Bank of America's Hartnett: Rate cuts are unlikely to shift funds to US stocks, whether a "soft landing" can determine whether the market avoids a crash

Hartnett 认为,通胀回升和就业市场疲软的现状很难带来 “软着陆” 的前景,降息不一定利好股市。统计显示,鲍威尔在杰克逊霍尔年会上举行的 6 次演讲中,有 5 次导致了标普在未来 3 个月内平均下跌 7.5%。

鲍威尔暗示即将降息后,经济前景成美股走势的一大决定性因素。

在本周三年度非农就业人数被大幅下修 81 万人后,美银著名策略师 Michael Hartnett 在其最新的 Flow Show 笔记中评论道,这显示劳动力市场低迷,印证了他此前 “较低的债券收益率正确地表明宏观经济疲软” 的观点。

而周五鲍威尔在杰克逊霍尔会议释放鸽派信号,这是否意味着硬着陆的风险降低?

Hartnett 的答案是否定的,他认为美联储的降息将出于经济衰退而非 “软着陆” 前景,而历史上这种情况往往会带来股市崩盘。

“硬着陆” 风险犹存,降息不一定利好股市

Hartnett 认为,通胀回升和就业市场疲软的现状很难带来 “软着陆” 的前景。

相关数据还显示,美国白领岗位的薪资水平基本持平去年、年初至今整体零售额实际增长为零、11% 的信用卡拖欠时间超过 90 天,均意味着经济低迷。

因此,Hartnett 仍秉持对美债的看好立场,尤其认为做多 30 年期美债是应对四季度硬着陆风险上升的最佳对冲工具。

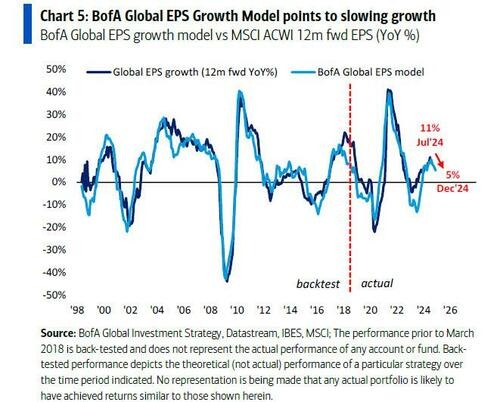

另一重加剧 “硬着陆” 风险的因素在于,全球企业盈利即将迎来 “狼来了(Wile E Coyote)” 时刻。

考虑到全球制造业 PMI 水平下滑、美债收益率曲线长期倒挂的影响等,Hartnett 预计,全球企业每股收益的同比增速将从 7 月的 11% 降至 12 月的 5%,其中 7 月是拐点。

因此,鲍威尔的鸽派转向可能也不会如预期利好股市。

根据 Hartnett 的统计,鲍威尔在杰克逊霍尔年会共举行了 6 次演讲,其中有 5 次导致标普在未来 3 个月内平均下跌 7.5%。

Hartnett 预计,首次降息前市场不会迎来大量资金:

“降息不可能成为 62 亿美元的货币市场基金和 25 亿美元的私募资金流入市场的导火索。”

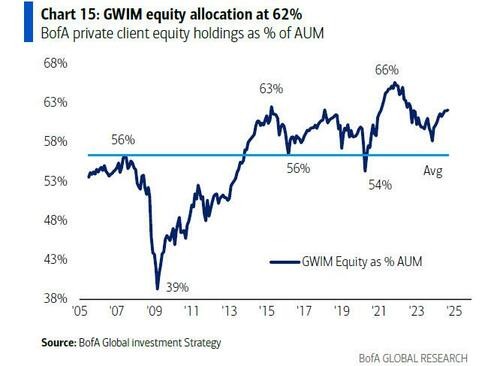

并且,该行的客户数据显示,私人客户的股票配置已接近历史高点的 62%,而标普现金余额已降至仅占资产的 8.8%,这意味着个人投资者继续买入以及企业回购股票的空间均不大,同样传递出看跌的信号。

报告最后,Hartnett 指出,黄金是今年以来唯一一个跑赢美国科技股的资产,也是所有资产类别中与股票相关性最低的资产之一,规模占比达到 16.1%,已经超越欧元成为全球第二大储备资产。

Hartnett 表示,今年以来金价的飙升不是由资金流入推动的,主要是各国央行大规模买入所推动的。