After "looking at US Treasuries", BofA's Hartnett: Gold hedges "second inflation", best "reverse trade" is oil and non-ferrous metals

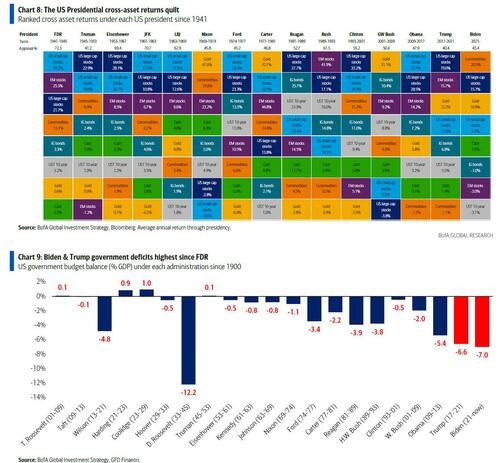

Hartnett 认为,无论是哈里斯还是特朗普最终当选美国总统,都不会改变美国政府债务扩大和赤字膨胀的轨迹,因此市场会在避险情绪下转向黄金,预计金价有望涨至 3000 美元/盎司。

由于经济衰退风险持续存在,美银著名策略师 Michael Hartnett 今年以来一直秉持看多美债的立场,认为随着未来 12 个月内货币政策会变得更加宽松。

事实证明他的预测是准确的。自 Hartnett 唱好美债以来,10 年期美债收益率已经累计下跌 100 基点,一度跌至年内新低。

除了债券,Hartnett 看好的另一个资产是黄金。Hartnett 近日发布研报表示,黄金是 “抵御 2025 年通胀再加速的最佳对冲工具”,和 2021 年、2022 年一样,黄金通过晋升为表现最佳的资产为这两年间爆炸式通胀提供了预警信号,预计金价有望涨至 3000 美元/盎司。

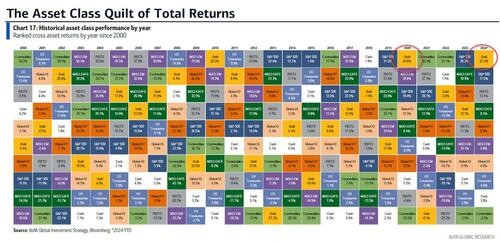

自罗斯福总统任期以来的历史数据显示,如果市场对经济充满信心,就会利好股市;如果反之,则利好黄金。

报告指出,在过去的 12 个月里,美国政府债务增加了 2.1 万亿美元,占 GDP 的比例达到 7.1%,而无论是哈里斯还是特朗普最终当选美国总统,都不会改变美国政府债务扩大和赤字膨胀的轨迹,因此市场会在避险情绪下转向黄金。

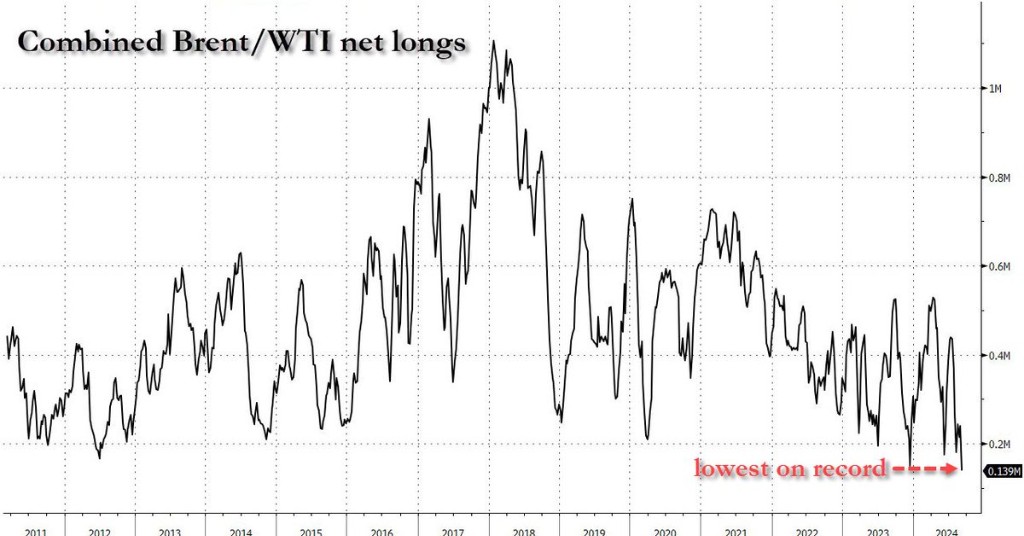

Hartnett 还预测, “首次降息交易” 中的最佳的 “反向交易” 是大宗商品,即石油和有色金属。他指出,在美联储未来 12 个月内降息 240 个基点的情境下,大宗商品是唯一一类被定价为硬着陆的资产类别。

以石油市场为例,当前的市场情绪比 08 年全球金融危机、欧洲主权债务危机和全球新冠疫情高峰期间的水平还要糟糕。

总体而言,在货币政策逐步宽松的前景下,Hartnett 看好 3B:黄金、美债、市场广度(Bonds, Bullion, Breadth)。

报告补充称,当前经济 “硬着陆” 的风险被低估,即使美联储首次降息时仅把利率下调 25 基点,之后仍会大幅降息,预计美债收益率将进一步跌至 3% 的水平。因此,现在最有利的操作是“卖出首次降息”,届时等待更好的风险资产入市时机。

Hartnett 还提及,决定美债收益率接下来是反弹还是下跌的决定因素将取决于下一份就业报告,看 9 月的非农新增就业人数是低于还是高于 10 万人,这将很大程度上消除不确定性。

“在那之前,风险会轮换,而不是分化或撤退。”