How far is Leapmotor from joining the ranks of top new forces? | Jianzhi Research

零跑的下一个目标,还是稳定的实现自我造血

5 月 17 日晚,零跑汽车率先公布今年第一季度的财报。作为国内二线造车新势力中的佼佼者,零跑汽车在一季度惨烈的价格战下,保持住了销量增长,净亏损出现收敛。

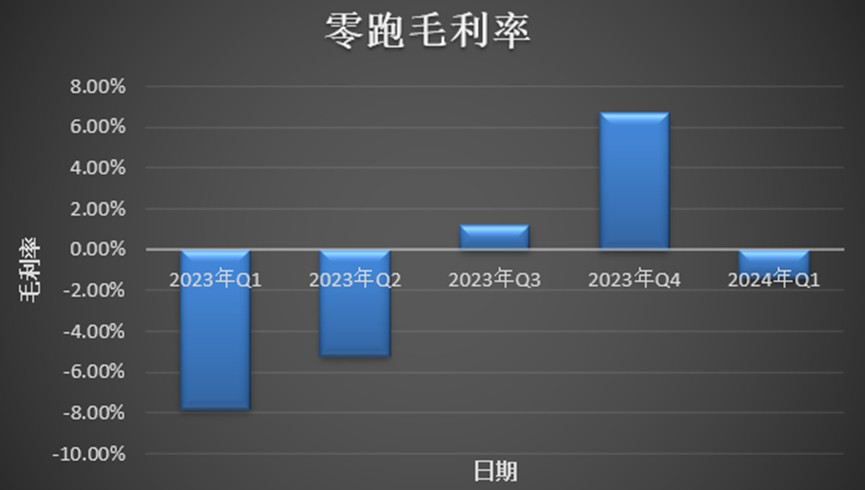

不过负面影响仍然存在,领跑一季度毛利率水平重新转负。

具体来看,零跑 Q1 在实现营业收入 34.86 亿元,同比增长 141.7 %,环比降低 33.9%;毛利率水平重新跌回负数为-1.4%,同比增长 6.4 个百分点,环比降低 8.1 个百分点;净亏损有所收敛,为 10.1 亿元,同比降低 10.6%,环比增长 6%。

1、今年海外市场将提供增量,助力零跑汽车实现全年销量目标

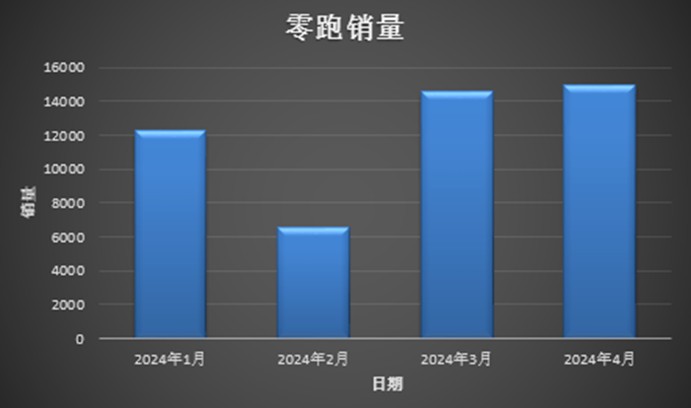

今年第一季度,零跑汽车的总销量高达 3.34 万辆,同比增长 217.9%。该销量不仅在二线造车新势力行列中名列前茅(哪吒 2.4 万辆,极氪 3.3 万辆),还超越了小鹏的 2.2 万辆和蔚来的 3 万辆。

零跑汽车全年销售目标在 25 万辆-30 万辆,同比增长 73.6%-108%。

这一目标并不低,零跑要完成目标则需要在接下来 3 个季度环比增速达到 40% 以上。

海外市场有望提供部分增量贡献。5 月中旬,零跑汽车与 Stellantis 集团宣布正式成立 Leapmotor International B.V.(零跑国际)合资公司,由零跑汽车提供产品技术,由 Stellantis 集团提供全球市场资源和影响力。

具体来看,作为全球第四大汽车集团,Stellantis 在全球拥有一万多家经销商,零跑有望直接利用这些现成的海外经销商渠道,将零跑汽车旗下首两款产品 TO3 和 C10 率先带到海外进行销售。

目前,零跑汽车的海外市场已经开始进入初期的产品导入阶段。零跑汽车预计,将在今年第三季度就全面完成出海产品认证并在欧洲正式开启销售,计划年底前将欧洲销售网络拓展至 200 家,并同步进军印度、亚太、中东、非洲以及南美的新能源汽车市场。

2、毛利率再次由正转负

零跑汽车在去年三季度首度实现毛利率的转正,并维持到四季度。但在今年一季度,零跑汽车的毛利率重回负数,环比降低 8.1 个百分点至-1.4%。

在惨烈的价格战背景下,零跑汽车的毛利率环比下滑超 8 个百分点,超市场预期,华尔街见闻·见智研究认为主要原因有以下几点:

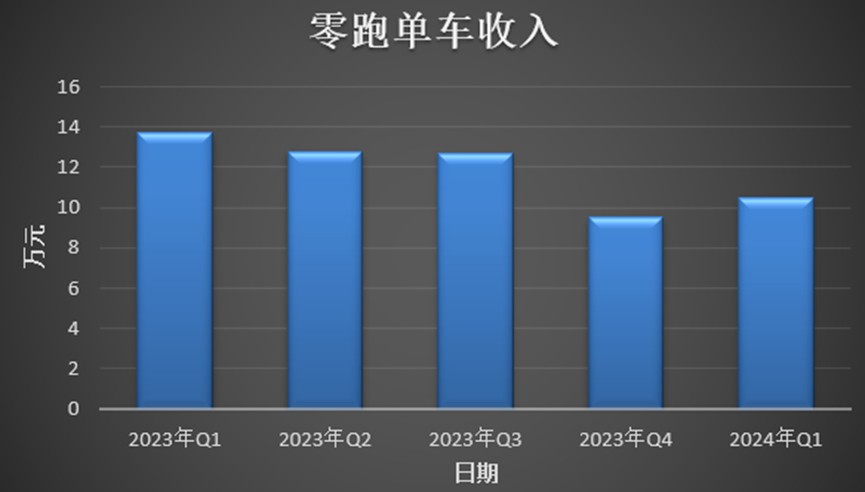

第一,零跑汽车的销量主力正从 10 万以下向 20 万元价格区间转移,但零跑汽车在今年一季度给出了较大幅度的降价促销,抑制了单车收入上涨的幅度。

今年一季度,零跑对其全系车型实施了 1.5 至 3.2 万元的现金优惠,并且新推出的 2024 款车型价格较旧款下降了 1 至 5 万元。

尽管,零跑汽车通过销量主力的转移,从单价区间 5-7 万元的 T 系列车型转向 10-20 万元的 C 系列车型。

具体来看,今年一季度零跑 T03 的交付量为 9433 辆,其销量占比较上一季度下降了近 10 个百分点,至 28%。与此同时,C 系列车型如 C11、C01 和 C10 的交付量分别为 12122 辆、3998 辆和 7857 辆,同比分别增长 129% 和 209%,C 系列车型的销量占比已经超过了 70%。

这一策略有效抵消了部分由降价带来的收入下滑,与去年四季度相比,单车收入实际上有所增加,上涨了 0.8 万元至万元 10.4 万元。

第二,今年第一季度,零跑汽车销量环比有所下滑,使得摊销和单车制造成本随之上升。

同时,部分锂电原材料如电池级碳酸锂的价格也是在一季度出现回暖,从 9 万元/吨左右回涨至 11 万元/吨以上。这也使得零跑汽车的单车成本出现增长,且幅度远高于单车收入增长。今年一季度,零跑汽车的单车成本为 10.58 万元,同比降低 4.32 万元,但环比增长 1.68 万元。

好在,后续零跑汽车将重心从纯电动车型转移至增程式车型,也将对毛利率有正向作用。

相较纯电动版本,C11 增程式版本的电池容量减少一半以上,以目前三元锂电池电芯(动力型)的平均价格 0.52 元/Wh 来计算,而燃油发动机在 5000 元左右,这将为零跑汽车带来近 2 万元的成本下降,但 C11 增程式版本的价格却只比纯电版本便宜 0.3 万元。

3、研发费用加大投入,短期弹药不是问题

零跑汽车经过 8 年的全域自研,除了三电系统(电池、电机、电控)等核心零部件外,近年来也显著加大了在智能驾驶技术上的投资,以期迅速赶上行业领先水平。

在 2024 年一季度,零跑汽车标志性地推出了其首次 OTA(Over-the-Air)升级,引入了包括高速智能领航在内的新功能,显著提升了车辆的智能化水平。此外,基于高精度地图的智能驾驶版本也已推向市场,城市 NOA(导航辅助驾驶)功能预计在第二季度正式启用。同时,基于云计算的车联网解决方案的开发也被提上了日程,成为公司研发的新重点。

2024 年第一季度,公司的研发开支已达到 5.2 亿元,同比增长 26.1%。这样的投资虽然短期内难以降低,但对于提升零跑汽车在智能驾驶领域的竞争力及市场地位至关重要。

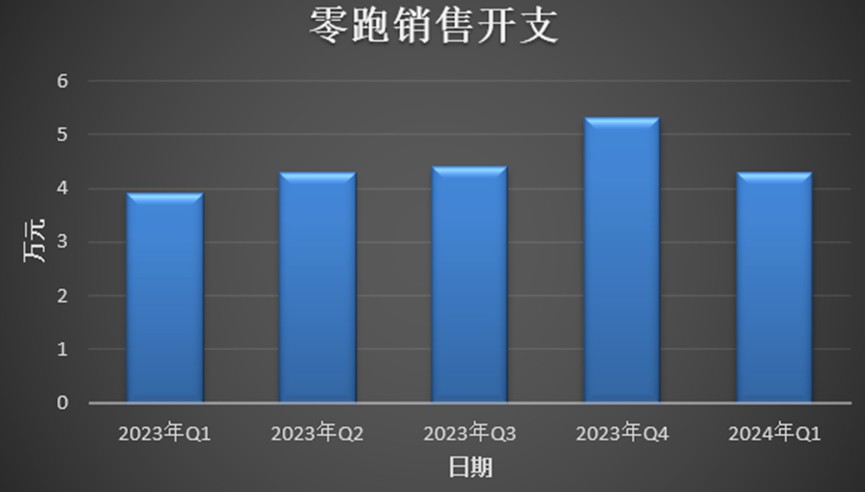

不过在销售费用上,零跑就有意在控制了。第一季度销售费用为 4.3 亿元,同比仅增长 8.8%,环比降低 19.8%。表现在门店数量环比减少了 50 家至 510 家。

现金流也有所好转,相比去年同期增长 87 亿元,环比降低 18 亿元,截至 1 季度末,公司现金及现金等价物、受限制现金和银行定期存款的金额为 175.8 亿元。

领跑汽车离一线越来越近了,但当下新能源市场的竞争仍然激烈,领跑需要尽快盈利。