US Stock Options | Across the board cooling down! FFIE, AMC, GME, Tesla, Nvidia all experienced a sharp drop in trading volume!

法拉第未来隔夜股价大涨 75%,期权成交暴跌至 35 万张,看涨期权占比 65.8%。6 月 21 日到期、执行价 2 美元的看涨期权成交 4.5 万张,执行价 1 美元的看跌期权成交 4 万张,执行价 0.5 美元的看跌期权成交近 4 万张。

隔夜,meme 股大反弹,科技股涨跌不一,中概股普遍下跌。

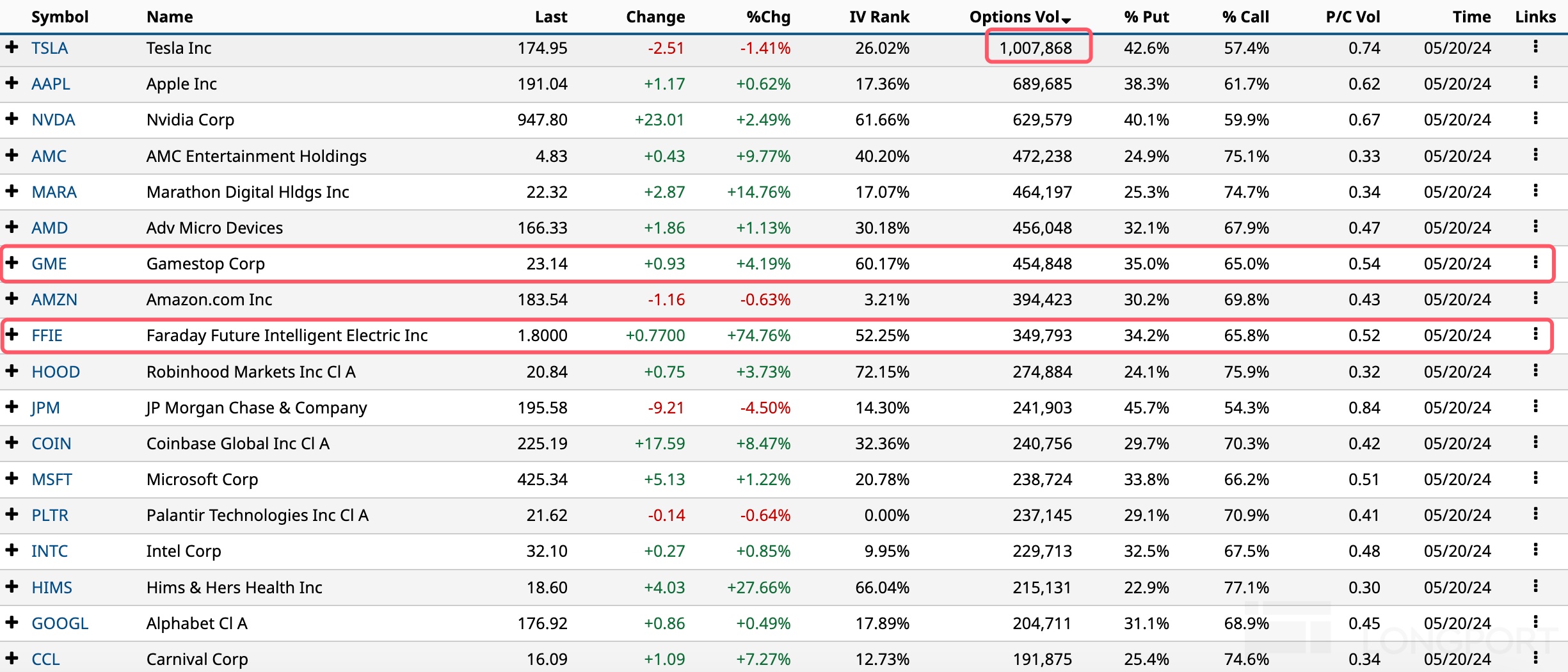

美股期权成交概览

隔夜前十大美股期权成交:特斯拉、苹果、英伟达、AMC 电影院线、Marathon Digital、AMD、游戏驿站 GME、亚马逊、法拉第未来、Robinhood。

其中:

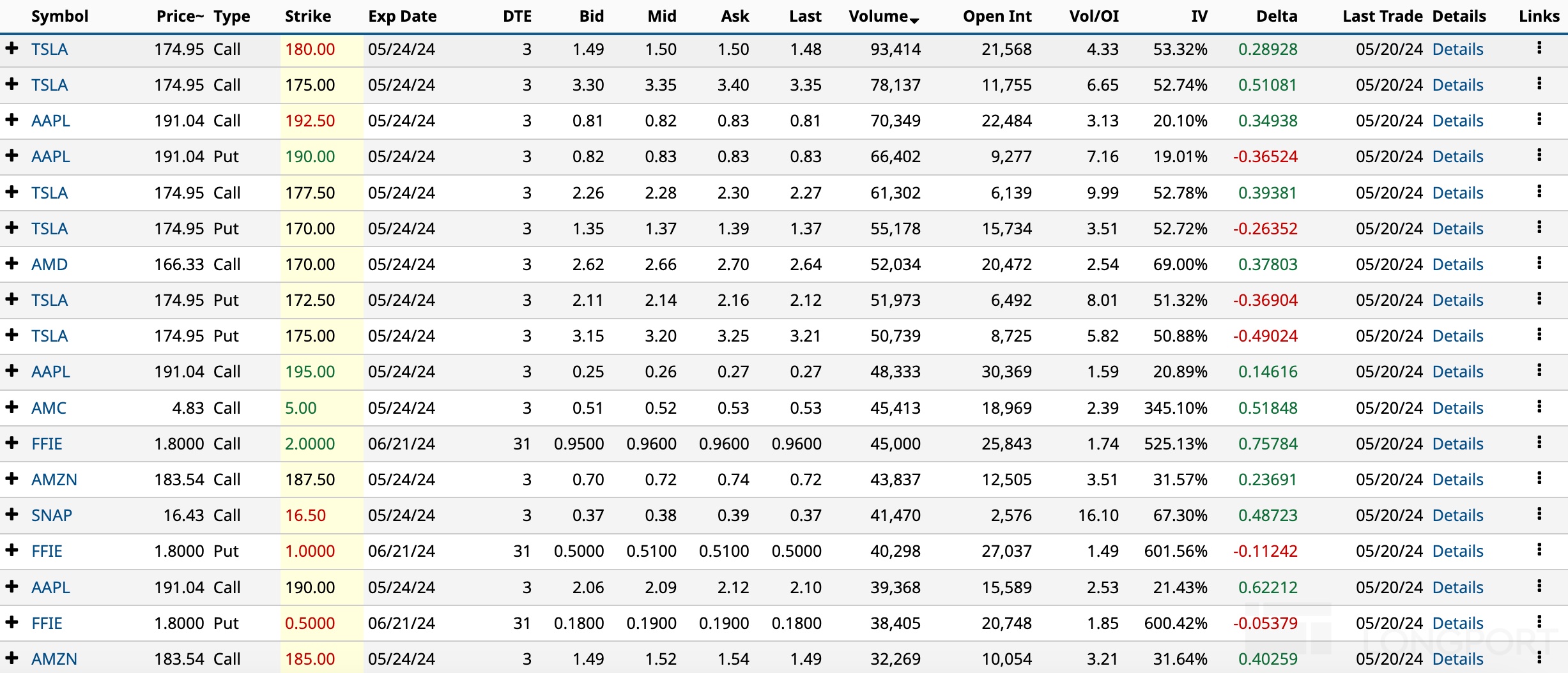

特斯拉跌超 1%,期权成交腰斩至 100 万张,看涨期权占比 57.4%。5 月 24 日到期、执行价 180 美元的看涨期权成交 9 万张,执行价 175 美元的看涨期权成交近 8 万张。

苹果涨近 1%,期权成交跌至 69 万张,看涨期权占比 61.7%。执行价 192.5 美元的看涨期权成交 7 万张,执行价 190 美元的看跌期权成交超 6 万张。

英伟达涨超 2%,期权成交狂跌至 63 万张,看涨期权占比六成。

AMC 电影院线涨 10%,期权成交跌至 47 万张,看涨期权占比 75%。执行价 5 美元的看涨期权成交 4.5 万张。

Marathon Digital 大涨 15%,期权成交涨至 46 万张,看涨期权占比 74.7%。

AMD 涨超 1%,期权成交暴跌至 46 万张,看涨期权占比 67.9%。执行价 170 美元的看涨期权成交 5 万张。

游戏驿站 GME 涨 4%,期权成交暴跌至 45 万张,看涨期权占比 65%。

亚马逊跌近 1%,期权成交跌至 39 万张,看涨期权占比七成。执行价 187.5 美元的看涨期权成交超 4 万张。

法拉第未来大涨 75%,期权成交暴跌至 35 万张,看涨期权占比 65.8%。6 月 21 日到期、执行价 2 美元的看涨期权成交 4.5 万张,执行价 1 美元的看跌期权成交 4 万张,执行价 0.5 美元的看跌期权成交近 4 万张。

Robinhood 涨近 4%,期权成交跌至 27 万张,看涨期权占比 76%。

Snap 合约异动,5 月 24 日到期、执行价 16.5 美元的看涨期权成交超 4 万张。