Amidst the sharp increase in difficulty in stock selection in the US stock market, Goldman Sachs has put forward two "wealth codes"

The difficulty of stock selection in the US stock market has increased, and Goldman Sachs has put forward two "wealth creation codes". Goldman Sachs strategists believe that the rise in US bond yields, high stock market valuations, and concerns about the US government deficit will affect the rise of the US stock market. Goldman Sachs expects that the benchmark index of the US stock market is unlikely to continue to rise, and reiterates its target forecast of 5200 points for the S&P 500 index by the end of the year. Goldman Sachs economists predict that the actual GDP growth rate in the US this year will be around 3%. Goldman Sachs advises investors to adopt a diversified investment strategy in a flat market environment. The stock analysts at Goldman Sachs have given two stock recommendations as "strong buy"

If Goldman Sachs' expectations for the future are accurate, stock selection will become more difficult in the short term. Peter Oppenheimer, a well-known strategist at Goldman Sachs, believes that under the combined effect of the upward trend in the 10-year US Treasury yield, high stock market valuations, and concerns about the sustainability of the US government's high deficit, the overall gains in the US stock market will be tightened.

A research report released by Goldman Sachs in May showed that as the market's expectations for Fed rate cuts dropped significantly from an initial 150 basis points cut to just 25 basis points cut, the Goldman Sachs strategy team expects that from now until the end of this year, the benchmark index of the US stock market - the S&P 500 Index is unlikely to continue to rise. Goldman Sachs reiterated the institution's target forecast of 5200 points for the S&P 500 Index by the end of the year, while pointing out that "from now until the end of this year, the return rate will remain roughly flat," unless the Fed cuts interest rates more aggressively than the market currently expects.

Goldman Sachs economists expect the real GDP growth rate in the US to be around 3% this year; the Goldman Sachs stock strategy team predicts that the earnings growth rate of the S&P 500 Index will reach 8% by 2024, while emphasizing that the current valuation of the US stock market is at historical highs.

"In our view, the faster the US Treasury yield rises, the greater the negative impact on US stocks," said Goldman Sachs strategist Peter Oppenheimer, adding, "Considering the valuation of the stock market, this will be a speed bump."

However, despite the possibility of US stocks turning into sideways movements or tending to adjust downwards, there is still a way forward. Oppenheimer pointed out: "Diversified investment is an opportunity for investors in a flat market environment."

Diversified investment is a more cautious portfolio management strategy, and in the face of upward pressure on benchmark indices, the "bottom-up" diversification logic is more suitable for investors. Oppenheimer's colleagues in Goldman Sachs' stock analysis team are selecting stocks with stable growth potential using a "bottom-up" stock selection logic.

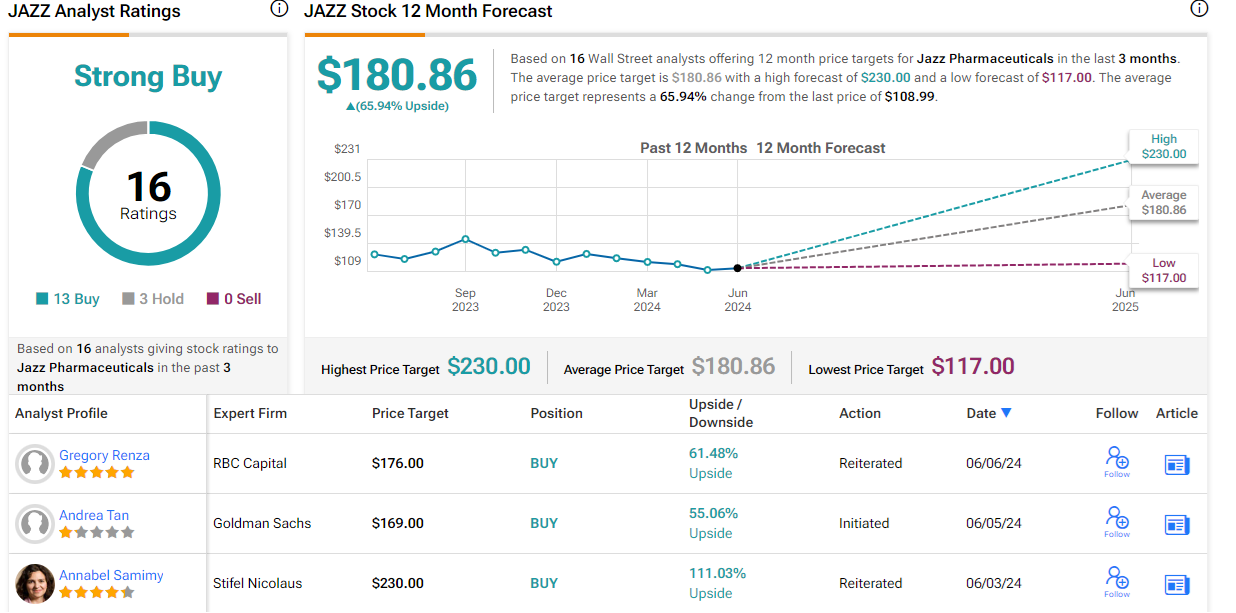

Data from TipRanks shows that analysts at Goldman Sachs recently gave two stock recommendations, indicating that the views of Wall Street banks are consistent with those of Goldman Sachs - analysts unanimously rated these two popular stocks as "strong buy."

Jazz Pharmaceuticals (JAZZ.US)

For biotech companies, getting a drug approved and on the market is like finding the Holy Grail - and Ireland-based Jazz Pharmaceuticals has a number of such approved products in the fields of neuroscience and oncology. These commercialized drugs ensure Jazz Pharmaceuticals' strong fundamentals, even as it maintains significant spending on a wide range of new drug research projects, while also maintaining relatively stable quarterly profits.

From an investor's perspective, this biotech company offers an almost "best of both worlds" biotech scenario, with both a stable revenue scale and sales record, as well as promising potential for clinical trial candidate drugs.

Among the company's existing and approved drugs, three drugs were rated as "key growth drivers" for the first quarter of this year. The total revenue of these three drugs increased by 12% year-on-year; Among the three main revenue sources, two come from the neuroscience products of Jazz Pharmaceuticals, and the third comes from the field of oncology. Ranked from lowest to highest growth, the main revenue sources are Epidiolex (a cannabidiol used to treat seizures), with a net sales growth of 5%; Xywav, a drug used to treat excessive daytime sleepiness, with a net sales growth of 14%; and Rylaze, a oncology drug used to treat acute lymphoblastic leukemia, with a net sales growth of approximately 20%.

Turning to the research pipeline, one of the company's candidate drugs, zanidatamab, is the subject of multiple clinical trial studies. These studies are investigating zanidatamab as a monotherapy and combination therapy for the treatment of various cancers. One of these studies is testing zanidatamab for the treatment of HER2-positive biliary tract cancer. The company released positive data on June 1 for a Phase 2b clinical trial of zanidatamab in previously treated, unresectable, locally advanced, or metastatic HER2-positive biliary tract cancer, showing that zanidatamab "demonstrated sustained and durable anti-tumor responses."

Just a few days before the data was released, Jazz Pharmaceuticals announced that the FDA had granted priority review to the Biologics License Application (BLA) for zanidatamab in the indication of previously treated, unresectable, locally advanced, or metastatic HER2-positive biliary tract cancer. The PDUFA review date is set for November 29, 2024.

Additionally, Jazz Pharmaceuticals presented at the 38th Annual Meeting of the Associated Professional Sleep Societies in early June. The presentations highlighted the safety and efficacy of Xywav, a flagship drug approved by the company for combating excessive daytime sleepiness.

For Goldman Sachs analyst Andrea Tan, part of the appeal of this company lies in the high quality of its research pipeline. In discussing the stock, she wrote, "While the prospects for the sleep business (and Epidiolex, to some extent) have been controversial, we are optimistic about the emerging pipeline that supports long-term growth prospects... Continued investment in research and early-stage pipeline development, as well as business expansion (if Jazz Pharmaceuticals were to leverage to a 5x leverage based on 2024 EBITDA, its balance sheet incremental capacity would reach approximately $8 billion) will be sources of growth." Given that Jazz Pharmaceuticals' stock has a higher discount relative to the S&P 500 index's 5-year average level, we believe the current level of the stock is attractive."

Goldman Sachs analyst Andrea Tan has given a "Buy" rating and a target price of up to $169, implying a strong upside potential of up to 55% within a year.

Wall Street analysts' "strong buy" consensus rating on Jazz Pharmaceuticals is based on 16 comments, including 13 "buy" rating reports and 3 "hold" ratings. The stock's average target price of $180.86 is even more optimistic than Goldman Sachs' view, indicating a potential upside of 66% from Monday's closing price of $108.99.

ZEEKR (ZK.US)

The next important stock on Goldman Sachs' supported stock list is ZEEKR, a luxury electric car brand partially owned by Chinese automotive giant Geely. ZEEKR is a luxury electric car brand that focuses on combining European car style and performance with the latest advanced production and manufacturing processes. The company's models include the Zeekr 001, a five-seater hatchback crossover, and the Zeekr X, a luxury city SUV. In addition, the company has also launched a 6-seater MPV Zeekr 009 and is developing a high-end luxury sedan. The company's cars are positioned as pure electric vehicles with high-end software and hardware applications to enhance the driving experience.

In May of this year, ZEEKR officially listed on the US stock market and released a strong quarterly performance report. Earlier this month, Zeekr announced delivery data for May 2024, showing strong year-on-year growth. In the first quarter of this year, ZEEKR delivered a total of 33,059 units, a 117% year-on-year increase, achieving revenue of 14.737 billion yuan, a 71% year-on-year increase; the vehicle gross profit margin reached 14%, a 3.9 percentage point increase year-on-year.

From January to May, ZEEKR delivered a total of 67,764 units, a 112% year-on-year increase, firmly ranking as the sales champion of Chinese pure electric brands with sales exceeding 200,000 in 2024. Among them, 18,616 units were delivered in May, a significant increase of 115% year-on-year, setting a new monthly delivery record.

This Chinese electric car manufacturer has caught the attention of Goldman Sachs electric vehicle industry analyst Tina Hou. When discussing newly listed stocks, she pointed out some obvious advantages of ZEEKR and then gave her long-term outlook: "We believe that by adopting a light-asset manufacturing model and utilizing its parent company (Geely)'s factory capacity, ZEEKR is in a more favorable position in competition, which helps alleviate heavy upfront capital expenditure burdens. Geely's mature supply chain also gives ZEEKR a cost advantage, with ZEEKR's car contributing a higher profit margin of 18.2% (compared to Nio and XPeng's contribution rates of 16.2% and 3.7%, respectively). In addition, ZEEKR had 3 billion yuan in net cash and 2.3 billion yuan in operating cash flow in 2023."

For Tina Hou, this is a stock worth buying now. The analyst gave ZEEKR an initial rating of "buy" with a target price of up to $34, implying a potential increase of up to 44% within a year

Overall, Wall Street analysts have a unanimous "strong buy" rating on this newly listed US stock, based on 3 "buy" rating research reports. As of Monday's US stock market close, the stock closed at $23.66, with a Wall Street average target price of $34.67, implying a potential upside of up to 46.5% in the next year