What will happen next after the historical "50 basis point rate cut"?

野村證券指出,美聯儲降息 50 基點的三個月後,小盤股大漲,價值股再次跑贏成長股,金屬價格飆升,收益率曲線呈牛市陡峭化趨勢。美聯儲此前已多次進行 75 基點的大幅加息,因此以 50 基點開啓降息週期並不意外,不一定會引發市場恐慌。

華爾街普遍預期,如果今晚公佈的美國零售數據不瘋狂反彈,美聯儲將在本週晚些時候的會議上開啓降息週期。然而,正如新 “美聯儲通訊社” Nick Timiraos 上週四所説,沒有人確切知道鮑威爾等人將採取多麼激進的行動。

截至發稿,芝商所 FedWatch 工具顯示,9 月降息 50 基點的可能性高達 67%,高於上週五的49% 和前一天僅 15% 的可能性。

在眾多華爾街大行看來,降息 50 基點未免顯得有些操之過急。美銀此前就警告稱,降息 50 基點“沒有道理,難以溝通,而且可能引發避險衝擊”。相比之下,以野村證券和摩根大通為代表的激進派認為,降息 50 基點勢在必行。

野村證券美債銷售主管Jack Hammond 在最近的一份報告中指出,美國實際失業率可能比美聯儲預測的更高,而核心 PCE 通脹比預測的更低,威廉姆斯等 FOMC 重要成員均暗示同意大幅降息。野村分析師 Charlie McElligott 指出,美聯儲此前已多次進行 75 基點的大幅加息,因此以 50 基點開啓降息週期並不意外,不一定會引發市場恐慌。

在研究了歷史上的降息週期後,野村證券發現,在美聯儲降息 50 基點的三個月後,標普 500 指數基本沒有變化,但小盤股大漲,科技股表現良好,價值股再次跑贏成長股,美元上漲,金屬價格飆升,收益率曲線呈牛市陡峭化趨勢。

摩根大通預計,FOMC 將在 9 月和 11 月會議上分別降息 50 個基點,此後每次會議均降息 25 個基點。他們還指出,美聯儲寬鬆週期的開始往往 “恰逢風險資產表現不佳”。

歷史上 “50 基點降息” 後,小盤股大漲,價值股再次跑贏成長股

以史為鑑,幾乎每當美聯儲以 50 基點拉開降息帷幕時,市場表現都相當糟糕:2001 年 1 月(互聯網泡沫後)、2002 年 11 月(經濟復甦放緩)、2007 年 9 月(全球金融危機)和 2020 年 3 月(新冠疫情)。但那都是過去的事了,McElligott 在最新報告中寫道:

當聽到人們説 “嗯,50 個基點是在告訴市場,美聯儲認為經濟有一個大問題,這可能導致避險情緒的爆發”,我的想法是,在這種充滿怪異元素的週期中,沒有什麼是正常的(前所未有的貨幣和財政干預,市場過度反應和不足反應,伴隨着劇烈的轉向和制度轉變,造成了動量衝擊)。

事實上,我們在一年半的時間裏經歷了 11 次美聯儲加息,包括多次 75 個基點的大幅加息……所以,在政策逆轉時做出相應類型的舉措應該是可以預期的,不是嗎?

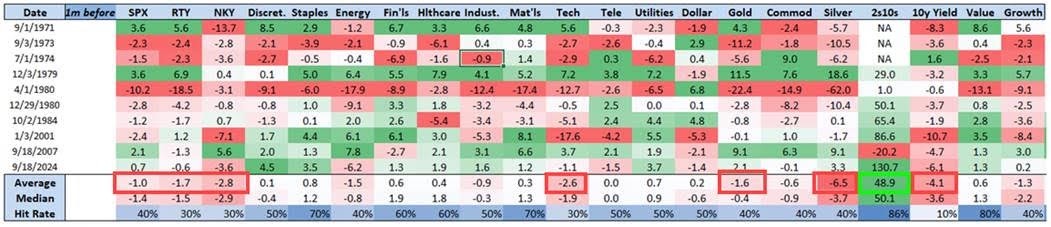

野村研究了所有先前降息 50 基點的案例,並篩選了美聯儲降息前一個月和降息後幾個月的市場回報。以下是他們的發現:

在利率決議出爐前的 30 天,標普 500 指數平均下跌 1%,其中生活必需品類是表現最好的板塊之一,平均上漲 0.8%,而科技類股則是表現最差的板塊之一,下跌 2.6%。

小盤股羅素2000 指數平均下跌了 1.7%,能源股、工業股和貴金屬的表現也不好。價值股的表現優於成長股,收益率曲線呈牛市趨勢。

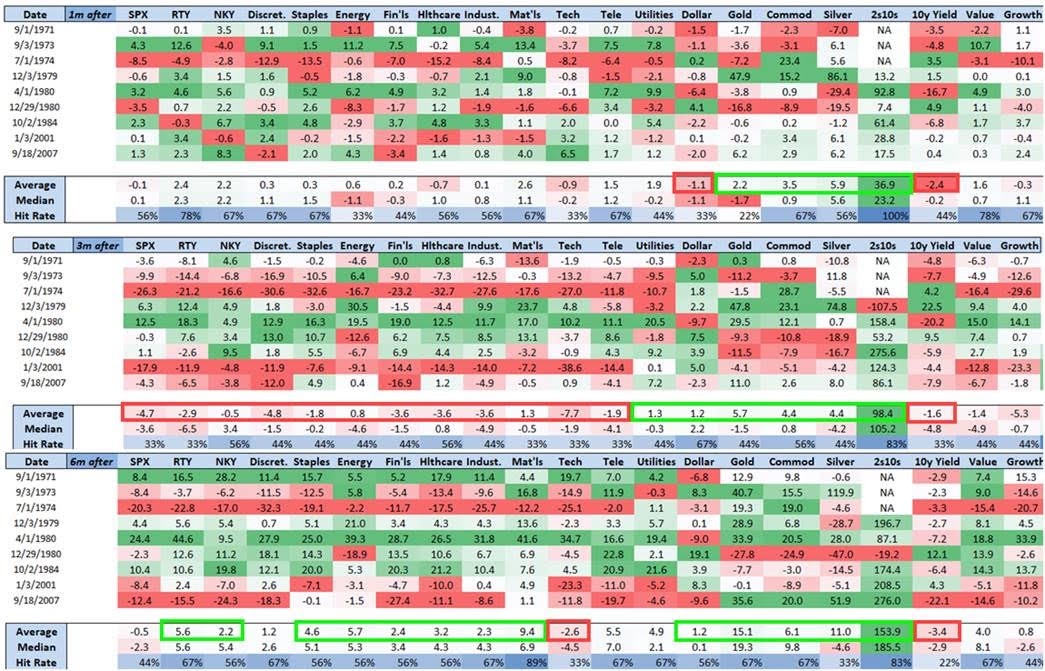

降息 50 基點的三個月後,標普 500 指數基本沒有變化(除了 2007 年、2001 年和 1974 年,當時標普 500 指數遭遇了重創)。相反,小盤股平均上漲了 5.6%。科技股表現良好,價值股再次跑贏成長股,美元上漲,金屬價格飆升,收益率曲線呈牛市陡峭化趨勢。

然而,在當前這種非常規的經濟週期中,野村預測可能不準確。畢竟,疫情爆發後,美國的衰退期間家庭淨財富實現了首次增長,標普 500 指數的收益依然穩健,利潤率在增長,就業市場也相對緊張。

今天的美國,與 1995 年更像

出於以上和其他原因,摩根大通認為,投資者可能正在 “探索未知領域”。他們還認為,與當今形勢最相似的可能是 1995 年開始的降息週期,當時首次降息 25 個基點。

摩根大通指出,1995 年的降息週期有兩大背景:

實際 GDP 增長率為 2.7%,CPI 為 2.5%,失業率為 5.7%。當年的非農新增就業數據只有兩次低於 10 萬,如果去掉那兩次,非農就業數據平均每月為 20.7 萬,而包括那兩次數據後為 17.9 萬。

M3 貨幣供應增長迅速,這主要是因為有大量資金流入貨幣市場基金(MMF),這些MMF 的收益率隨着貨幣市場利率的下降而緩慢調整。

美股對降息反應較為積極,標普 500 指數表現良好。

TS Lombard分析師 Dario Perkins 認為,1995 年美國 “軟着陸” 對今天的美聯儲是個好兆頭。

Perkins 在報告中寫道,目前經濟金融環境沒有出現明顯的失衡現象,降低了美聯儲落後於市場曲線時發生嚴重問題的風險。美聯儲可能會採取更大幅度的降息措施以避免落後於市場曲線,如果美聯儲以更小的 25 基點降息,可能會在 9 月股市淡月引發市場波動。