Non-farm payrolls reclaim the "most important data" throne as the biggest source of volatility for US stocks

根据美国银行的分析,标普 500 指数期货合约对非农就业报告的敏感度已经超过了对通胀数据的反应,非农就业报告成为股市的重要波动来源。分析师指出,随着通胀回落,投资者现在更关注劳动力市场。尽管美国经济稳健,股市对美联储降息前景感到兴奋,但 “火热的非农就业数据” 仍构成更大的风险。

智通财经 APP 获悉,根据美国银行全球研究的分析,标普 500 指数的期货合约对美国就业报告的敏感度已经超过了对通胀数据的反应。

在 9 月 2 日发布的一份报告中,美国银行的分析师表示:“非农就业报告重新成为对股市而言最重要的数据。” 他们提到,本周所有目光都将集中在 8 月的非农就业报告上,这份报告将由美国劳工统计局在周五发布。

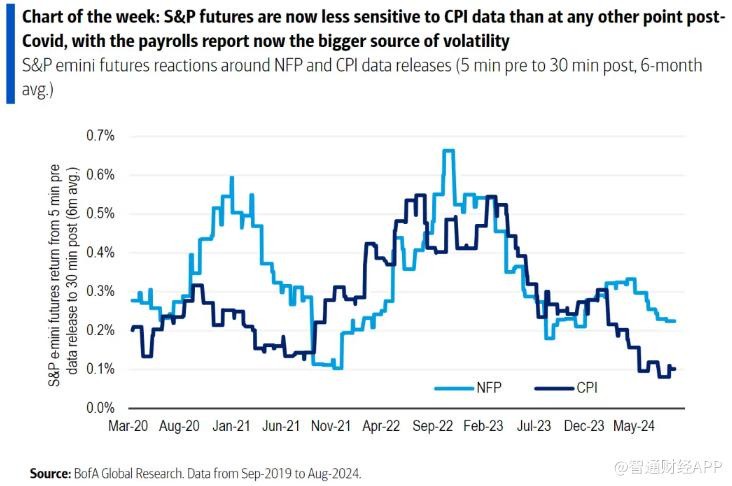

根据美国银行的研究,标普 500 期货合约现在对消费者价格指数 (CPI) 通胀数据的敏感度降至 “新冠疫情后历史最低水平”,而非农就业报告则成为更大的波动来源。随着通胀从 2022 年的峰值大幅回落,投资者现在密切关注劳动力市场的走软迹象。

该行的一张图表显示,自 2019 年 8 月以来,eMini 标普 500 连续期货合约在非农就业和消费者价格指数数据发布前 5 分钟到发布后 30 分钟的反应情况,基于六个月的平均值。

美国银行的分析师指出:“与对潜在经济衰退的担忧相比,股市似乎对美联储今年降息的前景更为兴奋。” 他们表示,美国市场在 8 月的反弹正是这一趋势的体现。因此,他们写道,本周 “火热的非农就业数据对股票市场构成了更大的风险”。与此同时,该行的报告指出,美国经济仍然稳健。

周二公布的数据显示,尽管美国供应管理协会 (ISM) 追踪美国制造业的指数从八个月低点略有回升,8 月份的工厂仍处于低迷状态。

Capital Economics 的北美经济学家 Thomas Ryan 在关于 ISM 制造业指数的报告中表示:“尽管调查结果疲弱,基于硬数据的我们对第三季度 GDP 增长的追踪仍维持在年化 2.5%。”

美国经济分析局在 8 月底估计,美国第二季度的国内生产总值 (GDP) 以修订后的年化增长率 3% 扩张。

美国银行的分析师表示:“与去年相比,增长确实有所放缓,但这是一个逐步的过程。” 他们指出,第二季度 GDP 的最新修正估计得到了强劲消费增长的支撑,消费者继续保持支出。