Is the "Buying Insurance Fever" in Hong Kong fueling it? AIA Group's new business value grew by over 20% in the first half of the year

8 月 22 日,友邦保险率先发布上市险企首份中报。 报告期内,友邦保险年化新保费共计 4…

8 月 22 日,友邦保险(1299.HK)率先发布上市险企首份中报。

报告期内,友邦保险年化新保费共计 45.46 亿美元,同比增长 14.11%(按实际汇率,下同);税后营运溢利 33.86 亿美元,同比增长 3.48%。

负债端持续回温,年化新保费(Annualized New Premium,ANP)、新业务价值(New Business Value, NVB)2 项关键指标已连续 2 个半年保持增长。

过半保费由中国内地及香港地区贡献。

中国内地与香港地区年化新保费分别为 13.82 亿美元、12.72 亿美元,共计占整体比重 58.38%;新业务价值为 7.82 亿美元、8.58 亿美元,共计占比 62.47%。

友邦保险集团首席执行官兼总裁李源祥在业绩发布会上指出,内地仍有庞大机遇。

“地域扩张仍在持续。” 李源祥表示,“上半年我们在四川省、湖北省的 3 个新城市开启运营。相信可以在经济周期中继续强劲增长。”

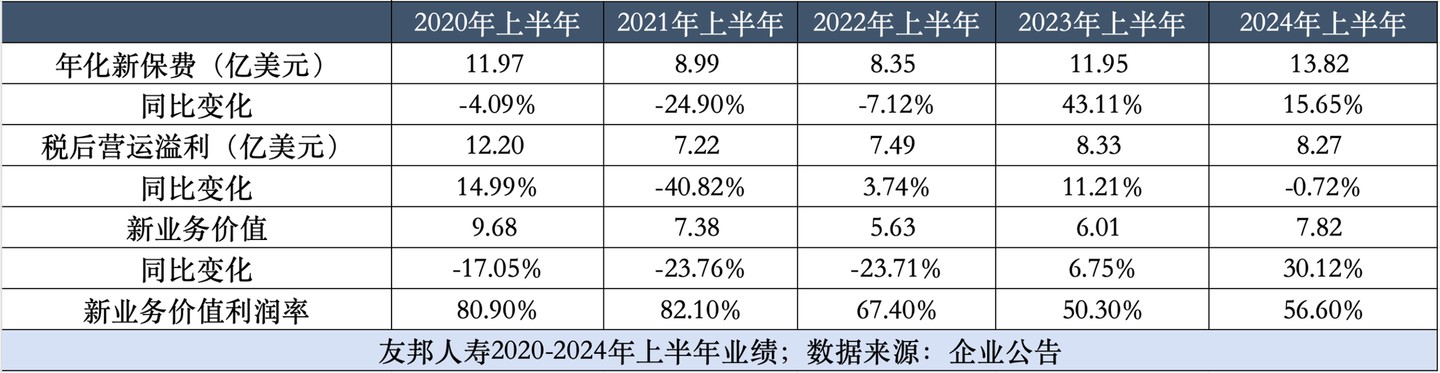

报告期内,友邦保险内地子公司友邦人寿新业务价值同比增长 30.12%、年化新保费增长 15.65%、新业务价值利润率增加 6.3 个百分点。

内地客户的强烈需求,同样促成友邦香港业务增长。

去年年初香港内地恢复通关后,港险凭借设计灵活、收益较高的优势吸引大批内地访客。

香港保监局披露,今年一季度源自内地访客的新增保费已创下五年来新高,同比上升 62.6% 至 156 亿港元。

李源祥透露,“中国大陆游客与香港居民的需求都很强劲、客户细分。”

友邦保险香港贡献了 8.58 亿美元的新业务价值,为各市场之首。其中香港本地客户群与内地访客带来的新业务价值增幅均在 20% 以上。

渠道强化推升业绩

各项指标看,友邦保险经营已走出疫情后的低谷。

一是负债端连续 2 个半年增长。

报告期内,年化新保费增速为 14.11%,虽不及上年同期的 43.41%,但较 2020 年上半年与 2022 年上半年的负值,已显著提升。

能够体现保单长期价值的新业务价值为 21%,较上年同期下降 11.1 个百分点,但仍维持较高水平。

二是税后营运溢利超越 2021 年同期。

报告期内,友邦保险税后营运溢利为 33.9 亿美元,超越过去 3 年同期。

不过这一数字较 2020 年同期的 59.4 亿美元仍有较大差距。

负债端回温源于销售渠道的强化。

友邦保险销售核心,是名为 “最优代理” 的个险。

1992 年,友邦上海将代理人模式引进内地。

寿险行业依赖规模扩张的时代,“大进大出” 的代理人模式迅速打开市场,平安、人保、太保在 2 年后跟进,个险渠道在后续发展中成为保险销售无可争议的主流。

2020 前后,随着互联网普及与客户需求细化,“人海战术” 失灵,代理人数量由 2019 年末的近千万人锐减至如今的百万。

不过近一年,陆续有险企表示代理人队伍已企稳。

友邦保险中报透露,“我们在内地、香港及东盟市场实现新业务价值双位增长,得益于活跃代理人的增加。”

当下保险销售的核心,正由规模转向效率。

友邦保险透露,公司已将优质招聘视为策略性优先任务。“已制定专属招聘计划,为新入职代理提供数码支援培训,支持实现全职、专业和高生产力。”

例如为代理提供如客户生命周期管理、需求及建议一类数据分析,优化交叉销售机遇。

友邦保险透露,内地子公司友邦人寿客户人均持有公司保单数量为 6 份。

这也展现出 “最优代理” 的交叉销售能力。

分销渠道同样有增长。

报告期内,友邦保险分销渠道年化新保费增速达 26%、新业务价值增速达 39%。

银保渠道新业务价值利润率的增加,源于与银行的合作。

友邦保险方面表示,公司与花旗银行、东亚银行在部分地区达成独家合作,在印尼与 Bank Central Asia 的伙伴合作关系已延长至 2038 年年底。

同时,达成了科技主导的银行保险策略。

例如与东亚银行在中国内地的策略性伙伴关系中,推出科技工具及健康检查,支持年化新保费、平均保单保费及活跃率的增长。

持续加码内地

对于友邦保险而言,内地是重要程度仅次于香港的阵地。

报告期内,中国内地年化新保费规模已超越香港地区。

“分改子” 之后,友邦人寿持续推进内地布局,于 2023 年推出 “新五年计划”。

当年 4 月,河南分公司获准开业;年内,友邦人寿石家庄中心支公司升级为分公司、泸州中心支公司与宜昌中心支公司获批筹建。

区域拓展速度也在加快,襄阳中心支公司、泸州中心支公司及宜昌中心支公司于 1 月、3 月和 4 月相继开业。

凭借可复制的运作模式,友邦人寿上半年在天津、河北、四川、湖北、河南 5 个新开发区域的分公司实现个险新业务价值 44% 的增长。

广设分支机构外,友邦人寿在 1 月成功 “买楼”,收购位于北京市朝阳区中央商务区(CBD)的办公楼项目控股权。

针对内地市场的高质量发展,友邦人寿首席执行官张晓宇表示,发展是第一要务。

“我们高度关注公司业务结构、差异化竞争能力、人才储备与发展进展。” 张晓宇表示,“有三个目标:一是做高质量发展样本;二是聚焦客户、差异化渠道和地域拓展,实现商业发展;三是聚集创新、敏捷、高效和人才培养,实现组织发展。”

具体策略上,坚持 “客户驱动”。

李源祥表示,公司目标客户是 “地区富有韧性的中产阶级和富裕客户”。

对此这一群体而言,服务体验尤为重要。

友邦人寿方面对信风(ID:TradeWind01)表示,公司将 “客户驱动” 作为整体推进,射击方面包括企业文化、产品设计、服务流程、组织架构、资源分配等公司经营前、中、后端。

例如重视端到端的客户体验,针对不同阶段、不同消费力、不同家庭状况的客户给出差异化解决方案,通过 “自建团队 + 多元伙伴” 模式提供包括 “北上广直通车”、“专案管理体系” 等多项服务在内的一站式服务。

报告期内,友邦人寿新业务价值同比增长 30.12% 至 7.82 亿美元。

由于假设条件调整,实际增长幅度或更大。

友邦保险表示,公司 2023 年新业务价值未使用 2024 年上半年经济假设重述,若按可比口径计算,新业务价值增长率则高于报告所示。

不过发展过程中,“增收不增利” 现象较为突出。

信风(ID:TradeWind01)统计发现,在年化新单保费同比增长 15.65%、新业务价值增长 30.12% 的同时,友邦人寿税后营运溢利同比下滑 0.72%。

这一数字受汇率影响较大。若参考固定汇率而非实际汇率,税后营运溢利将同比上升至 4%。

盈利承压或与低利率环境有关。

友邦保险透露,中国市场有效保单组合中的增长部分被利率下降影响抵销。

友邦保险未透露中国市场具体投资收益。但公司整体投资业绩净额为 17.44 亿美元,同比下降 2%。

面向未来,友邦保险依旧看好中国内地增长潜力。“随着计划继续执行,相信内地绝大多数不断增长的中产人口会在我们覆盖范围内。”

对友邦人寿此后在内地的策略与业绩,信风(ID:TradeWind01)将保持关注。