The wave of AI applications is sweeping in! Software stocks embark on the "NVIDIA-style surge"

Bank of America’s research report points out that with the widespread application of AI, market focus has shifted from semiconductors to software stocks. Software stocks like AppLovin have surged 800% in price this year, attracting investor attention. The AI revenue data from software giants indicates that the investment frenzy is not mindless speculation, and future performance is expected to grow significantly. Jack Ma mentioned at the 20th anniversary meeting of Ant Group that the AI era will bring unimaginable changes, and AI application software will enhance the efficiency of businesses and individuals

Recently, the stock market's investment focus around AI has shifted from semiconductors, which are at historical highs in both stock prices and valuations, to software stocks. The "AI superstar stock" AppLovin (APP.US) has seen its stock price soar by 800% this year, far exceeding NVIDIA's explosive growth, and its skyrocketing performance has driven a frenzy of investment in AI, shifting funds from semiconductor giants like NVIDIA to software stocks closely related to AI. This is also the core logic behind the recent significant surge in stock prices of AI application leaders in the US, European, Hong Kong, and A-share markets.

From the AI revenue data and performance outlook of software giants like ServiceNow, Palantir, and AppLovin, the investment craze surrounding software stocks is by no means "mindless speculation," but rather a market bet that software companies will have performance data several times stronger than current levels as a core pillar under the epic AI boom. Software stocks are expected to continue leading the AI investment wave, and those companies with strong performance growth are likely to replicate the "NVIDIA-style surge curve" that has seen an epic rise of 1000% since October 2022.

NVIDIA, the "shovel seller" in the AI field, has delivered unparalleled performance for several consecutive quarters, ChatGPT has taken the world by storm, Sora has made a significant debut, and "AI agents" have sparked a massive wave of AI applications, which may signify that human society will gradually enter the AI era starting in 2024. On the evening of December 8, at Ant Group's 20th anniversary meeting, Jack Ma, who had not appeared publicly for a long time, showed up at the Ant campus. In his speech, he emphasized: "Twenty years ago, when the internet was just emerging, our generation was fortunate to seize the opportunities of the internet era. The changes that the AI era will bring in the next 20 years will exceed everyone's imagination because AI will be an even greater era."

AI application software is undoubtedly a groundbreaking generative AI—namely, the core technology behind ChatGPT, which permeates the core carriers of human life and can achieve breakthrough improvements in business operational efficiency as well as personal work and learning efficiency. The field of AI application software includes all software products that use artificial intelligence technology, especially generative AI, to solve practical problems, possessing capabilities such as natural language processing, predictive analytics, efficiently addressing user inquiries, or automating tedious tasks, which can directly provide practical value to businesses or individuals, such as improving efficiency and optimizing cumbersome workflows.

From the current technological trajectory, the development direction of AI application software is concentrated on "generative AI application software" (such as ChatGPT, Sora, and Claude launched by Anthropic, which are popular worldwide), and the AI functionality is shifting from a chatbox-style question-and-answer format to "AI agents that autonomously execute various tedious and complex tasks," such as ServiceNow's "Agentforce" and the AI Agent embedded in Microsoft's Dynamics 365 series. These two directions are both a hallmark of AI technological advancement and represent the main line of future comprehensive AI innovation. Among them, AI agents are likely to be a major trend in AI applications before 2030, and the emergence of AI agents means that AI will begin to evolve from an information assistance tool to a highly intelligent productivity tool starting in 2024.

No Longer a Gimmick! AI Begins to Contribute to Software Companies' Performance

OpenAI announced that starting from December 5 local time, it will hold 12 live broadcasts on cutting-edge AI applications. From the already released live content, these innovative activities fully showcase the forefront applications and future development directions in the AI field. Through these conferences, OpenAI proves to the world with a series of heavyweight AI applications that AI is by no means an ethereal gimmick; the AI era has not only arrived but is also rapidly reshaping business efficiency and labor productivity. This is why, after each new content release by OpenAI, the stock prices of leading AI application companies experience a strong upward trend.

From the live broadcasts that have already taken place, OpenAI showcased several innovative AI applications that sparked heated discussions among both enterprise and individual users, with the "AI faith" sweeping the world once again. For example, the fully upgraded version of the reasoning large model o1, which rivals the top experts in various fields; the highly anticipated text-to-video generation tool Sora made its official debut; and OpenAI's "reinforcement fine-tuning" was also prominently featured—allowing the creation of top expert-level AI large models in specific fields with minimal training data.

Among them, Sora's text-to-video generation capability not only demonstrates its outstanding potential in content creation but also signifies its ability to conduct comprehensive dynamic simulations and emulations based on the physical world. This technology plays a crucial role in advancing the research and innovation process as well as the preliminary virtual modeling of super engineering, supporting large and complex simulation and emulation projects, significantly improving research efficiency, reducing corporate costs, and providing a highly flexible and scalable tool platform for solving many complex problems in the real world.

If the cutting-edge AI applications showcased by OpenAI are merely ambitious blueprints that have yet to generate substantial revenue data, then the following software industry leaders have indeed generated "AI revenue" far exceeding market expectations through their various AI applications, marking the imminent arrival of large-scale popularization of AI applications at least in the enterprise application sector; personal applications are experiencing explosive growth, but their scale cannot yet be compared to enterprise-level revenue. As their flagship AI applications iterate to nearly the same level as OpenAI's cutting-edge applications, and as AI agents accelerate, the contours of AI monetization are becoming increasingly clear and showing explosive growth.

Salesforce (CRM.US), a cloud software giant focused on customer relationship management (CRM), exceeded market expectations with its latest quarterly performance data driven by revenue increments from AI application software. After several consecutive quarters of disappointing performance, the company's sales for the third fiscal quarter ending October 31 achieved a year-on-year growth of 8.3%, reaching $9.44 billion, higher than the average Wall Street analyst expectation of about $9.35 billion; Salesforce expects sales for the next fiscal quarter ending in January to be in the range of $9.9 billion to $10.1 billion, indicating a year-on-year growth of 7% to 9%. This American veteran software giant's performance has "revived" and regained its growth curve, and the management's positive outlook for the future undoubtedly significantly enhances investors' confidence that the company's heavily promoted AI application software strategy will improve actual performance. **

Salesforce is a leading player in customer relationship management cloud software. Since the beginning of this year, it has been continuously increasing its investment in AI application software. From the financial reports of the past few quarters, it is evident that Salesforce has made substantial expenditures on artificial intelligence computing infrastructure (mainly NVIDIA AI GPUs), which have finally begun to contribute to its performance. Its AI application software products are rapidly penetrating major enterprise clients, and the "AI Agent" launched by the company has shown strong demand among corporate clients. These factors are the core logic behind the company's positive growth in both performance and outlook. Salesforce's stock price has surged 35% this year, far exceeding the S&P 500 index, with the increase almost concentrated in the second half of this year. The current stock price hovers near its historical high, with a market capitalization of up to $340 billion.

Salesforce's Executive Vice President Mike Spencer recently stated in an interview that the company has signed a "large number" of enterprise transactions related to its AI agent product—Agentforce. He added that these transactions are still in the preliminary stages, but the future growth expectations are very optimistic, although it will take some time to reflect in the company's performance reports.

Focusing on "AI + data analysis," data software giant Palantir (PLTR.US) can be considered an "AI growth stock," with its stock price repeatedly hitting historical highs this year, up 322% year-to-date. Palantir's third-quarter revenue significantly exceeded analyst expectations, and it raised its revenue outlook for the period, mainly due to increasing demand from the U.S. federal government and enterprises for its generative AI-based application software. Palantir's Q3 revenue reached $726 million, a year-on-year increase of 30%, far exceeding expectations, and its net profit nearly doubled, setting a new record for the company; even more significantly, Palantir expects U.S. commercial revenue to grow by over 50% in 2024.

Palantir's generative AI platform "AIP" is fully integrated with Palantir's existing data analysis software ecosystem, allowing clients to access Palantir's core modules and functions through simple Q&A, enabling organizations to effectively apply generative artificial intelligence to data analysis, enhancing insights and operational efficiency. The platform supports a range of AI technology-driven applications, from automated management of material shortages, logistics and supply chain optimization to predictive maintenance and threat detection in complex computing scenarios.

Focusing on providing cloud computing platforms to help enterprises efficiently optimize digital workflows, software giant ServiceNow (NOW.US) has also recently hit new highs, with a stock price increase of 62% year-to-date and a market capitalization of $236.6 billion. With the support of generative AI, ServiceNow has achieved strong performance growth. Like almost all its software industry peers, ServiceNow is integrating generative artificial intelligence capabilities into its products and offering more expensive subscription versions of these software tools.

Amid the global frenzy of enterprises investing heavily in AI technology, ServiceNow has gained favor among numerous corporate users with its upgraded cloud computing software services embedded with generative AI, as well as through the Now Platform supporting developers in creating custom models similar to ChatGPT generative AI applications, driving the company's quarterly performance since 2024 to achieve much stronger growth than the average levels of recent years. The company's total revenue for the third quarter as of September increased by 22% year-on-year, reaching $2.797 billion. Under the strong demand brought by generative AI, the company expects its fourth-quarter booked sales to grow by 21.5% year-on-year, exceeding Wall Street's expectations.

Mobile advertising marketing and mobile application technology development company AppLovin (APP.US) has seen its stock price soar an astonishing 750% this year, far surpassing AI chip leader NVIDIA, making it a veritable "super bull stock." By utilizing generative AI-based advertising software solutions, AppLovin can efficiently match supply and demand amid a vast number of advertising auctions. The company has launched its AI advertising engine model AXON 2.0 and developed intelligent advertising software solutions based on it, providing "AI + advertising marketing" services to both advertisers and application developers.

As AI computing resources and application software deployments covering artificial intelligence hardware infrastructure and AI large models gradually take shape, AppLovin has begun offering global enterprises AI-based "AI + advertising marketing solutions," covering an advertising marketing ecosystem that includes user reach, traffic monetization, advertising creative design, and marketing data detection. On November 7th, AppLovin's quarterly report significantly exceeded market expectations, with quarterly revenue of approximately $1.198 billion, a year-on-year increase of 39%; net profit soared to $434 million, a staggering 300% increase year-on-year, and the company even expects its annual operating profit margin to double.

Unlike the above software giants focusing on practical AI application software, the two cloud computing leaders, Amazon (AMZN.US) and Microsoft (MSFT.US), are fully focused on developing B-end and C-end application software ecosystems related to generative AI, aiming to significantly lower the technical barriers for non-IT professionals in various industries to develop AI applications. Other software giants providing similar AI application software development platforms include Chinese cloud giant Alibaba (BABA.US) and the American "blue giant" IBM (IBM.US), with ServiceNow also offering a similar one-stop development platform.

Amazon's market capitalization has reached $2.4 trillion, surpassing Google and ranking fourth globally. Its stock price has repeatedly hit new highs this year, with a year-to-date increase of 50%, which is rare for a giant with a market value exceeding $1 trillion. Amazon AWS leads the cloud computing market share far ahead of other participants, which has attracted a large number of enterprise customers to the AI application software development ecosystem launched by AWS—Amazon Bedrock—allowing for one-stop development of various AI applications with a low technical threshold. In the third quarter, Amazon's cloud computing division AWS saw revenue grow by 19% year-on-year to $27.5 billion, and under the joint promotion of Amazon Bedrock and IaaS + SaaS, the revenue growth rate of this cloud computing division has accelerated for five consecutive quarters. **

AI Agents - The Strongest "Revenue Engine" for Software Companies in the Future

The urgent demand from enterprises to improve efficiency and reduce operational costs has significantly accelerated the widespread application of AI agents recently. AI agents can automate repetitive tasks, perform big data analysis and aggregation based on incredibly powerful AI large models, and provide real-time monitoring insights and reports, as well as make appropriate decisions in extremely complex situations in a very short time, thereby enhancing operational efficiency. The logic of efficiency enhancement is fundamentally similar for individual learning and work efficiency. AI agents can also efficiently participate in large-scale projects across various fields globally, from blueprint planning to implementation, significantly speeding up project progress.

Software giant ServiceNow stated in its financial report that the company aims to soon shift its artificial intelligence strategy towards a cutting-edge AI application tool called "AI Agent." The core purpose of this currently hottest AI tool is to complete human tasks such as customer support or sales development without human supervision, and it can even participate in large tasks such as software development projects. This established software giant officially launched its AI agent-focused software service product called "Agentforce" in October, with an initial product pricing of approximately $2 per AI Agent conversation.

The newly launched Agentforce is a comprehensive artificial intelligence software platform with highly customizable attributes, designed to provide highly customizable autonomous AI agents. Its AI reasoning capabilities and ability to automate complex and tedious tasks far exceed that of Einstein Copilot, allowing it to connect enterprise data and easily automate various tasks across sales, service, marketing, and other fields. Agentforce allows users to create fully autonomous AI agents that can independently execute complex tasks without continuous human intervention. These agents can utilize enterprise data and ServiceNow's core application software system to make decisions, handling a wide range of tasks from simple to extremely complex.

Analyst Tyler Radke from Citigroup recently commented on ServiceNow's development prospects in a report: "ServiceNow's AI agent tools are beginning to replace the narrative logic of traditional customer relationship management (CRM) software."

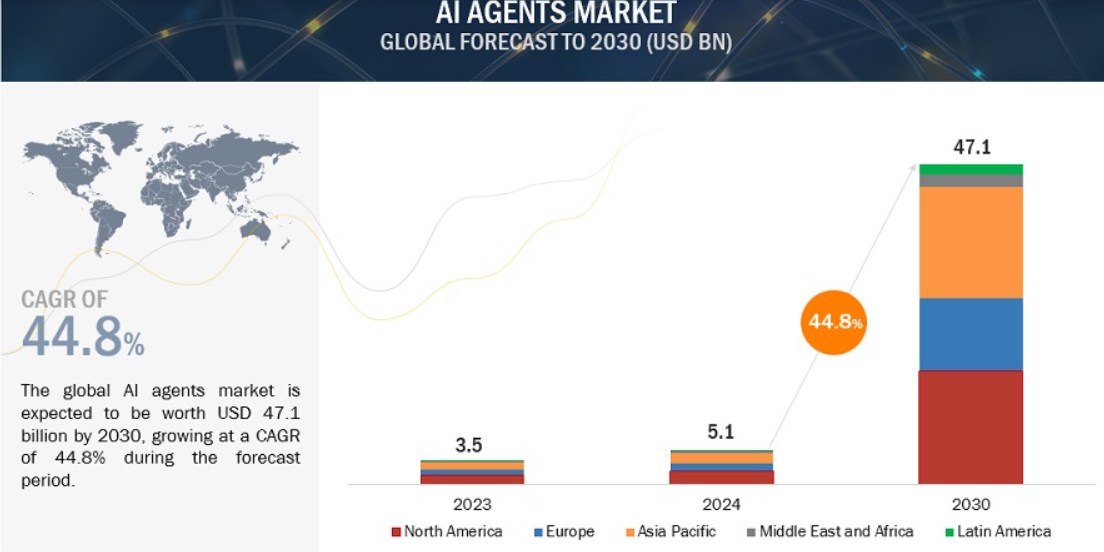

According to the latest forecast report from research firm MarketsandMarkets, the market size for AI agents is expected to expand significantly from just $5.1 billion in 2024 to approximately $47.1 billion by 2030, with a compound annual growth rate of up to 44.8%. The firm stated that by using AI agents, enterprises can automate various very complex processes and reduce human intervention to avoid frequent human errors. The integration of AI agents with enterprise-level internal automation tools will achieve one-stop AI processing from formulating product sales plans to after-sales service, greatly enhancing operational efficiency.

Are Software Stocks Entering a "Price Surge Mode"?

The revenue scale presented by software companies during the earnings season is merely the "tip of the iceberg" compared to the vast market size expected in the future. Software companies focused on AI application software may even be one of the biggest winners of this "AI investment wave" at least until 2028. According to IDC's expectations, the revenue scale brought by AI applications between 2024 and 2028 may far exceed the revenue scale of semiconductor giants like NVIDIA, Broadcom, and SK Hynix in the AI infrastructure sector.

Robin Vance, CEO of Bank of New York Mellon, stated on Wednesday local time that this American banking giant is ramping up investments in artificial intelligence and digital asset services to enhance its ability to provide solutions to clients. Vance introduced a new leadership team focused on growth in areas such as real-time digital payments and artificial intelligence while improving operational efficiency.

According to a survey of 800 business leaders from large enterprises, generative AI application software has rapidly penetrated various daily operations of businesses over the past year, extending from information technology to human resources, indicating that AI is no longer just a simple hype. According to a report from the Wharton School of the University of Pennsylvania and marketing consulting firm GBK Collective, about 72% of business decision-makers reported using generative AI at least once a week, a significant increase from 37% in the first year of the survey in 2023. According to a recent forecast by the well-known research institution IDC in its "Worldwide Artificial Intelligence and Generative Artificial Intelligence Spending Guide," the agency expects that by 2028, global spending related to artificial intelligence (AI) (focusing on AI-supported applications, AI chips, and other AI infrastructure, as well as related IT and business services) will at least double compared to the current level, reaching approximately $632 billion.

IDC predicts that global AI spending will achieve a compound annual growth rate (CAGR) of 29.0% during the forecast period from 2024 to 2028. IDC emphasizes that AI application software or AI applications will be the largest category of AI technology spending in the coming years, accounting for more than half of the entire AI forecast market in the report.

Wall Street's expectations for the stock price growth of software giants such as ServiceTitan, AppLovin, ServiceNow, and Amazon are also being continuously revised upward. JMP Securities has significantly raised its target price for ServiceTitan, which has repeatedly hit new highs, to $425, indicating that the stock could rise by 27% in the short term among established software giants at historical highs; Oppenheimer has set a target price of $480 for AppLovin, suggesting that AppLovin, which has seen a rise of over 700% this year, is expected to continue surging by over 50% in the coming months.

Looking beyond 2025, Wall Street seems more optimistic about the investment prospects of software stocks under the catalyst of AI application software, especially AI agents. In a recent research report, financial giant Bank of America pointed out that as AI applications become fully popularized in both B-end and C-end markets, the market focus is shifting from semiconductor giants like NVIDIA to the second phase of the AI investment boom, which focuses on generative AI and software stocks related to AI agents, as well as data center infrastructure providers such as network endpoint devices, power supply equipment, and liquid cooling facilities.

"Do not underestimate the short-term disruptive potential of AI at this stage; the entire AI investment field, especially software stocks, is unlikely to be fully priced in by the market. As the 'AI moment' for software arrives, AI monetization is expected to begin in 2025 and become meaningful in 2026 as enterprise adoption accelerates," Bank of America wrote in the report.

Bank of America noted: "As enterprise AI penetration begins in 2025 and accelerates in 2026, the market focus in the coming years will shift to the second phase of AI beneficiaries, particularly software companies. The new wave led by AI agents is expected to catalyze the accelerated development and deployment of AI-driven applications, as well as industrial and commercial robots, which may change global productivity sooner than investors expect."