The dilemma of the top perfume stock in China

中国香水市场前景良好,预计 2023 至 2027 年复合年增长率为 13.4%。国内香水品牌管理公司颖通已提交招股书,拟于港交所上市,拟成为中国香水第一股。尽管核心收入来源于代理品牌,如 Hermès 和 VERSACE,消费者的品牌意识却使得独立品牌面临竞争压力。颖通在国内拥有广泛的销售渠道,但面临在品牌认知中的挑战。

当香水成为社交名片时,一场接替口红经济的嗅觉经济正在加速进行。中国香水市场是一个极具吸引力的增长机会,预计在 2023 年至 2027 年期间,复合年增长率将达到 13.4%。

按 2023 年零售额计,颖通是中国内地、香港及澳门综合市场最大的香水品牌管理公司,也是唯一上榜的中国企业。7 月 18 日,公司正式向港交所递交招股书,拟主板挂牌上市。

只不过,有望成为中国香水第一股的颖通却在当代年轻人热衷用香水社交、中国香水事业迎来发展之际,有了烦恼,烦就烦在品牌是代理的而不是自己的。因为当人们开始 “闻香识人” 的时候,品牌是这一社交行为的装 X 底气,也是这一行业中最重要的资产。

一、最硬核的客户

按 2023 年零售额计,颖通是包括港澳在内的中国市场最大的香水品牌管理公司。代理的品牌都是 Hermès(爱马仕)、VERSACE(范思哲)、Van Cleef & Arpels(梵克雅宝)、Chopard(萧邦)、Albion(澳尔滨)等十分硬核的奢侈品品牌客户。

从品类来看, 2022 至 2024 财年公司营收逐步放量,自 16.75 亿元增长至 18.64 亿元,其中香水分销收入为公司核心收入来源,自 14.95 亿元增长至 15.24 亿元,占比超 80%。

不同于竟对是品牌所有者,颖通是行业 CR5 中唯一的品牌代理公司,能以特殊身份跻身行业前列,在于颖通掌握了庞大线下渠道这一在香水销售中十分重要的竞争优势。

由于消费者需要通过闻及体验香水以了解其特性,线下实体店在很长一段时间里都是终端客户的首选渠道。颖通通过在国内(含港澳)逾 400 个城市布局的超 7500 个线下网点,为国际品牌进入中国提供了轻资产运营的便利。不仅解决品牌在新市场的进入战略、分销网络规划问题,在消费者迎合策略上,也可以出谋划策。

这种全面的品牌管理能力使颖通得以与品牌授权商建立并维持牢固的关系,一般的合作年限都在 10 年以上。

而在过去三年里,“嗅觉经济” 正在中国市场迎来蓬勃发展。根据欧睿数据的预测,到 2025 年,中国香水零售额将达到 300 亿元人民币,是全球市场增速的 3 倍。这一发展趋势也让颖通有了冲击二级市场的底气,因为当国内消费者不断进阶促使香水需求快速增长时,颖通代理的那些硬核客户也都在卯足了劲,进军中国香水市场。

InterParfums 是全球知名的大牌香水开发商也是颖通的第二大供应商。InterParfums 在中国市场的领先品牌分别是 Coach、万宝龙、Jimmy Choo 和梵克雅宝。未来该公司还准备推出自己的香水系列且主要在亚洲分销。今年上半年,爱马仕的香水和美妆部门销售额继续发展(+4.9%),为了加大促销,爱马仕也先后在上海、北京、成都等城市开启多场香水快闪活动。

颖通作为这些品牌的全渠道管理集团,在其代理客户加大市场投入的过程中理当受益。只是受益程度相对品牌本身,做代理的生意利润就要小很多。在硬核客户面前,颖通揽下的都是最脏最累的活,更要命的是,即使任劳任怨,公司依旧面临客户不续约的风险。

二、拉跨的商业模式

就像房屋中介最怕房东直租一样,颖通最怕代理的品牌转直营。

品牌代理的商业模式决定了颖通下游销售受制于经销商,上游供应受制于品牌商。从下游的销售渠道来看,公司真正通过自营对外销售的份额不足 1/4,仍高度依赖第三方渠道。

颖通做代理的商业模式差就差在,销售渠道大部分非自营,帮忙宣传的还是别家品牌,给别人做嫁衣的同时还要承担最重的渠道成本。所以,尽管近三年毛利率维持在 50% 以上,但因为需要大量的营销开支导致颖通的净利润率仅有 11% 左右,与传统贸易商无异。

从供应端来看,公司供应商集中,且十分依赖单一大客户。

越高度依赖过于硬核的客户面临的风险就越大。对颖通来说,奢侈品牌代理转直营的风险是当前最大的担忧。但为什么客户有代理转直营的风险?因为现在国内的消费市场真的很难搞。

欧莱雅是全球最大的美妆集团,它的财报基本可以通览全球美妆市场的概况。今年上半年,欧莱雅奢侈品部门同比增长 2.3%,按地区来看,表现强劲有欧洲、北美和新兴市场,唯独中国大陆表现不佳,这里面只有由 Yves Saint Laurent、Valentino、Maison Margiela 和 Prada 等品牌带动的香水业务在反弹。

作为欧莱雅在中国为数不多的增长品类,香水大概率也会成为各大在中国市场折戟的奢侈品集团代理转自营的对象。例如,开云集团就在去年宣布创立美妆部门,梵克雅宝的母公司历峰集团也组建了高级香水与美妆事业部,随时有可能收回梵克雅宝的销售代理权。

此外,尽管打造一个适合体验芬芳的线下场所对于香水品牌来说至关重要,但中国的分销市场过于独特,线下销售的主导地位正被逐渐打破。例如,2022 年,Interparfums 在中国通过线上渠道创造了 73% 的销售额,线下品牌精品店贡献的销售额只有 4% 。

中国分销渠道的独特特征,让原本十分依赖线下体验的香水经济,其销售渠道也变得多元化。对于品牌拥有者来说,直接布局线上的经济效应越来越大。

一是在各大平台去头部化下平台流量的 “众生平等”,且通过算法和投流数据线上运营效果更容易量化,品牌管理也更集中和高效。二是品牌自身本就拥有庞大的品牌信徒具有天然的流量效应,线上网络效应和算法推荐带来的用户转换比线下铺货要高效得多。

这种分销渠道的演变意味着颖通的线下销售网络优势正被一点点攻破,对公司来说,失去重要供应商的风险正在放大。而这种风险更是在不久前成为现实。2022 年 12 月,颖通与一家主要品牌授权商的协议到期后该品牌商决定自行经营,不再续约,而当期分销该品牌为颖通控股带来的收入高达 4.25 亿元,占当年总收入的 25.5%。

尽管这次解约并没有直接导致颖通全年业绩下降,但 2023 年是疫情开放、旅游复苏、国际机场及免税店客流量增加之大年,没有这次解约,公司理应取得更高的增速。

在这种有可能加剧的灰犀牛下,公司也在加强应对。自 2022 年开始,颖通便依托渠道优势,创立并运营自有香水品牌,此外公司也不局限香水这一种品类而是选择彩妆、护肤、眼镜多元代理,促进业务的全面发展。

当然,正如上述分析所说的,代理的商业模式终究是不长久的,所以此次冲击 IPO,发展自有品牌成为公司排在首位的募资用途。

三、自建品牌的难度很大

在一个不成熟的市场里,前期发展往往由成熟的外资品牌主导。

2025 年,中国香水零售额将达到 300 亿元人民币,是全球市场增速的 3 倍,而这 300 亿市场中,大众香水市场份额约会下降 15% 左右,小众香水及其代表的高端市场将增长 18%。随着中国小众香水的需求量增加,赛道容量变大,将会接纳更多的品牌。这一行业趋势,给了颖通自营品牌的土壤。

2022 年,公司选择以 OEM 方式生产自有的 Santa Monica 品牌产品,向市场推出 5 款入门级高端香水,此外,公司也开始对自营的线下渠道进行重塑;2022 财年至 2024 财年,传统线下门店/专柜数量自 102 家持续减少至 87 家,并逐渐加码电商平台。

一系列举措带动自有品牌营业收入从 2022 年的 100 万元提升至 2024 年的 1700 万元,涨幅不小,但在年度营收中自有品牌占据的比例只有 0.9%,外部品牌的代理销售依旧是颖通目前最主要的收入来源。

尽管行业趋势提供培育新品牌的土壤,但在一个尚未成熟的市场里,前期发展往往由成熟的外资品牌主导,消费者对产品的认可也往往会先入为主的 “崇洋媚外”,汽车如此、手机如此、美妆个护更是如此。

相关数据显示,2020 年和 2021 年,天猫国际小众香水的销售额均同比呈 3 位数增长,远超香水类目整体增速,梅森马吉拉、汤姆福特等品牌均进入 TOP10 榜单。到了 2023 年,这些小众香水销量依旧位列前茅。

但仔细观察就会发现这些小众香水并非真的小众。以下入榜的虽然没有香奈儿 5 号、Dior 真我这种商业香那么有认识度,但每一个品牌的来头都不小,这里的小众只是用来区别香型的,并非真的连品牌也是新秀、小众。

在 2018 年到 2021 年的四年间,每年都有近 300 家新的本土香水企业加入市场竞争。但随着国际品牌加码直播电商、加速拓宽布局,海外商业香水与海外小众香水的市场份额均明显增长,在次夹击下新生代国内香水品牌表现乏力,市占率较 2022 年出现小幅下滑。

当然,尽管在激烈的行业竞争中国品牌处于弱势地位,但并不意味着自营品牌就没有发展机会。例如,极具东方美韵的香氛品牌观夏,在今年 1-5 月就成为首个高跻身销售额 TOP30 的国产高端品牌。

但这其中很重要的一个前提是,观夏获得了欧莱雅的投资支持,国产品牌成功的大前提是得有钱去高举高打的做营销。

2022 至 2024 财年,颖通控股实现净利润分别为 1.71 亿元、1.73 亿元、2.06 亿元,共计 5.5 亿元。但需要注意的是,在上市之前,颖通已经将赚到的钱悉数分给了股东,累计分红共 6.31 亿元。刘钜荣以及其妻子陈慧珍,分别间接持有颖通控股 90% 和 10% 的股权。三年间,这对夫妻共获得 6.31 亿元分红,比公司三年净利润还要高出 0.81 亿元。

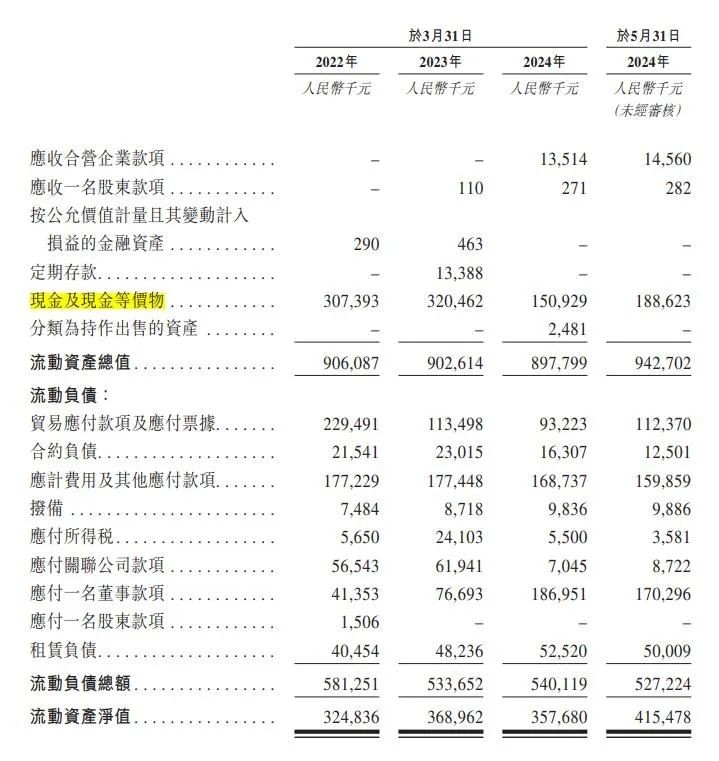

高比例分红显然会对公司的再投资能力产生影响。截至今年 5 月,公司现金及等价物为 1.88 亿元。尽管不存在有息债务,在国际大牌高举高打的营销策略下,这点现金显然不足以支持颖通应对同行竞争。

作为在行业耕耘几十年的老将,刘钜荣不可能不知道新品牌前期的投入有多大,在这种情况下还清仓式分红,多少有点不厚道了。

四、结语

当香水成为新社交货币、当几乎所有奢侈品集团在中国遭遇通缩时,品牌代理商的地位会逐渐被品牌拥有者挤压。

中国是香水行业快速发展的市场,但同时也是前期市场教育、品牌建设成本巨大的市场,相比欧洲人体味太重的生理需求和存在了上百年的浪漫基因,促使他们对香水几乎有着天然的需求,但现在不少中国人,尤其是两广地区,在炎热的夏天里喷六神花露水的频率都远高于香水。在一个竞争激烈的不成熟市场里培育一个没有底蕴的小众品牌,难度之大可想而知。

当然,颖通目前仍然拥有不错的渠道竞争优势,该优势的价值仍可以复用在自有品牌的销售上;此外,对于国内市场营销的熟练程度也让公司存在被不熟悉国内市场运作、初来乍到的国际企业合作或收购的可能。