Ethereum spot ETF has been listed for a month, with a mediocre response from investors

8 月 23 日周四,持有以太坊的 9 只 ETF 连续第六天出现资金流出,净流出 100 万美元。

7 月 23 日,备受期待的第二大加密货币以太坊现货 ETF 在美国推出,一个月过去了,投资者似乎兴趣缺缺。

加密货币 ETF 在美国的亮相被认为是数字资产行业的一个分水岭,该行业长期以来一直向监管机构争取推出以比特币和以太坊基金。1 月,比特币 ETF 推出;7 月,包括贝莱德、英伟达和富达投资在内的八家发行商终于获得了美国证券交易委员会的批准推出以太坊现货 ETF。

但是,以太坊现货 ETF 似乎没有获得投资者的青睐。8 月 23 日周四,持有以太坊的 9 只 ETF 连续第六天出现资金流出,以太坊现货 ETF 净流出 100 万美元,这是自 7 月 23 日以太坊现货 ETF 首次亮相以来最长的连续撤资记录。

目前,以太坊现货 ETF 的净流出约为 4.58 亿美元,这主要归因于 Grayscale 以太坊信托基金,该基金转换为 ETF 后,投资者一直在不断撤回资金。

但是,许多分析师仍然看好以太坊现货 ETF。VanEck 数字资产研究主管 Matthew Sigel 表示:

“本周所有场所的交易量都已崩溃,Grayscale 以太坊信托基金的资金流出仍在继续。市场的整体情绪和头寸已经重新设定,9 月和 10 月情况应该会变好。”

同时,分析师表示美联储近期的货币政策影响着以太坊现货 ETF 的交易。过去的两周里,市场参与者一直热切关注着杰克逊霍尔会议,以获得关于未来货币政策的更多明确信息。FRNT Financial 联合创始人 Stephane Ouellette 表示:

“我不认为 ETF 投资者在杰克逊霍尔会议前削减比特币降低风险是令人惊讶的,因为他们远不像加密货币原住民那样熟悉加密货币,而是在利率预期调整时谨慎行事。

需要注意的是,无论以太坊现货 ETF 流出了多少资金,都只是市场一个相对较小的部分,这些基金约占以太坊市值的 2%。”

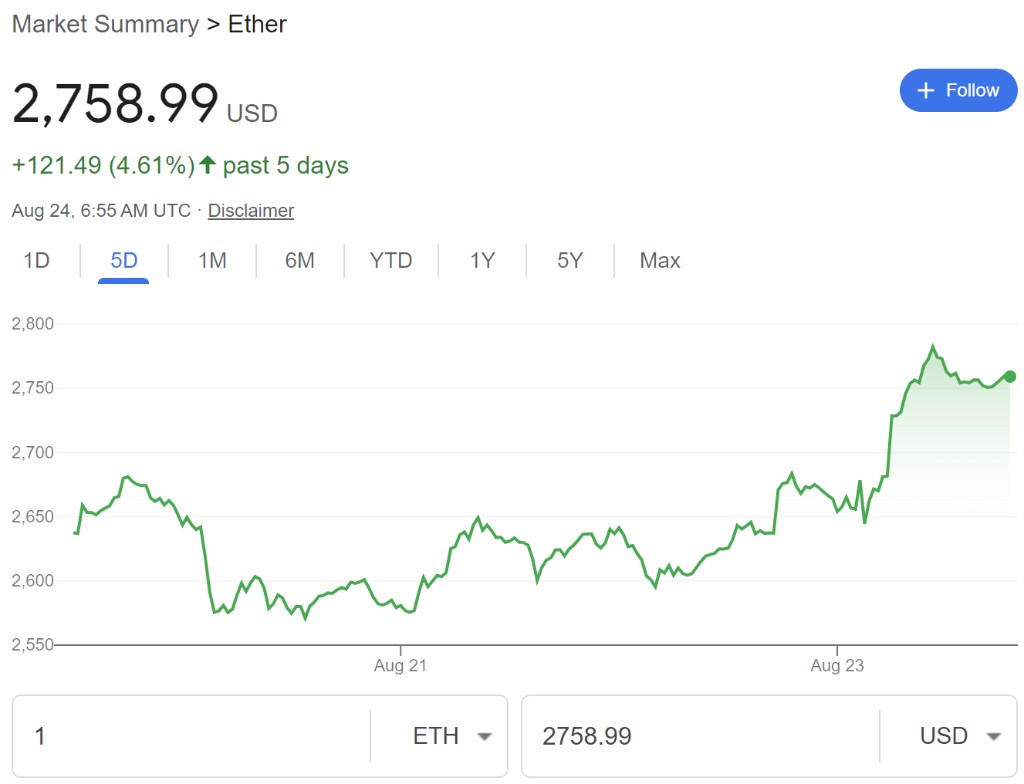

周五上午,鲍威尔对美国通胀回到 2% 表示信心,并明确暗示 9 月会进行降息。鲍威尔讲话后,以太坊上涨 4% 至 2730 美元。

与比特币 ETF 相比,以太坊 ETF 的推出要温和得多,比特币 ETF 在 1 月份发布的两个月后,比特币的价格飙升至创纪录的水平。根据彭博智库的数据,贝莱德和富达投资发行的比特币 ETF 成为 ETF 领域中仅有的两只在前 20 个交易日内吸引超过 30 亿美元的基金。截至周四连续 6 天以来,以太坊 ETF 资金不断流出,持有比特币的美国 ETF 却每天都有资金流入。Crypto Is Macro Now 的通讯作者 Noelle Acheson 表示:

“比特币通常是投资者加入加密货币交易的入口,虽然随着多元化变得更加重要,以太坊最终可能会迎头赶上比特币,但就目前而言,比特币更可能继续跑赢大盘。”