The 20-year Treasury bond auction failed, with domestic demand in the U.S. hitting a record low, leading to declines in both U.S. Treasury bonds and stocks

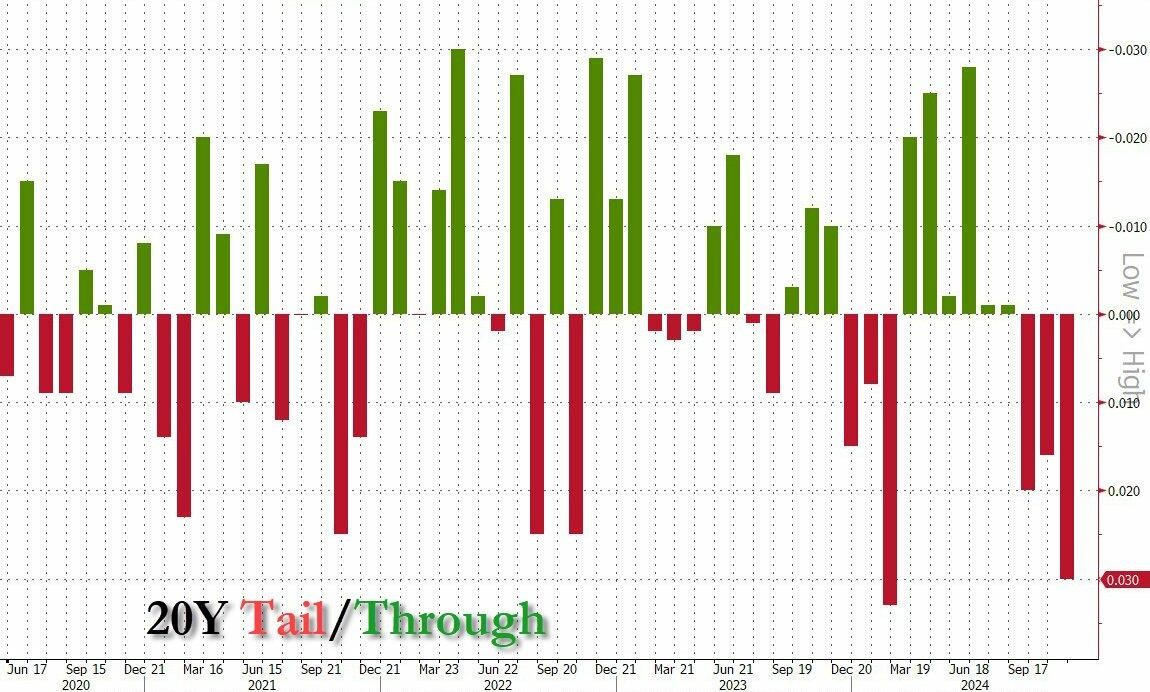

The pre-issue interest rate for this auction was 4.650%, and the final winning rate was 3 basis points higher than the pre-issue rate, marking the second-largest tail spread on record. The bid-to-cover ratio for this auction reached its lowest level since August 2022. UBS stated that real money has not yet started buying U.S. Treasuries, and it is best for real money to intervene as soon as possible, or the situation will quickly deteriorate. Financial blog Zerohedge described this auction as catastrophic

Local time on Wednesday, the U.S. Treasury auctioned $16 billion in 20-year bonds, with dismal results and several key indicators performing poorly. Financial blog Zerohedge bluntly stated that this auction was catastrophic.

The winning yield for this 20-year U.S. Treasury auction was 4.680%, up from 4.590% on October 23 of last month.

The pre-auction yield was 4.650%, and the final winning yield was 3 basis points higher than the pre-auction yield. This marks the third consecutive time that a tail spread reflecting weak demand has occurred, and it is also the second-largest tail spread on record.

The bid-to-cover ratio for this auction was 2.34, the lowest level since August 2022, down from 2.59 previously.

As an indicator of domestic demand in the U.S., the allocation ratio for direct bidders, including hedge funds, pension funds, mutual funds, insurance companies, banks, government agencies, and individuals, was 7.9%, the lowest on record, a sharp drop from the previous 17.6%.

Overseas demand was a relative highlight for this 20-year U.S. Treasury auction, but it was only slightly better. The allocation ratio for indirect bidders, typically foreign central banks and other institutions participating through primary dealers or brokers, was 69.5%, up from 67.9% last time, but still below the recent six-auction average of 71.6%.

As the "backstop" for all unsold supply, primary dealers had an allocation ratio of 22.6% in this round, the highest level since May 2021, a significant increase from the previous 14.5%.

Given the poor auction results, the yield on 20-year U.S. Treasuries rose after the auction results were announced, with the 10-year Treasury yield increasing by 2 basis points to 4.41%, impacting risk assets as well.

Regarding this auction, UBS stated that the previously strong demand for 10-year and 30-year bond auctions seemed to be merely quick profits for short sellers, and real funds have yet to start buying U.S. Treasuries. It is best for real funds to intervene as soon as possible, or the situation will quickly worsen.

Four years ago, the U.S. Treasury restarted monthly auctions of 20-year U.S. Treasuries, but data shows that the performance of these bonds has become disconnected from the market. Earlier this year, former U.S. Treasury Secretary Steven Mnuchin, who reintroduced the 20-year Treasury bond, stated that the purpose was to lock in lower borrowing costs for the coming decades, which seemed reasonable at the time But the actual effect is not as expected, it is time to end the 20-year U.S. Treasury bond