担心美联储储备金跌破 3 万亿示警流动性?解决债务上限前,财政部先要大 “放水”

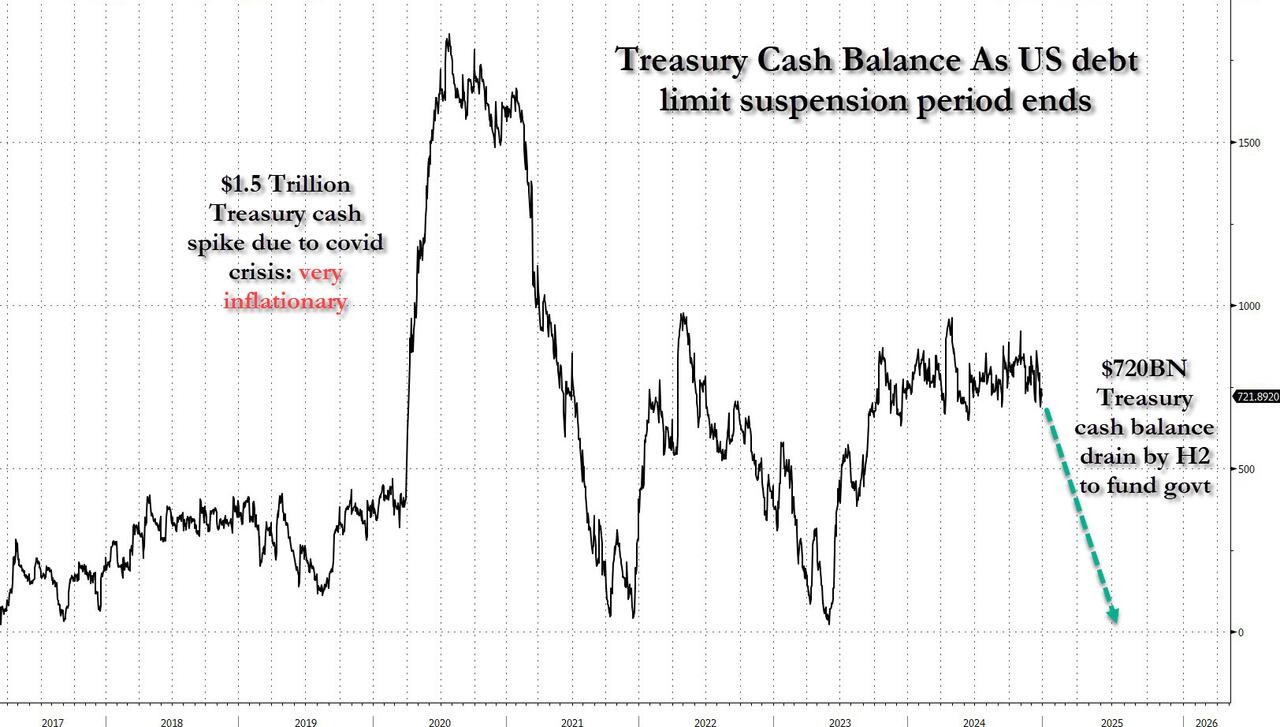

本周三,美国银行体系的储备金首次跌破 3 万亿美元,引发市场对流动性危机的担忧。美国财政部在解决债务上限前需进行流动性释放,预计在 2025 年初债务上限暂停期结束后,面临抽水风险。高盛报告指出,财政部可能在 1 月中旬采取超常规手段避免违约,TGA 余额将影响政府支付能力。历史数据显示,债务上限生效前六个月,美债供应量和 TGA 资金均会减少。

本周三,美国银行体系的储备金四年来首次跌破 3 万亿美元大关,令市场人士担心,美联储持续的量化紧缩(QT)会不会引发流动性危机。而考虑到将要卷土重来的美国政府债务上限法定限制,美国金融市场首先要面对的是债务上限生效后财政部带来的流动性大 “放水”,债务上限一旦解决,才面临大 “抽水” 的风险资产利空威胁,。

高盛利率策略主管 William Marshall 在本周四的报告中指出,2025 年初,债务上限的暂停生效期就要结束。美国财长耶伦最近向国会两党领袖警告,由于债务上限生效,财政部可能 1 月中旬需要动用超常规手段避免债务违约,直到国会拿出决议解决债务上限问题为止。而后,下一个债务上限截止期可能是在 2025 年 7 月或 8 月。

华尔街见闻曾提到,美国财政部的一般账户(TGA)用于存放税收等政府收入和支付政府支出,通过维持适当的现金余额确保联邦政府的正常运作。在债务上限问题悬而未决的情况下,财政部通常会使用 TGA 的资金和超常规措施延迟潜在的违约,TGA 余额直接影响政府在达成新债务协议之前能够继续支付账单的能力。

Marshall 的上述报告提到,高盛估算,债务上限生效之初,财政部的 TGA 余额将略高于 1 万亿美元。目前尚不确定财政部将如何管理可用的杠杆——即消耗 TGA 资金相比通过增加净流通借款消耗超常规措施的速度。2011 年至 2023 年的数据显示,相比没有债务上限的情形,有上限束缚的情况下,总体的影响是,美国国债的供应量减少,TGA 余额下降带来的广泛流动性增加。

按照以上十多年的纪录估算,达成债务上限协议前的六个月内,平均美债供应量下降约 1300 亿美元,TGA 资金减少约 2250 亿美元。达成协议后的变化会更快,未偿还流通债务规模和 TGA 都会在协议达成后平均一两个月内扭转下降势头。

相比过去达到债务上限时的财政部的 TGA 余额、比如 2021 年 和 2023 年的高点均约为 4500 亿美元,今年的财政部的 “荷包” 很鼓,TGA 余额的起始水平很高。高盛预计,今年的 TGA 缩减将与 2021 年和 2023 年的经历相当。那两年,在达到债务上限和解决上限之间的窗口期内,TGA 余额下降了约 4250 亿美元。

如果上述窗口期持续到 2025 年第三季度,TGA 可能会剧减。因为7 月和 8 月往往是一年中季节性的高赤字月份。因此高盛估计,在这种情况下,前两个季度的偿债规模将在 4000 亿至 6000 亿美元之间,与 2021 年的偿还额相当。高盛报告指出,

“债务上限的限制意味着,在达成(债务上限)协议之前,美债的供应量将减少,而总体流动性水平将高于无上限时的水平。”

美债供应减少意味着,财政部因无法为国债展期而被迫动用 TGA,与此同时,到期国债的流动性会被分配给其他风险资产,从而提升了这些风险资产,尽管另一场危机显然迫在眉睫。换言之,债务上限截止期以前的时期通常非常有利于风险资产,那并不是因为市场低估可能迫在眉睫的政治危机,而是因为整体流动性水平飙升。

考虑到美联储缩减资产负债表(缩表)的QT 继续进行,高盛预计,TGA 余额减少带来的金融系统整体流动性——银行储备金 + 逆回购工具 RRP 的增长会较小。在假设到 2025 年年中还未达成债务上限协议的基准假设情况下,流动性增长规模约为 1500 亿至 2500 亿美元。

而如果 TGA 余额下降规模更大,持续时间更长,延续到下半年,可能流动性增长规模会超过 2023 年的水平。反之,如果 QT 和/或结束时间比高盛基准预测的上半年还晚,一切潜在的流动性增长都会受到抑制,尽管特朗普可能寻求美联储激进行动提高整体流动性,高盛预计那种情况不会发生。最终,如果没有任何债务上限约束,美国国债的供应量将大致持平,同时上半年系统整体流动性将减少约 3500 亿美元。

也就是说,相比过去达到债务上限的情况,这次美国财政部的 TGA 余额处于历史高位。如果 2025 年上半年没有达成债务上限的解决方案,TGA 余额下降将完全抵消通过 QT 和减少国债供应量造成的流动性流失。

由此看来,美国即将迎来财政部的流动性大潮也不算意外。高盛认为,TGA 的较高起始水平和任何潜在偿债的规模至少应该能够支持,今年上半年美元融资环境比无债务上限情况下更为温和,从而抑制债务上限持续期间一直存在的掉期利差收窄倾向。

以高盛的经验,流动性较当前水平增加 1000 亿美元,相当于 SOFR-FF 利差变动 0.5 个基点,未偿还债券减少 1000 亿美元,相当于 0.1 个基点的变动。市场定价已经很大程度上消化了这一点,大多数 SOFR-FF 收窄措施都将推后到下半年。这就让市场容易在出现债务上限更快解决或 QT 更迟结束的情形时受到打击。

值得注意的是,过去一年中,在推动融资市场波动方面发挥更大作用的是资产负债表的容量限制,而不是整体流动性水平,——现在年底已经过去,这些限制可能会有所缓解,但这并不是因为债务上限。

金融博客 Zerohedge 认为,从以上分析看,特朗普不可能要求更好地解决债务上限危机,因为美国财政部约 7500 亿美元的 TGA 资金加速流失将为风险资产提供充足的缓冲,使它们在 2025 年下半年保持高位,那是特朗普非常乐于见到的。

讽刺的是,结束债务上限闹剧对风险资产来说反而是利空。因为财政部往往在债务上限问题解决后迅速补充流失的 TGA 资金,那意味着,融资和利差市场中的任何有利因素都可能迅速消失。考虑到美联储 QT 政策进入更加成熟的阶段,财政部这次可能在恢复 TGA 正常水平时更加谨慎,尤其是财政部的 “稳定状态” TGA 目标略高于疫情前水平时。

高盛表示,2019 年8 月至 9 月的回购危机可能是最接近的利空结果:当时QT 结束,9 月中旬 TGA 的跃升恰逢融资市场波动性激增,促使美联储注入流动性。虽然最终的结果是一样的,但更渐进地补充财政部的 TGA 余额会降低因快速从金融系统撤出流动性而可能产生的过度波动风险。

Zerohedge 总结称,这意味着,在 TGA 流失期间,股票和比特币等市场的流动性会激增,然后一旦债务上限决议达成,2025 年第三季度某个时候,财政部从市场抽走 7500 亿美元,风险资产就会下跌,然后如果抽走流动性带来的压力太大,会让美联储祭出又一轮 “非 QE”,那将在 2025 年末及以后时间引发下一次通胀冲击。

风险提示及免责条款

市场有风险,投资需谨慎。本文不构成个人投资建议,也未考虑到个别用户特殊的投资目标、财务状况或需要。用户应考虑本文中的任何意见、观点或结论是否符合其特定状况。据此投资,责任自负。