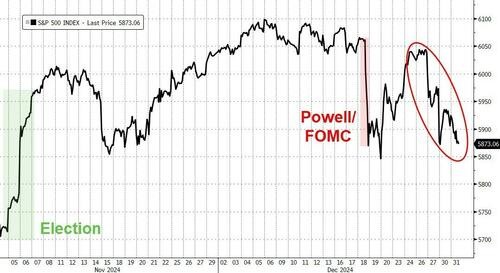

罕见 “四连跌” 收官,美股不是好消息?

尽管全年再度涨超 20%,但美股对这辉煌一年的收官却不怎么漂亮。 标普 500 指数连续 4 天下跌的成绩结束了这一年,自 1966 年以来从未发生过。 高盛衍生品交易员 Brian Garrett 认为: 今年最后两周的表现并不像预期的那样强劲,空头增加了交易量,技术面正在占据主导地位,流动性受到挑战,风险偏好的健康回调才刚刚开始(空头增加,净多头减少等)。

尽管全年再度涨超 20%,但美股对这辉煌一年的收官却不怎么漂亮。

标普 500 指数连续 4 天下跌的成绩结束了这一年,自 1966 年以来从未发生过。

高盛衍生品交易员 Brian Garrett 认为:

今年最后两周的表现并不像预期的那样强劲,空头增加了交易量,技术面正在占据主导地位,流动性受到挑战,风险偏好的健康回调才刚刚开始(空头增加,净多头减少等)。