Mercedes-Benz plunges 8% intraday! The company issues profit warning, this year's profit may be "significantly lower" than last year

欧洲汽车行业正经历着前所未有的挑战,奔驰销售低迷,全年汽车调整后 ROS 预测由 10%—11% 下调至 7.5%—8.5%,大众和宝马二季度利润率也均出现了下滑。

周五,梅赛德斯 - 奔驰欧股大幅低开低走,盘中跌逾 8%,创下 2020 年 6 月以来的最大盘中跌幅。股价创年内新低,较年内高点跌去逾 24%。

奔驰崩盘,到底发生了什么?

近日,梅赛德斯奔驰集团修正 2024 年业绩指引,称宏观环境进一步恶化。预计全年汽车调整后 ROS(销售回报率)为 7.5%—8.5%,之前预计为 10%—11%。预计今年 EBIT(息税前利润)将 “大大低于” 低于上年。

瑞银分析师表示,梅赛德斯的前景调整 “并不令人意外”,但与同行相比,此次预警的规模可能会引发投资者的恐慌,并导致进一步的降级。

“MBG(梅赛德斯 - 奔驰集团)的盈利预警比宝马更大,而且与大规模召回无关,这一事实将让市场对 2025 年的潜在盈利能力和资本配置感到困惑。”

梅赛德斯奔驰 CEO Ola Källenius 周五表示,梅赛德斯将 “尽一切可能” 提高业绩,包括推出新产品以拉动销售。“我们将积极顺风而行,而不是只是观风而行。”

销售低迷,汽车行业正经历着前所未有的挑战

梅赛德斯在周四的声明中表示,梅赛德斯的调整是由 “宏观经济环境进一步恶化” 引发的。“总体而言,预计 2024 年下半年的销售组合将与上半年保持不变,因此低于最初的预期。”

在欧洲地区,奔驰的交付量在 8 月份下降了 13%,1-8 月下降了 3%。电动汽车销量尤为惨淡,8 月份,电动汽车在欧洲的交付量下降了 36%,市场份额从 21% 下降至 14.4%。

梅赛德斯 - 奔驰的利润警告为德国汽车行业敲响了警钟,反映出其向高端市场进军的战略受阻,更显示德国这一支柱产业在电动化转型中所面临的重重困难。

作为德国工业的代表,汽车行业正经历着前所未有的挑战。德国两大汽车巨头——大众和宝马——二季度的利润率均出现了下滑。

大众汽车正考虑首次关闭在德国的工厂,并废除工资协议,以进一步削减开支。二季度大众在中国市场的交付量下滑了 19%。

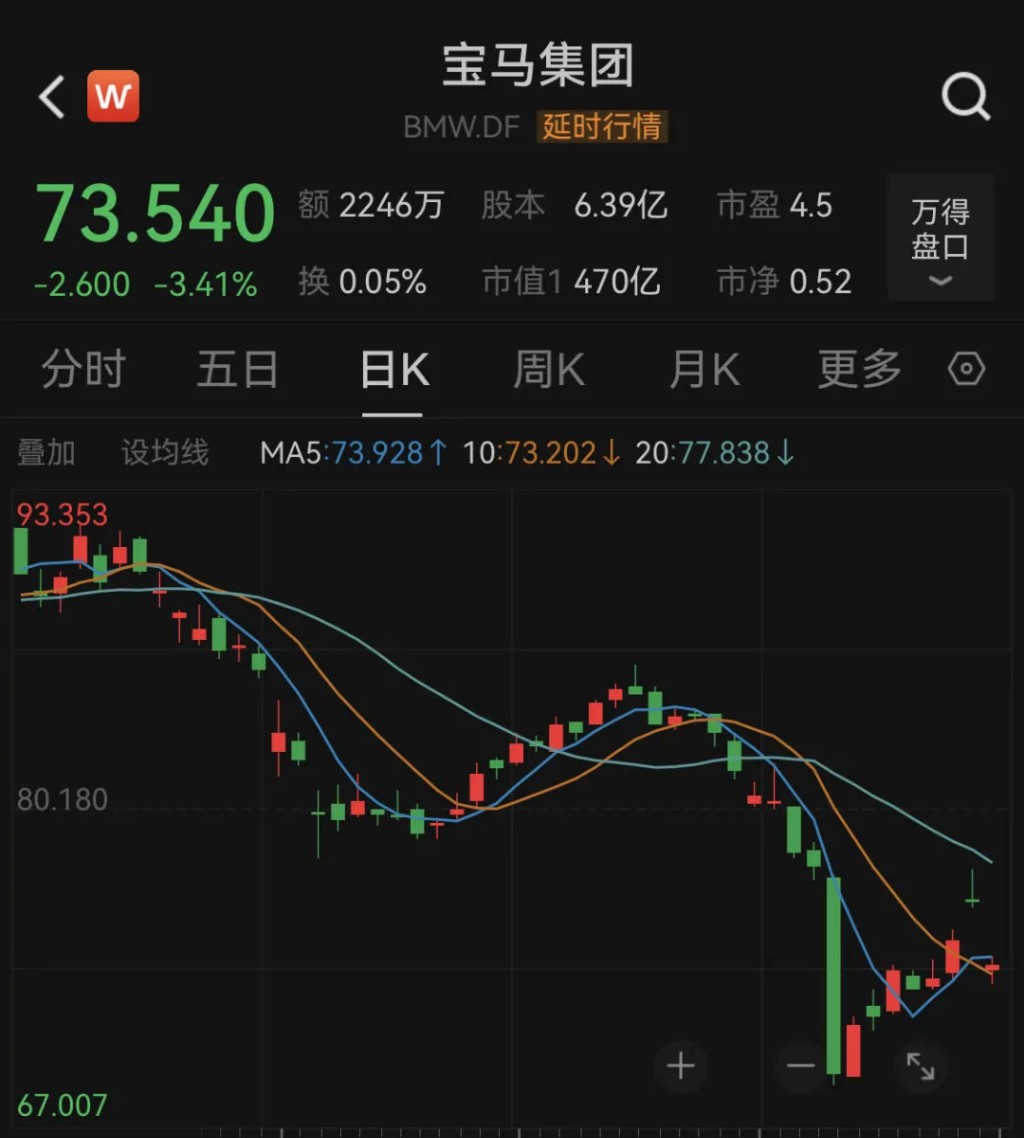

受刹车系统召回事件影响,宝马集团也于上周下调了全年盈利预期至 6%,之前的预期为 8%-10%。第二季度,宝马销售额为 369.4 亿欧元,同比减少 0.7%,且不及市场预期的 379.9 亿欧元。上半年中国市场销售额下降了 4%。

今日,宝马集团股价也跟奔驰随低开低走,跌逾 4%。大众汽车、保时捷等欧洲汽车业巨头股价今日均低开低走。

此外,随着欧盟明年将开始实施更加严格的车辆排放规定,电动汽车销量下滑使欧洲汽车制造商面临巨额罚款的风险。

昨日,欧洲汽车制造商协会(ACEA)敦促欧盟推迟新的碳排放目标(每辆车每公里约 95 克二氧化碳),并呼吁采取 “紧急且有意义的行动” 以扭转颓势。大众、宝马和雷诺等顶级汽车制造商已经建议推迟目标,否则它们将面临数十亿欧元的罚款风险。