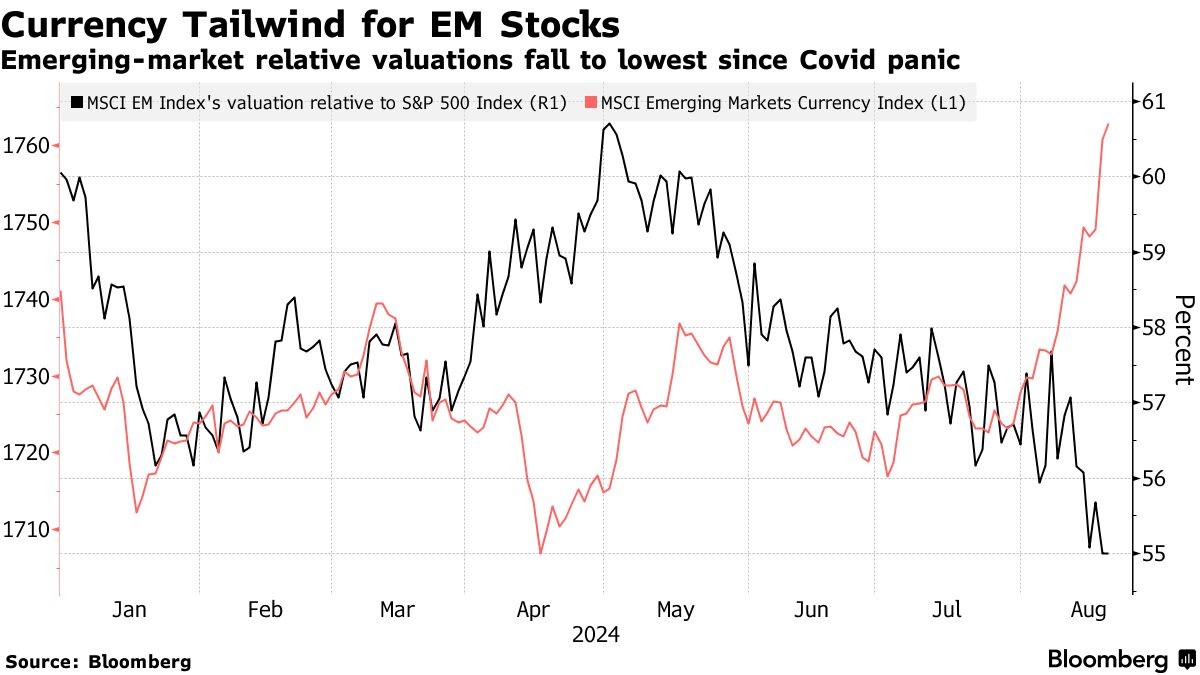

Investor sentiment remains cautious, with the discount of emerging market stocks to US stocks reaching the highest level in over 3 years

由于投资者情绪依旧谨慎,新兴市场股市相对于美国股市的折价幅度达到了 2020 年 3 月以来的最高水平,为 45%。尽管 MSCI 新兴市场指数的收益预期上调,股市仍落后于标普 500。分析师指出,美元强势、通胀高企及高利率对新兴市场形成负面影响。投资者希望美国经济实现软着陆,以促进降息,从而改善新兴市场股市的前景。

瑞士宝盛银行驻苏黎世的股票策略师 Nenad Dinic 表示:“尽管盈利预期有所改善,但目前新兴市场相对于标普 500 指数的估值较低,反映出投资者的犹豫。”“这种谨慎情绪与正在进行的有关美国经济增长的辩论、以及共和党候选人特朗普可能胜选的潜在影响——可能会带来高额关税并严重影响新兴市场的情绪——有关。”

数据显示,新兴市场股指的市盈率为 11.9 倍,而标普 500 指数的市盈率为 21.5 倍。新兴市场股市相对于美国股市的折价幅度达到 45%,高于 3 年多以前的 28%,原因是美元走强、通胀居高不下和利率高企对新兴市场增长和企业业绩的负面影响。此外,尽管 MSCI 新兴市场指数自今年以来已累计上涨近 8%,但仍可能连续第七年表现逊于美国股指。

GAM UK Ltd.投资总监 Ygal Sebban 表示:“新兴市场非常便宜,尽管不被青睐,也不被看好。” 他补充称,全球经济增长将是新兴市场股市开始跑赢大盘的关键。他表示:“我们需要美国经济软着陆,以促使美联储降息 (这将有利于新兴市场利率和外汇)。我们还需要美国关税的一些确定性。”

基金经理们指出,需要持续走弱的美元,以及更多可以让投资者感到兴奋的、可以与美国所谓的 “七巨头” 相提并论的新兴市场公司。宝盛银行驻新加坡的亚洲研究主管 Mark Matthews 表示:“长期以来,新兴市场的核心问题是,它们的创新企业非常少。”“自 2010 年左右以来,投资者一直关注创新,因此新兴市场总体上落在了后面。”

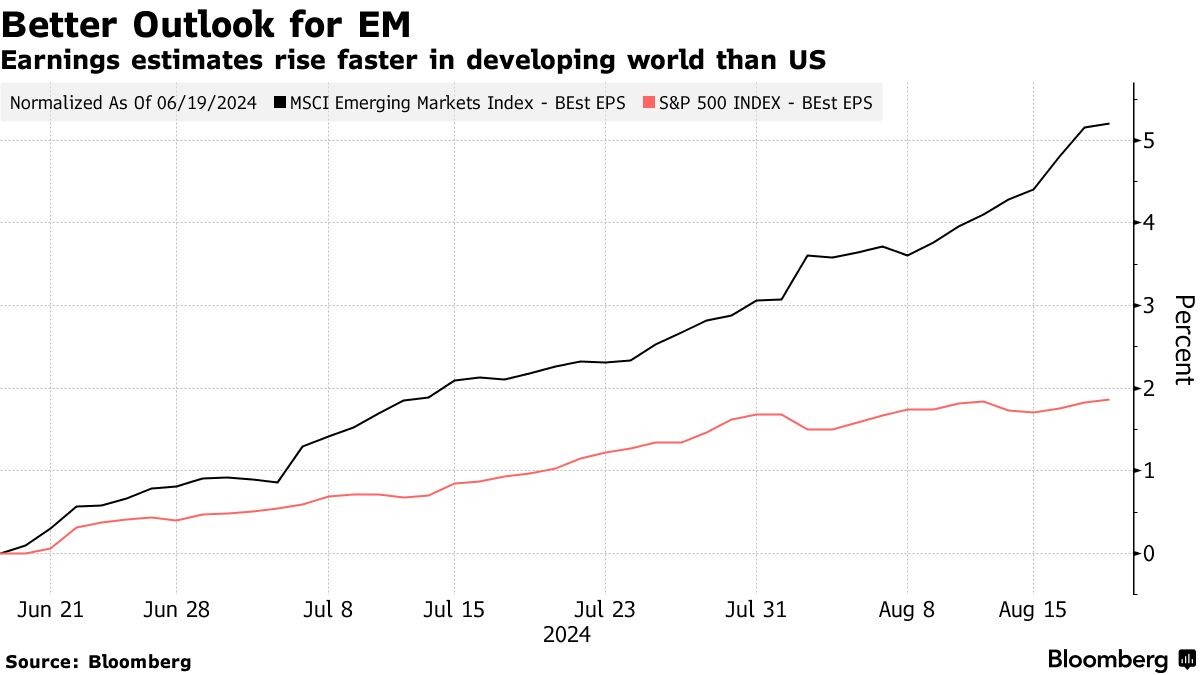

就分析师而言,他们正在提高对新兴市场企业盈利的预测,因为人们越来越预期美联储的宽松政策将支持新兴市场降息。分析师对科技公司的普遍利润预期接近历史高点。与美国类似,对人工智能的兴奋情绪支撑了新兴市场股市今年以来的上涨。但也有人担心,该行业预期的财务表现可能不会很快实现。投资者正在等待备受关注的英伟达 (NVDA.US) 即将于下周公布的最新业绩,以判断该行业的涨势能否持续。