US Steel pre-market drops over 8%, reports say Biden will officially block Japan's $15 billion acquisition plan

There are views that Biden's move will have a broader impact on investments and mergers and acquisitions by Japanese and other foreign companies, and will affect the stability of the US-Japan alliance. Previously, since Pennsylvania, where US Steel's headquarters is located, is a key swing state in the election, the acquisition case once became a "political bargaining chip" in the competition between the two party candidates to win the votes of US Steel union members

Biden may decide to formally halt Nippon Steel's acquisition plan of US Steel. Will the political storm surrounding this acquisition case finally subside?

According to a report by The Washington Post on Friday, current US President Biden will block the deal in which Japanese steel giant Nippon Steel plans to acquire US Steel for $15 billion.

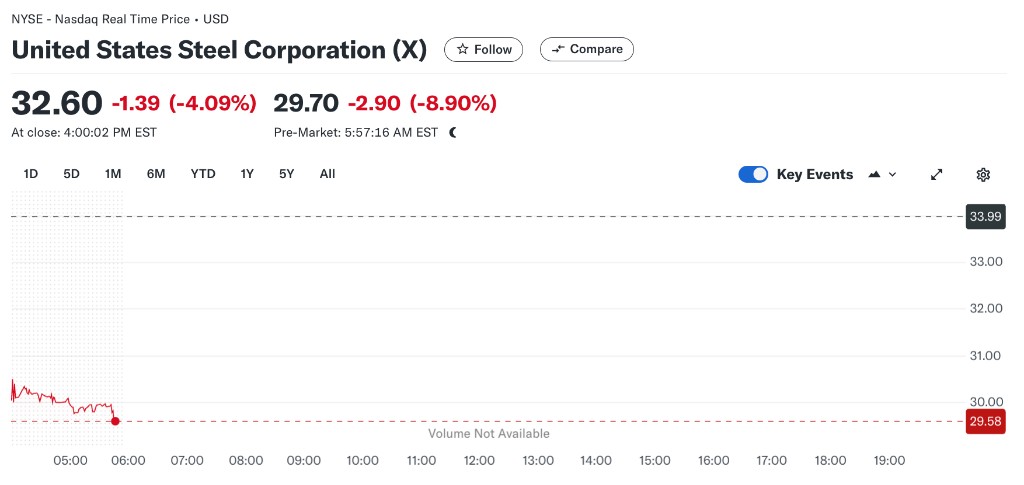

As a result of this news, US Steel's stock plummeted over 8% in pre-market trading.

The report states that the White House is expected to announce Biden's decision as early as Friday. Sources have indicated that Nippon Steel may take legal action against Biden's ruling.

Founded over 120 years ago, US Steel was once hailed as the calling card of the American steel industry and was the first company in the world to exceed a market value of $1 billion.

Due to intensified international competition, insufficient technological innovation, and weak domestic demand, this steel giant has gradually declined. Meanwhile, Nippon Steel has rapidly risen to become the fourth-largest steel manufacturer in the world.

Industry insiders expect that if the acquisition of US Steel is successful, Nippon Steel's crude steel production capacity will be greatly enhanced, potentially making it the second-largest steel producer globally.

Political interference from the US, US Steel's acquisition case became a "political bargaining chip"

In December 2023, Nippon Steel announced plans to spend 2 trillion yen to acquire US Steel, but the acquisition proposal faced widespread opposition. The United Steelworkers Union, as well as presidential candidates from both parties, including Harris and Trump, have publicly opposed the deal.

In April 2024, US Steel convened a special shareholders' meeting to approve the Nippon Steel acquisition, with the US government's review becoming the key to the success of the acquisition.

As time has passed, the focus on this case has shifted to political elections and even national security.

Firstly, there are concerns that Nippon Steel may hinder US Steel's capacity plans, thereby interfering with American manufacturing. Reports have revealed that the Committee on Foreign Investment in the United States (CFIUS) is worried that if the acquisition proceeds smoothly, Nippon Steel may reduce the production capacity of US Steel, posing a risk to US national security.

Secondly, the advancement of the acquisition coincides with the US election period, and Pennsylvania, where US Steel's headquarters is located, is a key swing state.

Analysts have noted that the United Steelworkers Union has taken a strong opposition stance against the acquisition, citing damage to the interests of steelworkers and national security. To compete for the votes of US Steel union members, presidential candidates from both parties have stepped in to halt the deal, and the Biden administration has also intervened to cater to voters, politicizing the acquisition.

According to Xinhua News, Watanabe Tsuneo, a senior researcher at the Sasakawa Peace Foundation, pointed out that the reason the Democratic Party opposes the acquisition is actually due to Trump's opposition. With the election approaching, since Trump has proposed ideas that align with union opinions, the Democratic Party has no choice but to adopt a similar approach On the eve of last year's election, the Japan Business Federation, along with some American business groups, jointly sent a letter to U.S. Treasury Secretary Janet Yellen expressing concerns about "political interference" in the review of acquisition plans, stating that the review "puts the U.S. economy and workers at risk" and "should not turn into a policy disguised as national security."

As news emerged that Biden might officially halt the acquisition case, some U.S. and Japanese government officials expressed to the media their concerns that Biden's move could have broader implications for investments and mergers by Japanese and other foreign companies, and could impact the stability of the U.S.-Japan alliance.