After-hours plunge of over 16%! Affected by companies tightening spending, C3.ai's Q1 subscription revenue and full-year guidance fall short of expectations

AI 软件服务提供商 C3.ai 因企业收紧支出,其第一财季订阅营收为 7350 万美元,低于分析师预期的 7910 万美元,导致股价在盘后暴跌逾 16%。尽管总营收达到 8720 万美元,同比增长 20.5%,但由于经济不确定性和高利率影响,C3.ai 对 2025 财年营收的指引也低于市场预期。

智通财经 APP 获悉,由于企业在经济不确定性下收紧支出,AI 软件服务提供商 C3.ai(AI.US) 公布了季度订阅营收不及预期的第一财季财报,受此影响,该公司股价在周三美股盘后出现暴跌。

面对高利率和不稳定的业务,企业对新软件投资的谨慎态度影响了对 C3.ai 产品的需求。该公司第一财季的订阅营收为 7350 万美元,分析师平均预计为 7910 万美元。

财报公布后,截至发稿,该股盘后暴跌逾 16%。在 2023 年翻了一倍多后,该股今年已经下跌了 20%。

C3.ai 股价的暴跌凸显了科技公司必须在创新和市场稳定之间保持不稳定的平衡。虽然该公司的总营收略高于预期,但订阅营收的大幅下降反映了人们对经济不确定时期企业支出的普遍担忧。

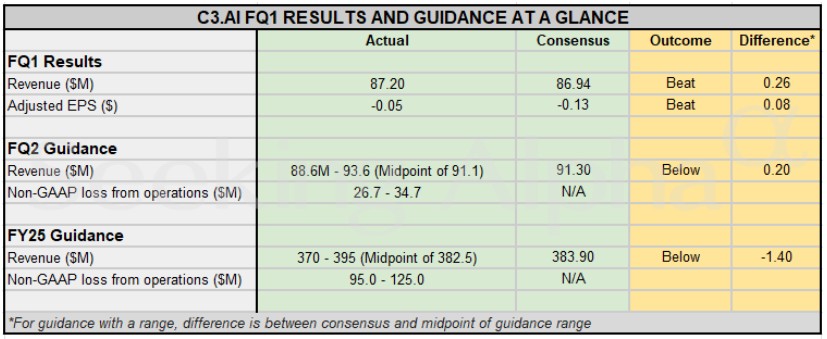

展望未来,尽管有美国国防部和杜嘉班纳 (Dolce & Gabbana) 等知名客户,但 C3.ai 的指引仍低于分析师预期。该公司将 2025 财年的营收预期维持在 3.70 亿至 3.95 亿美元之间,中值低于分析师预期的 3.839 亿美元。预计第二财季营收将在 8860 万至 9360 万美元之间,中值与 9110 万美元的预期一致。

该公司的情况强调了企业在经济不确定的情况下重新调整技术预算的更广泛趋势。该公司的解决方案利用生成式人工智能技术,迎合了制造业、国防、航空航天和制药等不同行业的需求。但对本财年和下一季度的预期表明了其谨慎的乐观态度。随着企业适应动荡的经济环境,科技行业的韧性将受到考验。

不过,该公司总营收达到 8720 万美元,同比增长 20.5%,超过了分析师 8694 万美元的预期,调整后每股亏损 0.05 美元,市场预期为每股亏损 0.13 美元。

得益于企业客户对人工智能的兴趣,C3.ai 一直在推出具有生成式人工智能的产品。这家总部位于加州红木城的公司表示,在截至 7 月 31 日的季度中,它与大公司和政府机构完成了 17 个生成式人工智能试点项目。

C3.ai 董事长兼首席执行官 Thomas M. Siebel 表示:“我们的财年开局稳健,对企业人工智能的需求不断增长,推动了我们连续第六个季度的营收加速增长。C3.ai 是最早的企业人工智能公司。我们坚定不移地致力于解决企业中最具挑战性的问题,这使我们成为业内客户满意度最高的公司。”