The market is using real money to fully price in the rate cut expectations! The Fed's rate cut in September is just a step away from official announcement

随着交易员押注降息周期的临近,市场对美联储在 9 月降息的预期不断增强。美国国债期货表现强劲,交易员几乎完全定价了降息 25 个基点的预期。杰克逊霍尔年会将是关键时刻,美联储主席鲍威尔的讲话将提供政策方向的更多线索。如果降息信号传出,股市可能反弹;反之,则可能迎来抛售。

在美债交易市场,债券交易员正在承担创纪录的看涨风险,因为他们押注于美国国债市场的持续反弹之势以及可能出现的长期牛市,而这一潜在反弹的庞大押注规模主要是由美联储即将开始四年多来的首次降息预期所推动。从美国国债市场押注来看,债券交易员们几乎 100% 定价 9 月降息 25 个基点的预期,11 月和 12 月类似步伐的降息预期也被越来越多交易员定价。

在北京时间周五晚间怀俄明州杰克逊霍尔小镇举行的央行年度经济研讨会之前,美国国债期货的杠杆头寸数量已升至历史最高水平。在本次活动中,美联储主席杰罗姆·鲍威尔将发表至关重要的讲话,并就今年剩余时间内的美联储货币政策路径提供更多的见解。

对于上周经历堪称 “超级大反弹” 的全球股市来说,北京时间周五晚间举行的杰克逊霍尔央行年会堪称 “关键考验”,届时美联储主席鲍威尔与英国央行行长贝利等政策制定者们将发表重要讲话。在上周五的交易时间段,期权市场对本周五标普 500 指数超过 1% 的高波动性进行定价,押注该基准指数在本周五无论涨跌波动性都将超过 1% 这一阈值。

“如果交易员们听到降息即将到来的重磅信号,股市将给出积极反应。” Steward Partners Global Advisory 财富管理执行董事埃里克·贝利表示。“然而,如果交易员和投资者们都听不到想要听到的积极信息,那么经历大反弹后的股市可能将迎来大规模抛售。”

“市场非常确信,降息即将到来。” 贝利表示。“如果鲍威尔没有强调这是未来的道路,那将是一个巨大的引爆点。”

来自 US Bank Wealth Management 的全美投资策略师汤姆·海恩林表示:“回顾过去杰克逊霍尔年会的演讲内容,我们不太可能从鲍威尔那里得到非常规范性的降息评论。”

纽约联邦储备银行前主席比尔·达德利表示,美联储主席鲍威尔可能会暗示不再需要实施过于紧缩的货币政策。但他预计鲍威尔不会暗示首次降息的幅度以及具体的时间线,尤其是因为 9 月 6 日将发布一份至关重要的非农就业和失业率报告,供美联储政策制定者们在 9 月 18 日做出下一次政策决定之前更全面的权衡。

芝加哥商业交易所集团 (CME Group Inc.) 的数据和 Bloomberg 分析数据显示,在上周,期货市场未平仓合约,即可以选择做多或做空方向的交易者所承担的整体风险规模,达到了创纪录的近 2300 万张 10 年期美国国债期货合约。基础现金票据每变动一个基点,风险约为 15 亿美元。

杠杆化——投资者们持有的国债期货风险金额创历史新高

随着交易员们押注降息周期临近,他们选择大量买入美债期货。这一增长规模与过去几周美债市场看涨押注的增加相吻合,这些押注意味着资金选择押注美联储将在今年和 2025 年大幅降息。根据美国商品期货交易委员会 (CFTC) 截至 8 月 13 日当周的统计数据,资产管理公司们对 10 年期美国国债期货的净多头仓位增加了大约 12 万份。

虽然不少迹象显示出大多数杠杆头寸是资产管理者们选择做多国债期货,但其中一些可归因于基差交易,这是一种非常流行的对冲基金策略,交易者们通过现金国债和期货之间的价差赚取收益。

由于该策略涉及通过回购市场借款,如果市场整体贷款条件收紧,交易者们可能被迫兑现头寸以偿还贷款。如此迅速的仓位解除规模有可能将导致国债市场剧烈波动。

值得注意的是,一直担心美联储降息时机和规模可能不及市场预期的谨慎交易员们,一直在押注今年可能出现的各种情况。就在两周前,掉期市场预计美联储将在 9 月会议上降息 50 个基点,并且存在紧急降息的风险,但仍有一部分交易员始终坚持 25 个基点降息幅度。在目前,随着无比强劲的零售销售额数据以及暗示劳动力市场可能比预期乐观的初请失业金数据出炉,下个月降息 25 个基点的预期几乎 100% 定价。

现货交易市场已经显示出,在杰克逊霍尔会议之前,一度持续看涨的押注可能已经陆续开始解除。华尔街大行摩根大通当地时间周二发布的美国国债客户调查报告显示,相关的净多头仓位减少至一个月以来的最低水平。

以下是利率市场最新仓位指标的整体概述:

摩根大通最新调查数据

在截至 8 月 19 日的一周内,摩根大通的美国国债客户调查显示多头仓位下降了 6 个百分点,但是仍然使得净持仓至少在一个多月的时间里为多头情绪倾向,而空头仓位则在一周内小幅上升了 5 个百分点,幅度不及多头步伐。

摩根大通国债客户仓位调查——客户完全多头仓位在 8 月升至去年 12 月以来最高

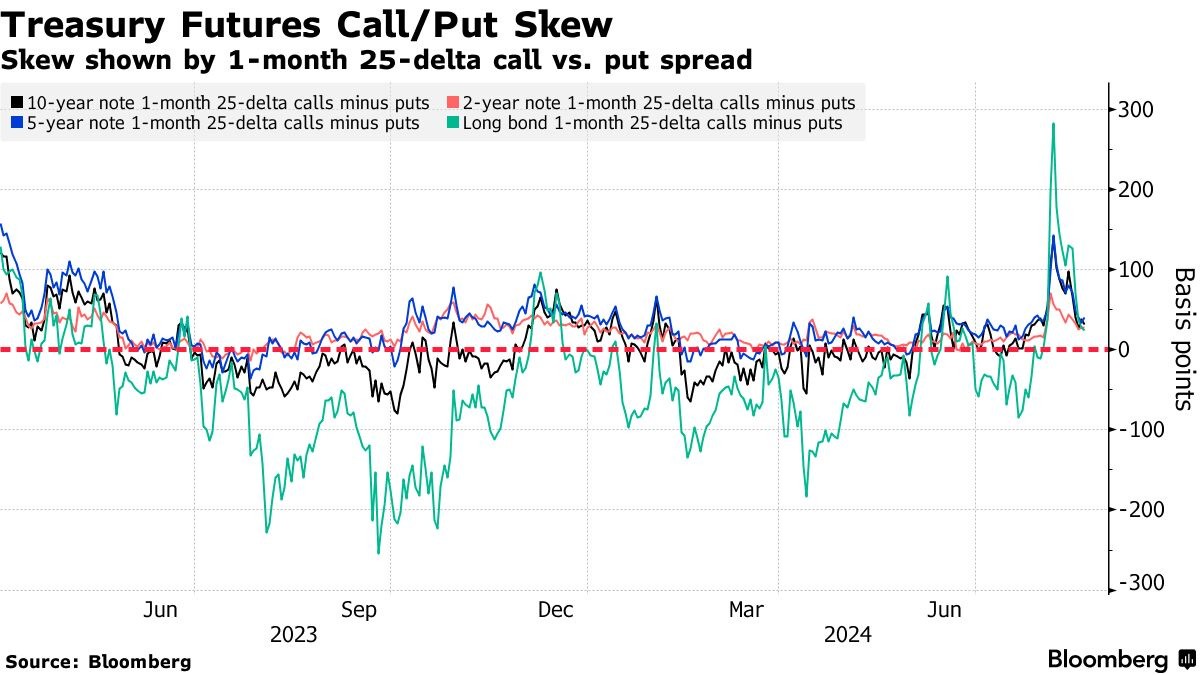

对冲溢价缓解

在几周前因交易员寻求美国国债市场持续反弹而出现看涨溢价后,为对冲市场波动所支付的溢价继续回落至中性水平。周二国债期权流动包括通过十月期权的套杀买方所进行的高达 500 万美元溢价长期期权波动押注,该期权将于 9 月 18 日美联储货币政策公告后两天到期。上周后半段,围绕 9 月和 10 月的 10 年期国债看跌期权出现大量交易流资金,表明有一部分交易者瞄准了更高的 10 年期美国国债收益率。

资金流动变化

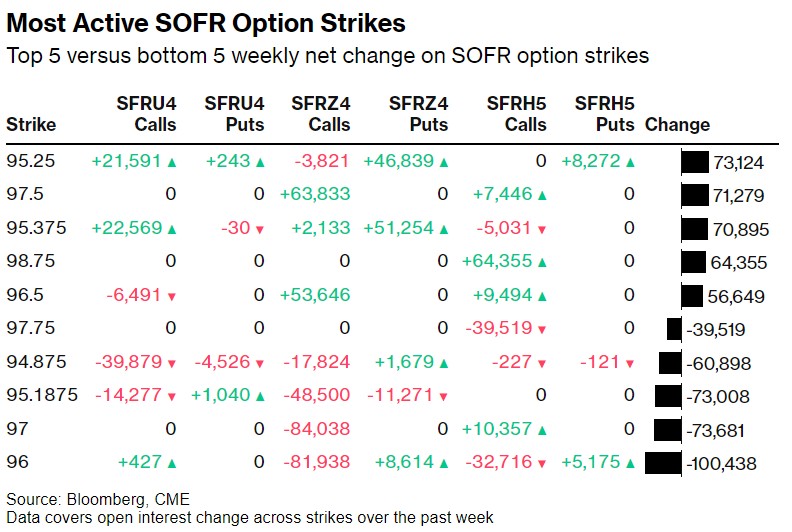

尽管过去几个交易日 SOFR 期货和期权交易量有所下降,但 9 月期限的资金流动现在主要集中在 25 个基点的美联储降息政策预期押注上,而远离了 9 月份会议可能降息 50 个基点的可能性。上周的资金流动数据来看,整体包括对降息 50 个基点的押注陆续解除,导致一些 Dec24 和 Mar25 的看跌期权出现大量清算。过去一周最大规模的套现发生在 Dec24 97.00 和 96.00 点位的看涨期权行权规模,此前现有的 96.00/97.00 点位看涨期权利差结构被解除,并翻转至新的 96.50/97.50 头寸。

最活跃的 SOFR 期权行使价——SOFR 期权行使价每周净变化前 5 名与后 5 名的对比

SOFR 期权热力图

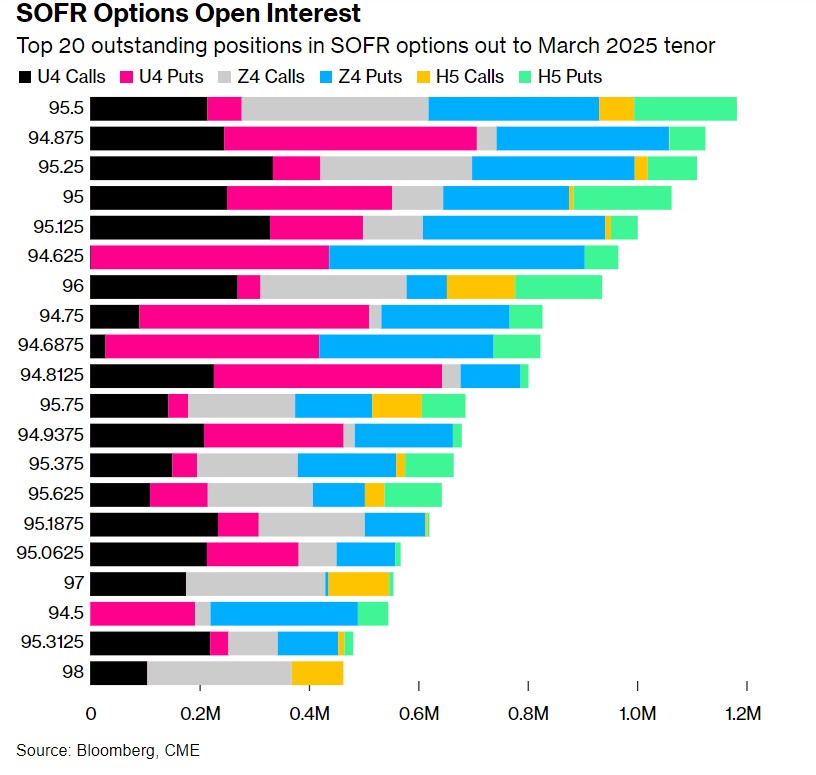

在 2025 年 3 月到期的 SOFR 期权中,95.50 的期权行权点位是目前未平仓合约中最高的,此前通过交易 96.00/96.50/97.00/97.50 看涨期权的交易提振,12 月 25 日的看涨期权价格在一周内有所上涨。

SOFR 期权持仓量——截至 2025 年 3 月期限的 SOFR 期权前 20 流动性头寸

从 SOFR 期权持仓数据统计来看,SOFR 期权市场似乎已经从对美联储可能采取的 50 个基点降息的押注全面转向 25 个基点的调整。95.50 点位的看涨期权和看跌期权的分布显示,市场对未来美联储基准利率可能维持在较低水平的预期在近日大幅增强。

这些期权点位的分布表明,SOFR 期权市场的绝大多数参与者预期美联储将自 9 月开启降息周期,押注今年降息幅度可能高达 75 个基点,并可能在 2025 年初达到某个底部利率水平。因此,投资者通过购买相应的 SOFR 期权来押注这些可能的利率路径,同时力争对冲相关的风险。

在美联储降息周期中,交易员们可能更倾向于通过 SOFR 期权市场来捕捉利率下降的获利交易机遇,同时通过调整头寸来应对市场的不确定性。看涨期权的增持反映出对利率下降趋势的乐观押注预期,而看跌期权的增持则可能是对潜在利率趋势不确定性的类似对冲策略。

资管机构与对冲基金关于国债期货立场出现分歧

截至 8 月 13 日的一周,一些大型头寸发生了明显变化,全球资产管理公司延长了大约 12 万张 10 年期美国国债期货合约的久期多头规模。这意味着这些大型资管机构看好美国国债价格的前景,认为利率可能持续下降,或者至少在未来一段时间内保持低位。因此,他们选择延长投资组合久期,通过长期持有较长投资期限的债券或相应期货头寸,以便在利率下降时获益。

然而,对冲基金则持截然相反观点,增加了基于净久期空头的大约 31.5 万张 10 年期美国国债期货合约。数据数据显示,对冲基金看跌 10 年期美国国债期货的立场倾向,推动它们的整体净空头仓位超过 200 万份美债期货合约,创下历史最高纪录。资管机构可能预期美联储未来将采取更为宽松的货币政策,或者认为经济增长可能放缓,从而压低基准利率。它们押注这将使得长期国债的收益率下降,价格上升,因此他们增加了多头头寸。

但是,对冲基金可能认为当前美国经济和劳动力市场仍然韧性十足,美联储不会像市场所预期的那样大幅降低利率,而是采取渐进式的缓慢降息举措,他们因此增加空头头寸,押注长期债券将在某一段时间出现价格下跌。