Unexpected rebound in US core CPI in August, Fed's rate cut probability almost "zero"

美国 8 月核心 CPI 意外上升,住房和旅游价格上涨削弱了美联储降息 50 基点的可能性。8 月 CPI 同比上升 2.5%,环比上升 0.2%。核心 CPI 环比上升 0.3%,同比上升 3.2%。分析认为,核心通胀数据高于预期,可能影响美联储的降息决策。尽管降息的可能性降低,但政策制定者仍关注劳动力市场的疲软,未来几个月的政策讨论将继续。

智通财经 APP 获悉,美国劳工统计局发布数据显示,8 月份美国 CPI 同比上升 2.5%,连续第五个月回落,符合市场预期,低于前值的 2.9%;8 月 CPI 环比上升 0.2%,与市场预期和前值持平。美国劳工统计局表示,住房是整体经济增长的 “主要因素”。

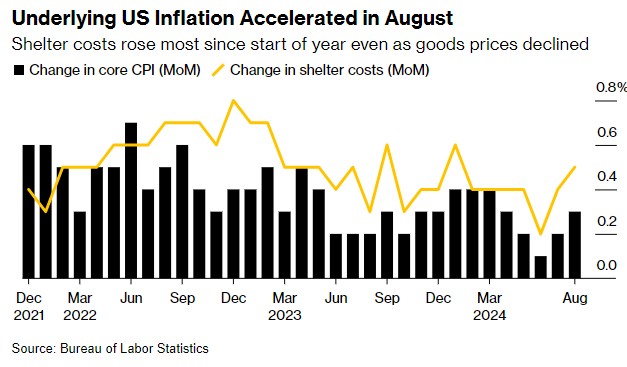

由于住房和旅游价格上涨,美国八月份基本通胀意外上升,削弱了美联储下周大幅降息的可能性。

市场注意到,美国 8 月核心 CPI 环比上升 0.3%,预估为 0.2%,前值为 0.2%。经济学家认为,核心通胀率比整体 CPI 更能反映潜在通胀。8 月核心 CPI 同比上升 3.2%,预估为 3.2%,前值为 3.2%。

机构分析认为,高于预期的美国核心通胀数据将成为下周三美联储降息 50 个基点的问题。眼下的焦点是核心 CPI 月率数据,该指标倾向于增加对顽固通胀的担忧。FOMC 成员中担心货币政策转向过快或过于果断的人,肯定会极力反对下周降息 50 个基点。

虽然周三的数据不会阻止美联储下周降息,但它降低了大幅降息的可能性。即便如此,政策制定者已经明确表示,他们高度关注劳动力市场的疲软,这更有可能推动未来几个月的政策讨论和决策。在 11 月和 12 月的会议之前,他们还将有更多数据需要考虑。

Premier Miton Investors 首席投资官 Neil Birrell 评美国 CPI 报告表示,美联储下周降息 50 个基点的可能性 “受到了这个数字的重大打击,但这根本不足以阻止美联储降息。”

交易员将美联储下周降息半个百分点的概率下调至接近零。美国国债收益率上升,标准普尔 500 指数期货小幅走低,美元缩减当日跌幅,使美元兑日元从 141.80 上升到 142.35。

住房仍然是通胀主力

除了住房之外,机票、服装以及日托和学前教育也推动了价格上涨。汽车保险费用和酒店住宿费用持续上涨。

住房价格是服务业中最大的类别,上涨了 0.5%,为今年以来的最大涨幅。这是连续第二个月上涨,打破了经济学家们普遍的降速预期。业主等价租金 (住房的一个子集,也是 CPI 中最大的单个组成部分) 也以类似的速度上涨。

据计算,不包括住房和能源,服务价格上涨 0.3%,为 4 月份以来的最大涨幅。尽管美联储官员强调在评估国家通胀轨迹时关注这一指标的重要性,但他们是根据单独的指数来计算的。

美联储更加青睐的通胀指标(即个人消费支出价格指数,简称 PCE)并不像消费者物价指数那样重视住房权重,这也是为什么它越来越接近美联储 2% 的目标。

将于本月晚些时候发布的个人消费支出 ( PCE ) 指标,参考了消费者物价指数以及生产者价格指数中的某些类别。周四发布的生产者物价指数报告预计将显示批发通胀步伐温和。