Boeing is constantly in trouble, with a major strike affecting production and credit ratings facing the risk of being downgraded to "junk" level

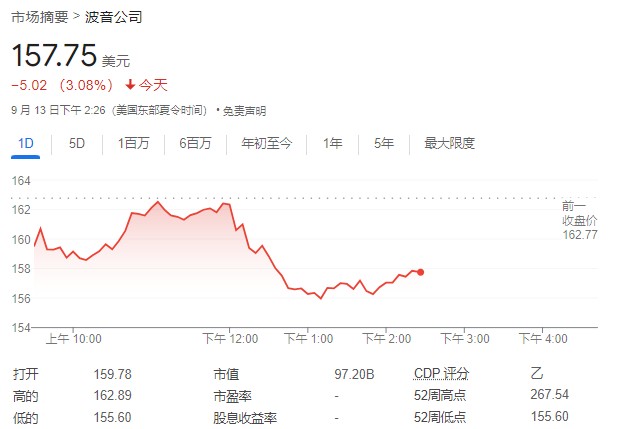

罢工或影响波音最畅销机型的生产,并加剧波音现金流恶化,有机构评估罢工将导致波音损失 30 亿至 35 亿美元之间。另外,波音面临被降级为 “” 垃圾级” 信用评级风险,多家机构周五公开表示,正在评估波音评级是否要下调,一旦波音的信用评级被降到 “垃圾级”,它的借贷成本将上升,这对波音来说,无疑是雪上加霜。受此影响,波音股价周五一度跌超 4%。

波音公司遭遇了 16 年来的首次大规模罢工,导致其最畅销的 737、777 和 767 喷气式飞机被迫停产,进一步打击了本已陷入困境的波音。

这场罢工始于美东时间 9 月 13 日周五午夜,数千名机械师在拒绝了工会领导与波音高管之间达成的劳工协议后,停止了工作。

该协议提议在四年内总计为工人加薪 25%。但该协议未能满足工会成员要求的四年内加薪 40% 的预期,因此波音工会成员 16 年来首次拒绝工会领导人推荐的合同。

他们对新合同的不满主要集中在起薪和福利上。许多员工认为,考虑到过去十年工资增长停滞,而生活成本却在不断上涨,合同中提议的加薪幅度远远不够。

一位员工指出,新合同提议的起薪为每小时 21 美元,这与当地汉堡连锁店 Dick's Drive-In 的起薪相当,而后者还为员工提供健康保险和 401(k) 退休金匹配计划。这位员工讽刺地说:“你翻汉堡都能赚更多钱。”

波音面临现金流恶化、信用评级下调风险

罢工对波音来说无疑雪上加霜。

其一,波音会面临延产问题。西雅图是波音的历史发源地,也是其最大的生产中心。除了生产 737 飞机,波音还在西雅图北部的埃弗雷特工厂制造 777 和 767 型号的飞机。罢工可能会打乱这些工厂的生产计划,并影响更广泛的供应链,导致原本精细运作的生产体系陷入混乱,加剧飞机短缺问题。

其二,罢工会加剧波音现金流恶化。工会员工上一次签订劳资协议是在 2008 年,那次谈判导致了长达 57 天的罢工,每天给波音造成约 1 亿美元的损失。而据 TD Cowen 分析师 Cai von Rumohr 估计,如果此次罢工持续 50 天,类似于之前的罢工,波音的现金流将损失 30 亿到 35 亿美元。波音在今年 1 月的阿拉斯加航空事故后,已经陷入了现金流紧张和债务增加的困境,波音还背负着 450 亿美元的巨额债务。

其三,波音面临信用评级下调风险。穆迪将波音公司置于下调观察名单,罢工可能会使其下调波音信用评级至垃圾级。穆迪在周五的声明中表示,正在评估波音的评级是否会被下调,并将考虑罢工的持续时间、对现金流的影响,以及波音可能采取的筹集资金措施,以增强流动性。此前,波音的无担保债务评级自 4 月以来一直保持在穆迪评级的 Baa3。

波音一直在努力保住投资级评级,如果波音的信用评级被降到 “垃圾级”,它的借贷成本将上升,这对于目前正努力扭转商业和国防业务的波音来说,无疑是雪上加霜。波音还在一些国防合同上亏钱,太空业务也因为延期和成本超支问题受挫。根据穆迪的数据,波音在 2025 年有 40 亿美元的债务到期,2026 年还有 80 亿美元到期。

如果波音的信用评级被降到 “垃圾级”,还会带来其他财务影响,比如愿意购买波音债务的投资者会减少。一般需要有两家评级机构将公司的评级降到投机级(垃圾级),它的债务才会被从投资级指数中移除,不再被视为高质量的债务。

但信用评级机构 Fitch(惠誉)在周五表示,波音的投资级评级因罢工问题面临 “有限的缓冲空间”。与穆迪一样,惠誉也将波音的评级维持在比投机级(垃圾级)高出一档的水平。同样的情况也适用于标准普尔(S&P),他们将波音评级为 BBB-,这是投资级的最低级别。

波音的首席财务官 Brian West 在摩根士丹利会议上对分析师表示,公司正在考虑采取必要措施来加强财务状况。他说,波音正在评估资本结构,以确保能够在未来 18 个月内偿还到期债务。

West 还表示:“我们仍然致力于谨慎管理资产负债表,我们的优先任务是保持投资级信用评级。” 意思是,波音会尽量采取行动保住它的投资级评级,以避免更高的借贷成本。

受此影响,波音股价周五盘中一度跌超 4.1%。

员工对起薪和福利表示不满

工会领导表示,国际机械师和航空工人协会(IAMAW)中有 94% 的成员投票反对该合同,96% 的成员投票支持罢工。工会官员还表示,他们将寻求重新与公司进行谈判。

波音质量检查员 Marcus Amador 在离开位于华盛顿州伦顿市的波音 737 制造工厂后表示:“我们认为我们要求的并不过分,自上次劳资协议以来已经 16 年了。”

波音公司财务总监 Brian West 在投资者会议上表示,公司正在制定新的合同提议,以解决工会的担忧。他警告说,罢工可能会 “危及我们的复苏”,并透露公司目前正在尽可能地节约现金。首席执行官 Kelly Ortberg 上周访问了工厂,听取员工的反馈,并强调重建与员工和工会的信任关系是公司的当务之急。