Deutsche Bank warns that the market's expectations for a rate cut by the Federal Reserve are overly optimistic, and volatility risks will rise

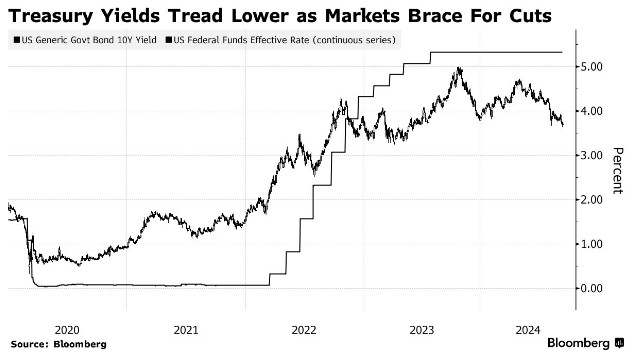

德意志银行警告市场对美联储降息的预期过于乐观,预计波动性将上升。美债市场因降息押注而加速运转,10 年期美债收益率已连续 4 个月下跌。德银预计美联储将降息 6 次,低于市场预期的 9 次,可能导致市场大幅逆转。分析师预测到 2025 年,10 年期美债收益率将达到 3.73%。

智通财经 APP 注意到,最近几天,对降息的押注刺激了美国国债,但德意志银行的私人银行部门警告称,波动性即将上升,因为美国政策制定者的宽松程度可能低于交易员的预期。

德银新加坡亚太首席投资官 Stefanie Holtze-Jen 表示,美联储可能会在下周启动降息周期,预计在截至 2025 年 9 月的一年里总共降息 6 次。这比交易员预计的大约 9 个要少,德银警告道,错误定价可能会引发市场的一轮波动。

关于美联储将放松多少货币政策的问题,已使美债市场陷入超速运转,基准国债收益率已连续 4 个月下跌——这是 3 年来最长的连续下跌。如果事实证明,投资者的降息押注比政策制定者的预期更为激进,那么这种乐观情绪增加了市场出现大幅逆转的可能性。

去年,德意志银行的私人银行部门正确地预测到,美联储将不会降低借贷成本——在当时,随着对美国经济可能陷入衰退的担忧加剧,这一预测似乎与市场预期相反。当时,该机构还精准预测,到 2023 年底,基准的 10 年期美国国债收益率可能徘徊至 4.2%,这是去年 12 月曾经达到的水平。

Holtze-Jen在接受采访时表示:“市场将迎来重新定价,当然在此之后,市场将出现波动。”“美国经济看起来仍处于相当稳固的基础上,尤其是从消费者的角度来看。这种情况可以继续下去。”

德银预计,到明年 9 月,10 年期美债收益率将从目前的 3.63% 左右升至 4.05%,并预计美国经济将避免衰退。机构调查的分析师预测中值则是,分析师们普遍预计到 2025 年第三季度末,10 年期美债收益率将达到 3.73%。