End-of-year trading slows down, December sell-off leads to a decline in European bond prices

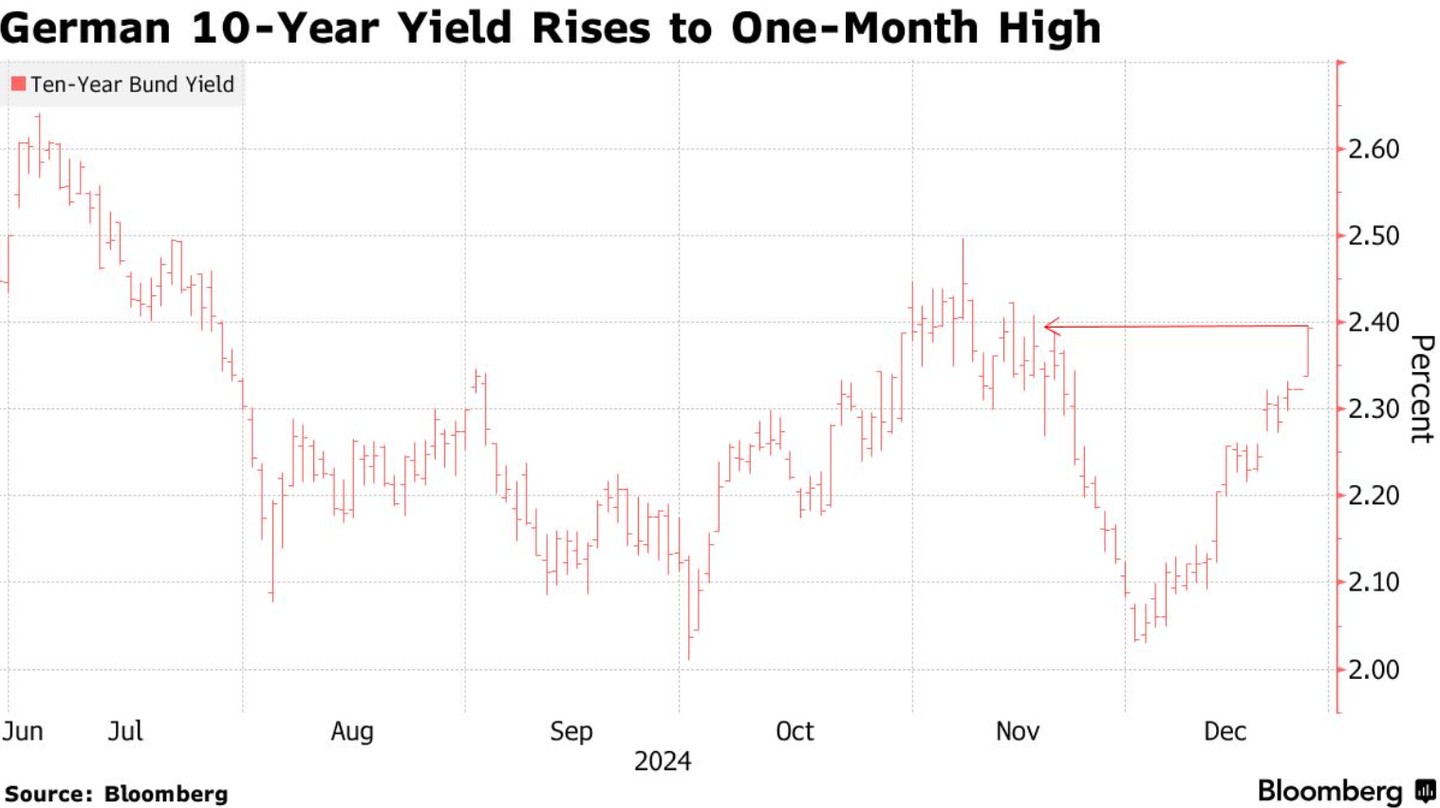

In Friday's trading, the European bond market declined as traders anticipated that the actions of major central banks to cut interest rates may not be as aggressive as expected. The yield on the 10-year German government bond rose to 2.40%, reaching its highest point since the end of November. Reduced market trading volume intensified volatility, and the market trend is expected to continue in December. Rising natural gas prices may affect market demand, leading to increased inflation and putting pressure on the European Central Bank's ability to cut interest rates. The money market expects four rate cuts next year, with the likelihood of a rate cut dropping to below 50%

According to the Zhitong Finance APP, the European bond market experienced a decline during Friday's trading, primarily due to traders' expectations that major central banks may not act as aggressively as anticipated in future interest rate cuts. Additionally, the reduced trading volume after the holiday further exacerbated market volatility. After the Christmas holiday, market trading resumed, and the yield on 10-year German government bonds briefly rose by 7 basis points to 2.40%, reaching its highest point since the end of November. Meanwhile, the U.S. Treasury market performed relatively better, with the yield on 10-year Treasuries rising only 3 basis points to 4.61%.

Jordan Rochester, the macro strategy chief for Europe, the Middle East, and Africa at Mizuho Bank, commented that these market fluctuations occurred in a "very weak market" and predicted that "we may continue to see the continuation of December's market trends over the next two weeks."

He also pointed out that the rise in natural gas prices could be a key factor affecting market demand. Russian President Vladimir Putin expressed skepticism about maintaining the agreement to supply gas to Europe through Ukraine, leading to a 5% increase in futures contract prices.

Rochester further analyzed that if rising natural gas prices lead to increased inflation, it could put pressure on the European Central Bank's ability to lower interest rates.

Since the beginning of December, the yield on 10-year German government bonds has risen by about 30 basis points, poised to record the largest monthly increase since September 2023. This repricing phenomenon occurred as traders reduced their bets on interest rate cuts by the European Central Bank, due to the Federal Reserve's more hawkish stance in early December, suggesting a more cautious approach to easing policies.

The money market currently fully expects four interest rate cuts next year, while the likelihood of a fifth cut has dropped to below 50%, a significant decrease from over 80% last week. This change in expectations reflects the market's latest assessment of the global central bank monetary policy outlook