Traders "hold their breath" waiting for the Powell Jackson Hole meeting, gold hits the largest single-day decline this month

周四黄金价格出现下跌,创下本月最大单日跌幅,主要受到美元走强和国债收益率上升的影响。鲍威尔将在杰克逊霍尔会议上发表讲话,市场对其或影响 9 月美联储降息预期的讲话充满关注。12 月交割的黄金期货价格下跌 1.2%,收于每盎司 2,516.7 美元。尽管如此,基本面依然看涨,继续建议在回调时做多。

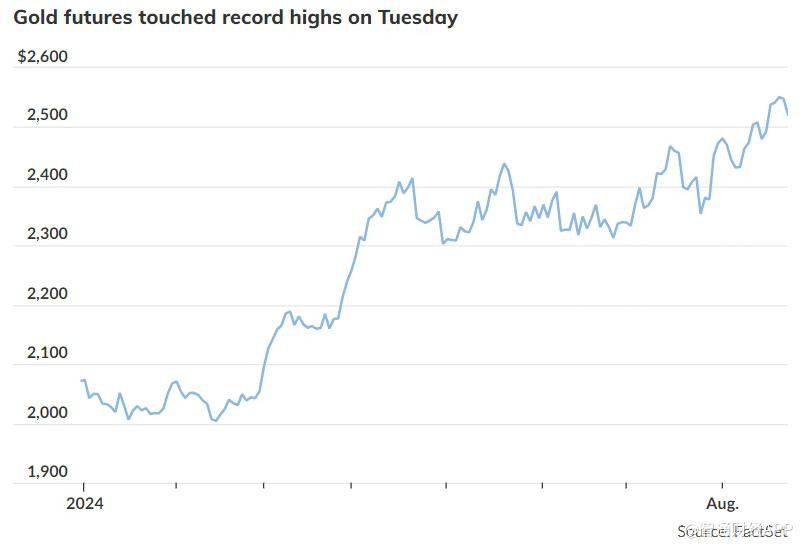

智通财经 APP 获悉,周四,黄金价格下跌,主要受美国美元走强和国债收益率上升的影响,这是黄金一个月来最大的一日跌幅。就在两天前,金价还创下了新的历史高点。

此次金价下跌正好在周五美联储主席鲍威尔发表讲话之前。Kitco.com 高级分析师 Jim Wyckoff 表示:“过去几年,央行官员都会在怀俄明州杰克逊霍尔经济研讨会上发表影响市场的讲话。” 鲍威尔的讲话可能会对市场预计的 9 月份美联储降息规模提供一些指引。

周四,12 月交割的黄金期货价格下跌了 30.8 美元,或 1.2%,收于每盎司 2,516.7 美元,此前曾一度跌至 2,506.4 美元。根据道琼斯市场数据,以最活跃合约计算的价格创下了自 8 月 15 日以来的最低点,并创下了自 7 月 25 日以来的最大单日跌幅。

周二,黄金价格曾创下历史新高,收于 2,550.6 美元,这是今年以来第 30 次刷新历史高点。

尽管如此,Altavest 的执行合伙人 Michael Armbruster 表示,“黄金牛市的基本面依然强劲,我们认为在进一步回调时可以做多或增加现有的多头仓位。” 他还指出,“外国央行的买盘和金本位的金砖国家货币是非常看涨的基本面因素。” 他补充道,“衡量黄金交易所交易基金 (ETF) 流量的数据显示,西方市场的黄金需求直到最近才有所活跃。”

周四交易中,ICE 美国美元指数上涨 0.5%,至 101.51。根据 FactSet 的数据,周三该指数曾跌至略低于 101 的水平。与此同时,10 年期美国国债收益率从周三的 3.778% 升至 3.859%。

XS.com 高级市场分析师 Rania Gule 表示,美联储可能的降息预期可能会限制美元的反弹,并为金价提供支撑。

周三的数据显示,截至今年 3 月,美国的就业增长较最初估计的要弱,同时美联储 7 月份会议的纪要显示,几位官员倾向于立即降息。Gule 称:“这进一步强化了美联储将在 9 月份开始货币宽松周期的预期,这将利好黄金。”