The global economy is expected to grow steadily in 2025, but massive debt will become a stumbling block for central banks to cut interest rates

The global economy is expected to grow steadily in 2025, with a GDP growth rate of 3.2%. Although inflation will be controlled and central banks may cut interest rates, massive debt will become an obstacle to economic expansion. The IMF predicts that public debt in developed economies will reach 100% of GDP by 2030. Politicians are reluctant to cut debt due to concerns about votes, making fiscal tightening policies difficult to implement

According to the Zhitong Finance APP, in 2025, the global economic situation is expected to be much better than at any time since the pandemic. Economic growth will remain robust, and inflation will eventually ease, creating ideal conditions for major central banks to lower interest rates. However, the virtuous cycle of loose monetary policy promoting rapid economic expansion will encounter a significant obstacle—governments' inability or unwillingness to reduce massive debts.

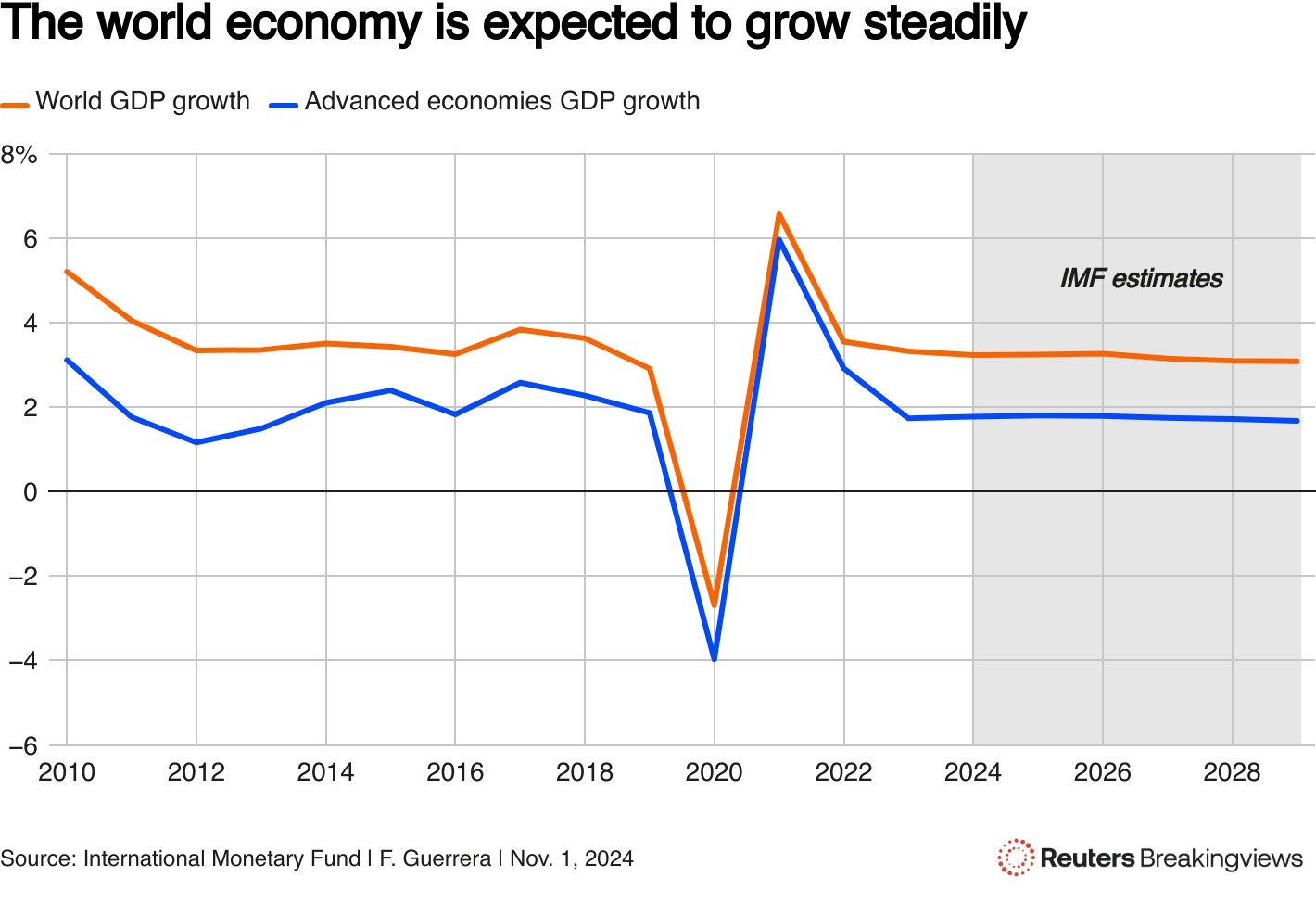

Unless there are significant external shocks, 2025 may be a year of steady global economic growth. The latest data released by the International Monetary Fund (IMF) indicates that global GDP is expected to grow by 3.2% in 2025, unchanged from 2024, and higher than the 2.9% growth rate in 2019. Among them, developed economies are expected to achieve a growth rate of 1.8% in 2025, which is similar to the pre-pandemic growth rate of 1.9%.

Indeed, global economic growth will still be below its long-term average. However, the relatively moderate growth outlook will also be accompanied by a slowdown in price growth. The IMF predicts that by 2025, the major central banks of all developed economies will control the inflation rate at around 2.5%.

This economic environment is typically favorable for central banks. In fact, major central banks such as the Federal Reserve, the European Central Bank, and the Bank of England have already begun to cut interest rates, and the market expects them to continue doing so in the next 12 months.

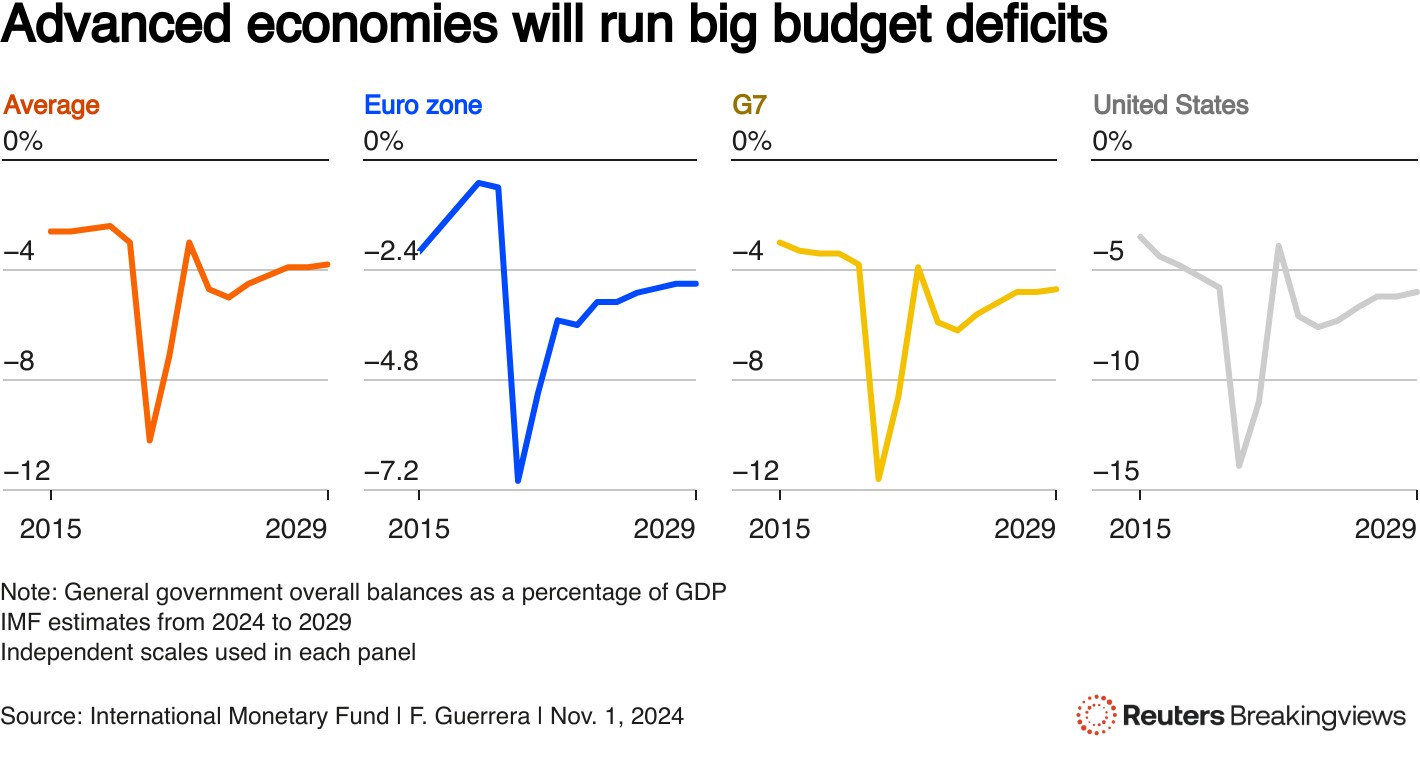

In normal times, stable economic growth, falling inflation, and declining interest rates would also bring about another positive outcome—encouraging governments to reduce public debt. However, politicians, especially those in developed economies, will waste this opportunity to tighten their belts. This is not because the global fiscal situation is good. In fact, the IMF estimates that by 2030, global public debt will reach 100% of GDP, which is 10 percentage points higher than the level in 2019.

Politicians in developed economies have accepted a near-permanent state of fiscal expansion, as fiscal tightening policies would lead them to lose a significant number of votes. Economists like Alberto Alesina have found that a package of tax increases equivalent to 1% of GDP would cause the ruling party to lose an average of 7% of the votes in the next election.

In the United States, according to data from the nonpartisan Committee for a Responsible Federal Budget, the policies promised by elected President Trump will increase the massive budget deficit by an additional $15 trillion by 2035. In the UK, the Labour government has proposed a plan to increase public spending by nearly £70 billion annually by 2029 and stated that it will provide half of the funding through increased borrowing Germany may also follow suit, as the elections in February this year could bring a more fiscally liberal German government. In Europe, seven countries, including France and Italy, have violated EU budget rules.

Politicians' preference for fiscal expansion and its inflationary effects present central bank officials with two unpleasant choices. The first option is to turn a blind eye to deficits and debt while continuing to lower interest rates, which would lead to inflation rates exceeding the 2% target. Few policymakers would take this route, as they fear that tolerating rising prices could result in persistently high inflation, which would have dire consequences for the central bank's credibility and people's living standards. Federal Reserve Chairman Jerome Powell, European Central Bank President Christine Lagarde, and their counterparts have faced severe criticism for allowing prices to spiral out of control in 2022 and 2023.

The second option is to stop cutting rates earlier than the market expects and to begin raising rates again when inflation shows signs of rising. The UK has already taken a step in this direction. According to derivatives data collected by LSEG, investors' reaction to the Labour Party's government spending plans is to bet that the Bank of England will abandon an anticipated rate cut. However, as global fiscal expansion gains momentum in 2025, investors will have to further lower their expectations for easing policies. This will keep the market volatile, with government bond yields remaining high, thereby pushing up financing costs. As politicians persist in heading towards a fiscal "abyss," homebuyers, bond investors, and businesses will pay a steep price