The "thrilling" August in the US stock market comes to an end, with the S&P 500 index experiencing the strongest upward volatility since June last year

本月美国股市波动剧烈,标普 500 指数强劲反弹,创下自去年 6 月以来最显著的上涨波动。独立研究公司 CappThesis 指出,标普 500 指数在 8 月份录得五次单日涨幅超 1%,表现优于预期。最近的经济数据缓解了投资者对劳动力市场疲软的忧虑,使得市场情绪提升。尽管经历了波折,该指数 8 月份仍上涨 1.5%,并在 2024 年迄今已上涨 17.5%。

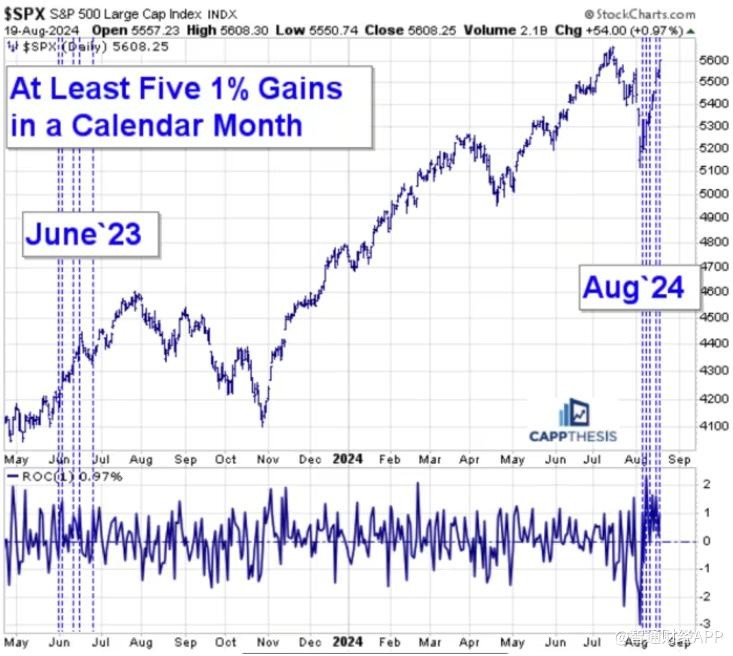

智通财经 APP 获悉,本月股市波动剧烈,标普 500 指数从 8 月初的低迷中强劲反弹,出现了自去年以来最为显著的上涨波动。据独立研究公司 CappThesis 的数据,标普 500 指数在 8 月份已经有五次单日上涨至少 1%,这是自 2023 年 6 月以来,单月内最多的一次。

CappThesis 创始人 Frank Cappelleri 在周二的报告中指出,标普 500 指数近期的一系列 “大幅波动” 源于其从 8 月初的抛售中反弹,自 8 月 6 日以来的 10 个交易日中,有 8 天出现了上涨。在这轮上涨中,虽然大市值成长股领涨,它们并非唯一的赢家,其他板块也有所上涨。

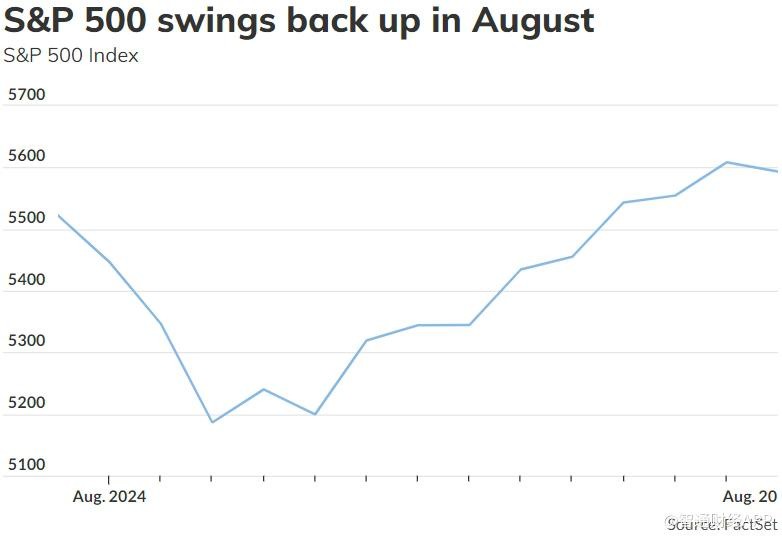

标普 500 指数的大幅反弹使得美国大盘股指数在 8 月转为正增长,这得益于最新的经济数据缓解了投资者对本月初劳动力市场疲软的担忧。例如,上周美国商务部发布的 7 月份零售销售报告显示数据强于华尔街预期,这也提振了市场情绪。

Cappelleri 表示,对标普 500 指数 8 月份的五次大幅上涨感到 “满意”,“考虑到这是对之前近 10% 的跌幅的反应。” 不过,他也提到,“回归到更平静的交易环境将为更多看涨的模式铺平道路。”

根据道琼斯市场数据,标普 500 指数周一上涨 1%,实现了连续八天的上涨,这是自 2022 年 11 月 8 日以来最长的连涨纪录。尽管周二标普 500 指数一度下跌 1%,但根据 FactSet 的数据,8 月份该指数仍上涨了 1.5%。

尽管 8 月经历了波折,美国股市整体上仍处于强劲的牛市中。

截至周二下午,标普 500 指数在 2024 年迄今为止已上涨 17.5%,而去年全年该指数飙升了 24.2%。根据道琼斯市场数据,标普 500 指数周一收盘仅比 7 月 16 日创下的历史最高收盘价 5667.2 点低 1%。