科技巨头又一次主宰美股,但瑞银并不担心:还有上涨空间!

瑞银策略团队在 2024 年展望中指出,大型科技股仍将主导美股市场,预计前六大权重股的回报率将达到 48%。尽管市场对涨势集中度表示担忧,瑞银认为这些科技股的盈利增速预期上升,估值增长放缓,仍有上涨空间。报告显示,过去十年中,标普 500 的涨势越来越集中,市值最大的六只股票占总市值的 31.2%。即使排除科技股,美股市场仍显昂贵。

回顾 2024 年的美股市场,大型科技股再次 “称霸群雄”,这是否意味着涨势集中度仍将成为美股市场的一大威胁?

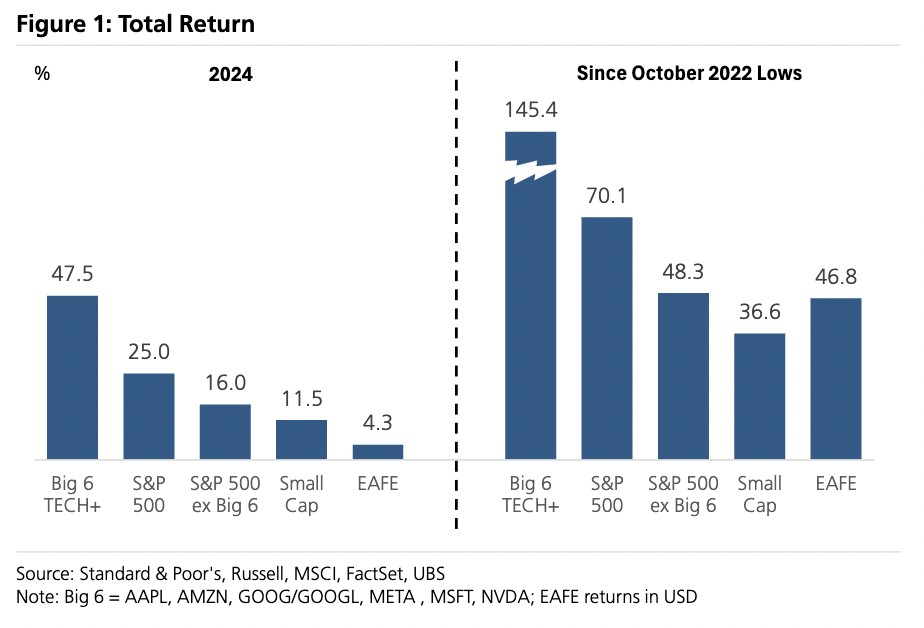

瑞银策略团队在 1 月 2 日发布的研报中表示,2024 年,头部科技股仍领衔市场上涨。排名最前的 6 只权重股 2024 年的回报率达到 48%,贡献了标普 500 指数过去一年来 9% 的涨幅,如果剔除这 6 只股票,剩下的标普成分股的年内涨幅仅为 16%。

尽管仍有投资者担忧市场涨势过于集中的风险,但瑞银认为,考虑到头部科技股明年的盈利增速预期显著向上,且与市场相比其估值增长显著放缓,其仍有潜在上行空间。

盈利动能强劲、估值相对较低,头部科技股有望继续上涨

报告显示,在过去十年中,标普的涨势变得越来越集中,市值最大的 6 只股票现在占总市值的 31.2%,较 2013 年时 11.2% 的水平大幅上升。

市场显然对涨势集中在头部科技股的趋势有所担忧。报告数据显示,大盘股投资组合对六大股指的平均减持比例超过 6%,只有对谷歌母公司 Alphabet 的减持比例低于这一水平。

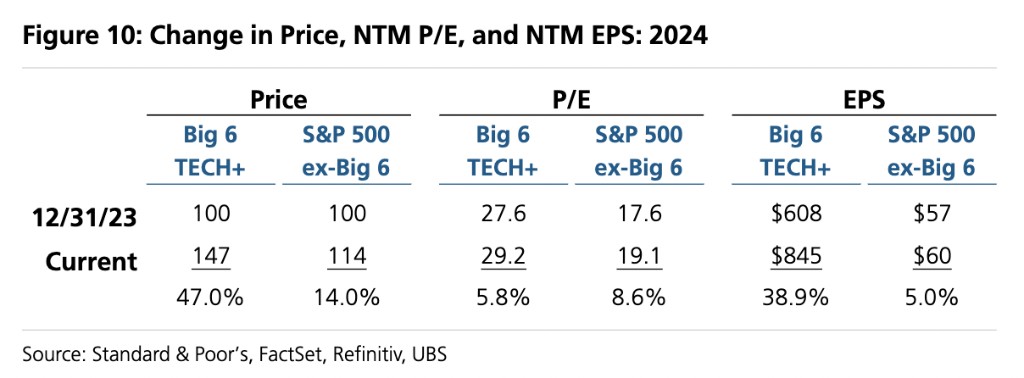

然而,报告同时补充称,在过去一年中,大型科技股对美股涨幅的贡献率(38.9%)远超其他个股(5%),估值增幅(5.8%)反而不及其他个股(8.6%)。这意味着,大型科技股在盈利持续扩张的同时,估值增长放缓,和市场整体相比变得 “更便宜了”。

即使排除科技股,美股市场仍十分昂贵。报告显示,纵向看,标普市盈率当前为 21.5 倍,比历史平均值高出约 1.5 个标准差;横线看,标普相较于非美发达市场指数(EAFE)的估值溢价持续扩大。

同时,就最为影响回报率的预期因素而言,报告表示,市场普遍预计六大科技股的每股收益增速(19.1%)将在明年继续跑赢大盘(10.8%),且仍远高于前 30 年的平均水平(5%)。

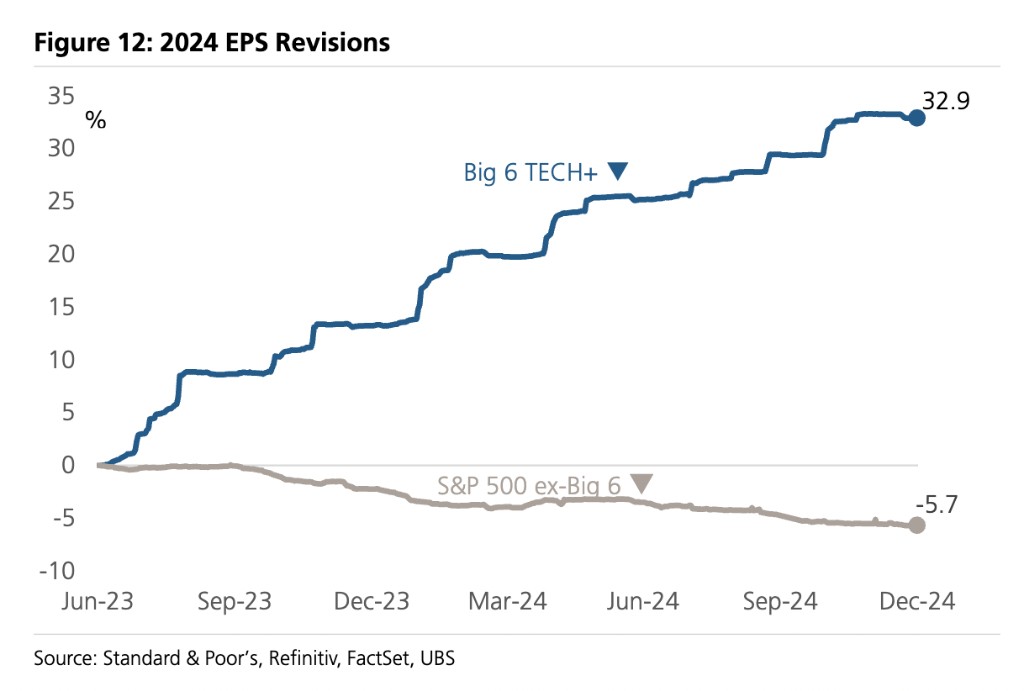

2024 年以来,对六大科技股的盈利预期持续上调,而其他部分则稳步走低,瑞银预计这一路径趋势将延续至 2025 年。

总体而言,报告认为,经济强劲增长、盈利超预期、信用利差收窄以及估值提升均支持了市场在 2024 年的上涨。

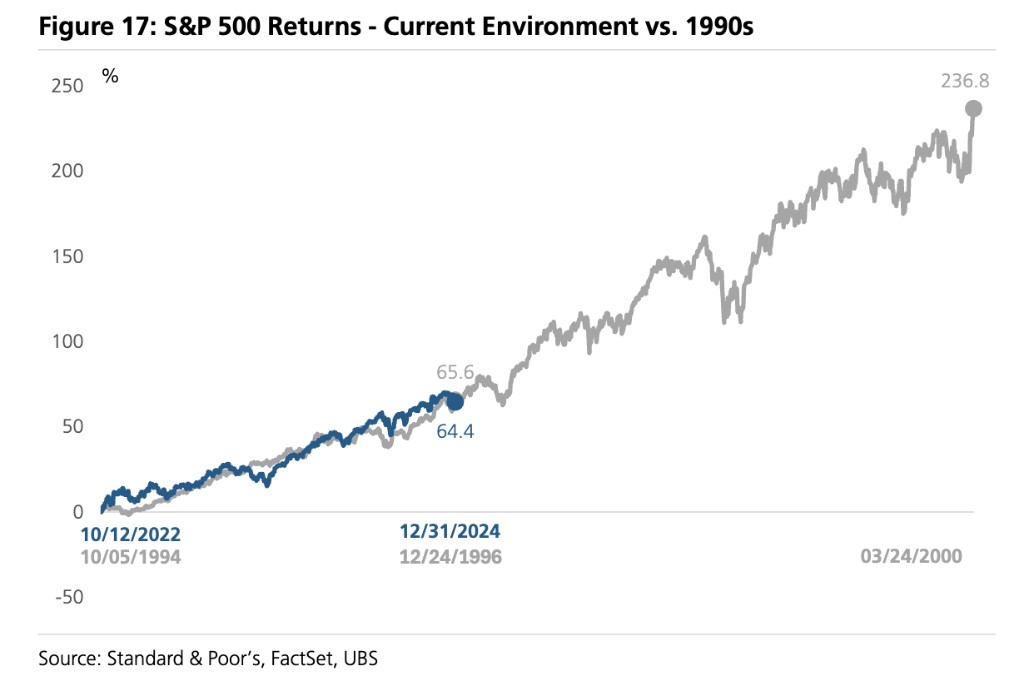

尽管部分投资者担忧市场过热,但报告认为,这种担忧可能被夸大。即使和科网泡沫时期相比,以当前经济与市场数据为基础,美股仍有上行空间,2025 年依然有望成为 “又一个强劲年份”。

风险提示及免责条款

市场有风险,投资需谨慎。本文不构成个人投资建议,也未考虑到个别用户特殊的投资目标、财务状况或需要。用户应考虑本文中的任何意见、观点或结论是否符合其特定状况。据此投资,责任自负。