After the Federal Reserve significantly cut interest rates, market expectations for easing still outpaced, leading to a decline in US bond yields

美联储降息后,市场对未来宽松政策的预期依然强烈,导致美国国债收益率下滑。交易员关注劳动力市场状况,短期美债表现优异。尽管鲍威尔称降息为政策 “重新调整”,市场仍预计年底前将再降息三次。分析师指出,未来经济数据将决定市场预期与美联储政策的对抗。

智通财经 APP 获悉,随着交易员将注意力从备受期待的美联储首次降息转向劳动力市场状况,美国国债小幅上涨。各期限美债收益率下滑,较短期美债表现优异。其中,两年期美债收益率下降 3 个基点至 3.59%。

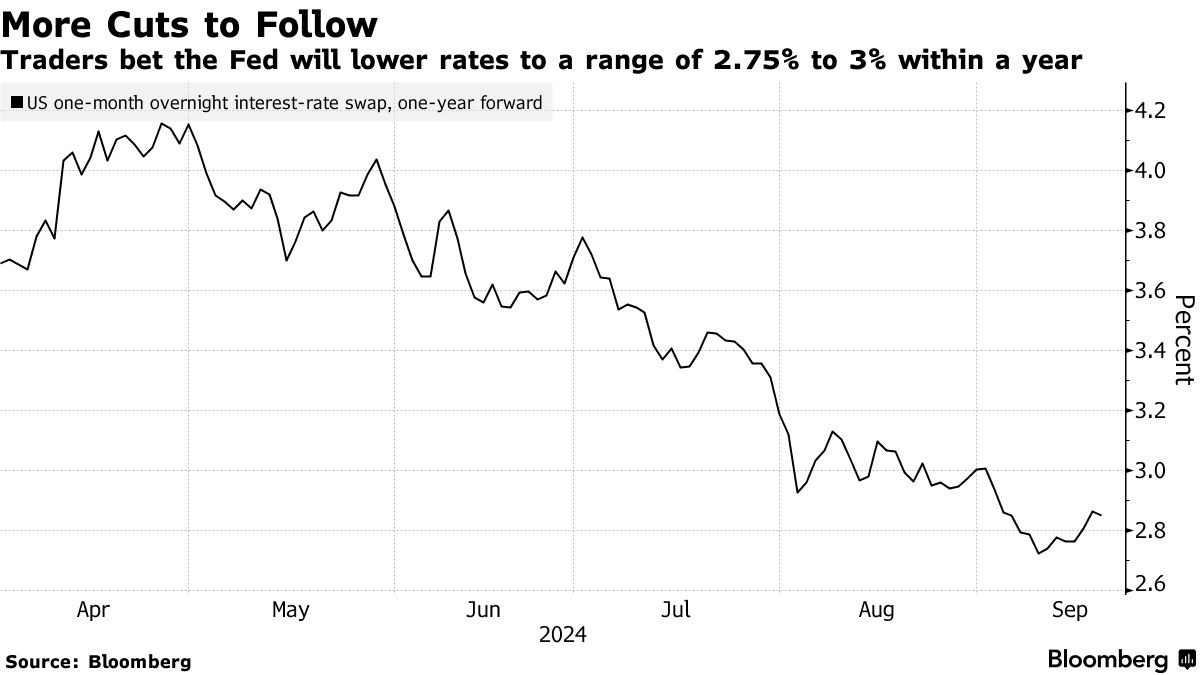

尽管美联储主席鲍威尔将周三降息 50 个基点的决议描述为对政策的 “重新调整”,但市场对今年及以后进一步宽松的速度和幅度的押注几乎没有变化。货币市场倾向于认为,美联储在年底前还将进行三次各 25 个基点的降息,预计明年还将降息 200 个基点。这样的预期比美联储最新公布的点阵图所显示的利率路径要更激进,点阵图只显示今年还会再降息 50 个基点。

Brandywine Global 投资组合经理 Jack McIntyre 表示:“现在将是市场预期与美联储之间的较量,就业数据——而非通胀数据——将决定哪一方是正确的。”“由于这一政策主要是传递信号,因此金融市场没有出现过大的波动。现在,每个人都回到了依赖数据的阶段。”

鲍威尔表示,美联储的降息幅度大于许多市场参与者预计的 25 个基点,这将有助于在美国经济仍然强劲的情况下限制经济衰退的可能性。他补充称,他认为政策制定者采取行动还不算太晚。不过,美联储更新的经济预测摘要中将 2024 年底的失业率预期中值从 6 月的 4% 上调至 4.4%,而鲍威尔上个月曾表示,劳动力市场的进一步降温将是 “不受欢迎的”。

贝莱德投资研究所主管 Jean Boivin 表示:“美联储周三的举措出人意料,短期内可能对市场有利。但我们认为,这加大了未来出现进一步波动的可能性,尤其是如果经济增长和通胀走势不符合美联储最新预测中的软着陆情形的话。”