Powell leads the market, will the US stock market return to an upward trend? | Overseas Major Asset Weekly Report

I'm PortAI, I can summarize articles.

美联储主席鲍威尔在杰克逊霍尔全球央行年会上发出迄今为止最明确的信号,暗示美联储将于 9 月开始降息。他还认为美国经济正在以 “稳健的速度” 增长,缓解了经济衰退的担忧。

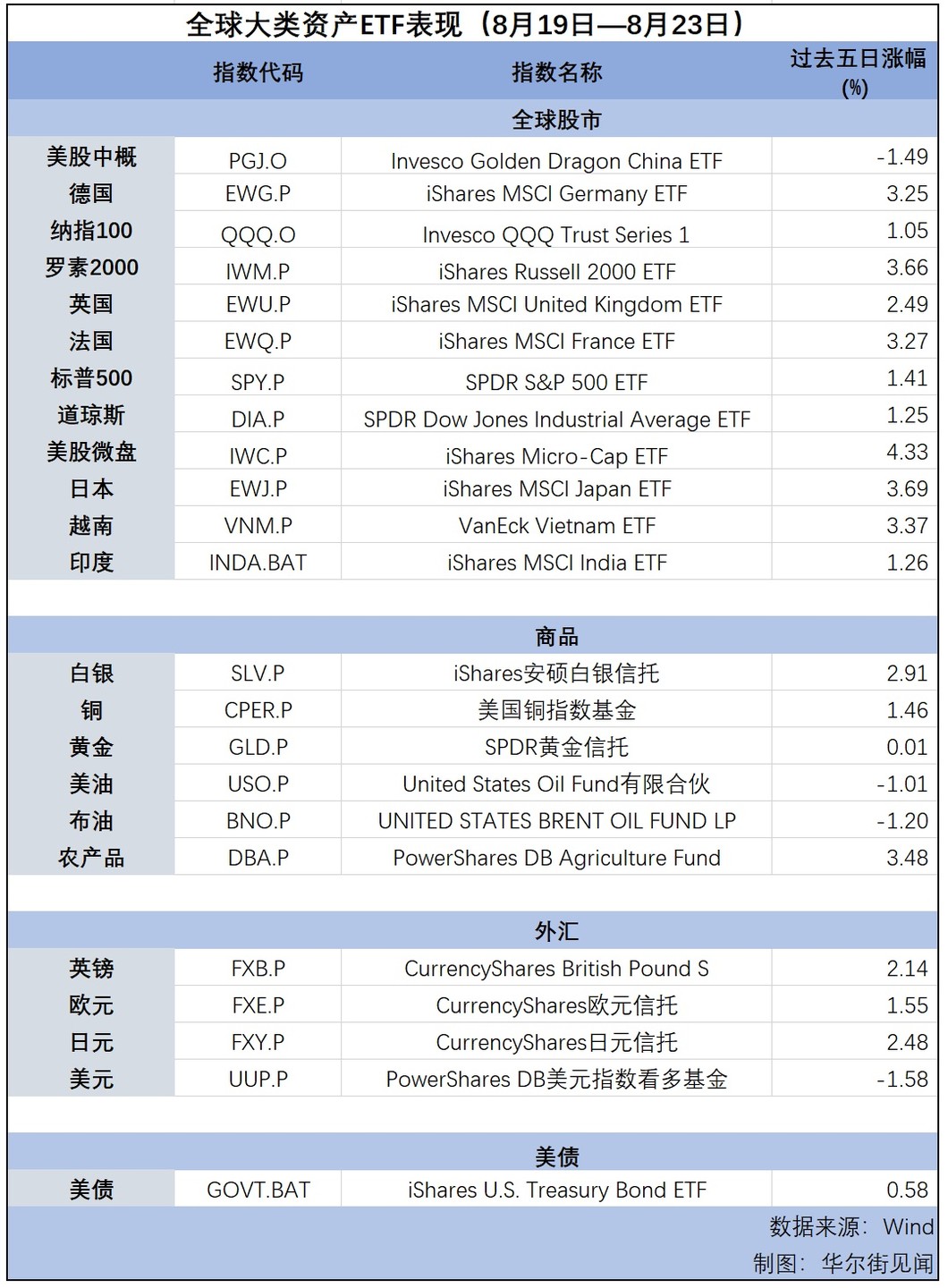

本周 (8.19-8.23)美联储降息预期主导市场。美联储主席鲍威尔在杰克逊霍尔全球央行年会上发出迄今为止最明确的信号,暗示美联储将于 9 月开始降息。他还认为美国经济正在以 “稳健的速度” 增长,缓解了经济衰退的担忧。

鲍威尔讲稿出炉后,风险偏好上行,道指一度升破 4.1 万点,标普大盘逼近历史最高。全周道指累涨近 1.3%,标普大盘涨 1.5%,纳指涨 1.4%,小盘股指涨 3.6%,芯片股指涨 1.1%。

欧股追随美股连续反弹,本周累涨 1.3%,创 3 月底以来最长连涨周数。

在鲍威尔 “转向” 之际,美股银行股全线上涨,地区银行指数表现亮眼,创八个月最大盘中涨幅。AI、机器人,光伏、地产板块领跑,油气能源板块垫底。

“鲍威尔转向日” 美债收益率大幅下挫。短端美债收益率跌幅突出,欧债收益率追随美债显著下挫。

美元指数创 13 个月新低,非美货币在 “鲍威尔转向” 后普遍走强,英镑近两年半最高。

美元及美债收益率走软支撑贵金属走高,伦敦工业基本金属集体上涨。

分析称,美联储主席鲍威尔的转向政策已经完成,鲍威尔在讲话中表现出了全面的鸽派。

但美银著名策略师 Michael Hartnett 警告,目前美联储的降息出于经济衰退而非 “软着陆” 前景,而历史上这种情况往往会带来股市崩盘。

根据 Hartnett 的统计,鲍威尔在杰克逊霍尔年会共举行了 6 次演讲,其中有 5 次标普在未来 3 个月内下跌,平均下跌 7.5%。