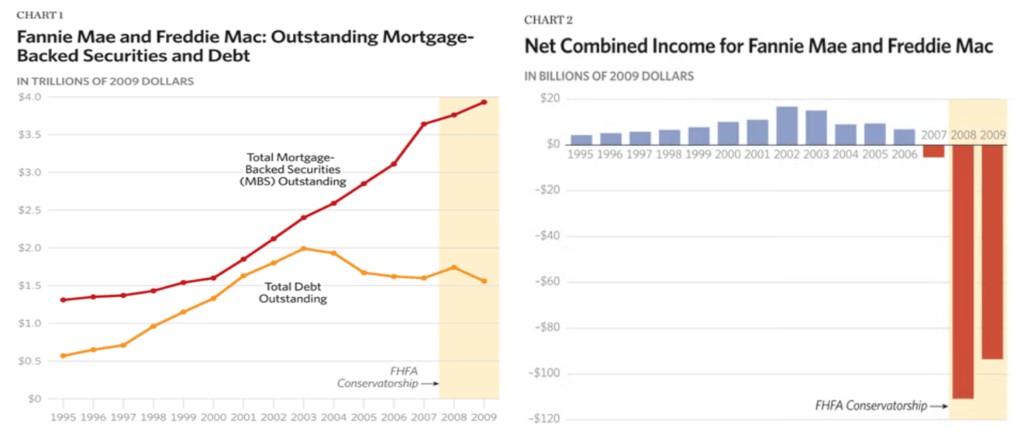

但 2008 年次贷危机全面爆发,全美 20% 的住房拥有人的贷款超过房地产的价格。两房手中持有的大量次贷资产价值迅速缩水,经营陷入亏损状态。两房股价同时开始暴跌,一年下跌 90%。

图:房利美和房地美股价(2007.07-2008.12)

考虑到两房的市场地位,为避免对美国经济与房地产市场造成灾难性影响,美国政府在 2008 年秋天正式接管两房,向其提供了 2000 亿美元的资金支持,确保两房持续运营。

但是被接管后,两房曾经的管理层被全部解雇,公司停止任何政治捐款,股票从纽交所摘牌,仅在 OTC 市场交易,员工工资也被下调到政府雇员水平。

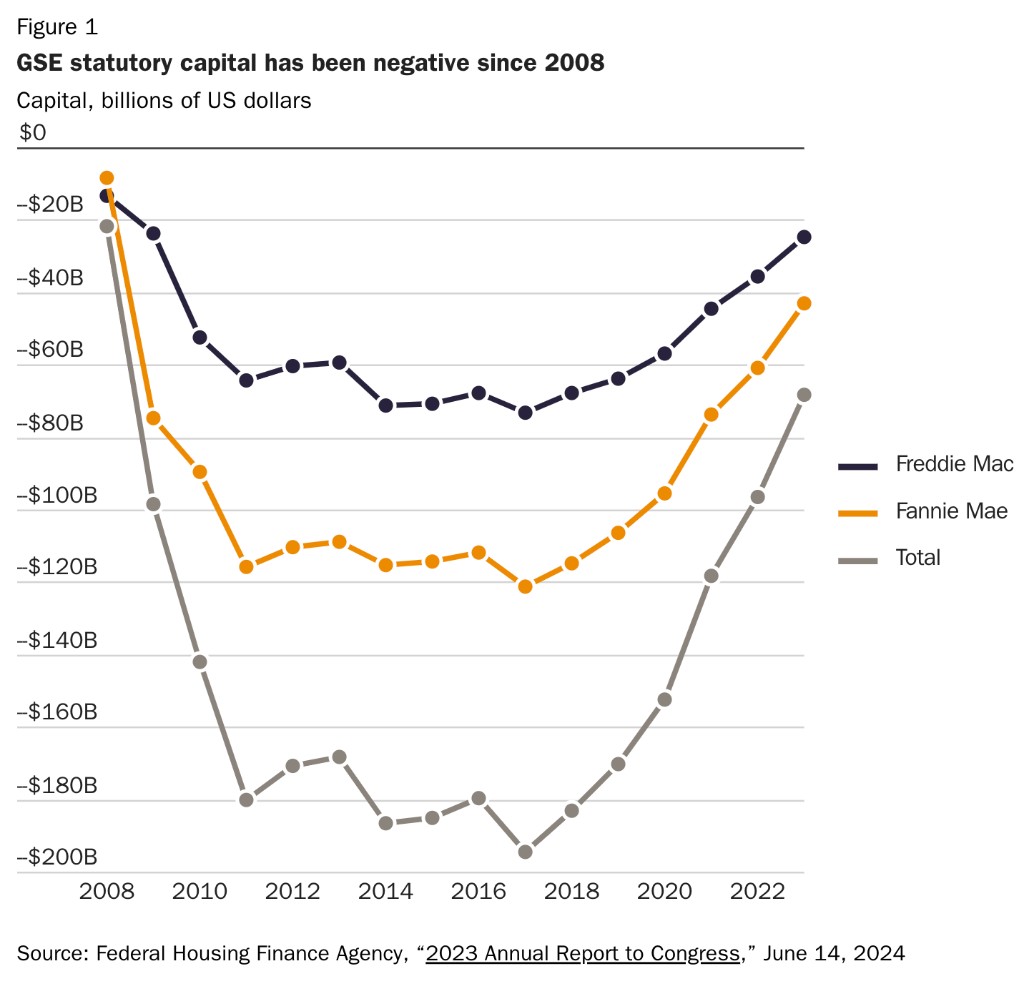

同时,两房的资本金基本上清零,此后每年如果有亏损,由美国财政部注资弥补,如果有盈利,也全部上交美国财政部。

成为 GSE 的代价,是股价长期低估

接管两房后,美国财政部持有两房 79.9% 的普通股及优先股认股权证(32.34 亿股),理论上持有后者近八成的股份,其余股东所持股票市值总计不到 10 亿美元。

虽名义上是 GSE、以盈利性为目的,但两房实际上已经不再按普通商业模式经营。