Dow Jones Industrial Average closes above 40,000 points for the first time, gold and copper hit new highs, silver and nickel surge, GME plunges again

降息预期回升,道指创新高且连涨五周,标普和纳指连涨四周创三个月最长,纳指科技指数本周涨超 3%。谷歌三日连创新高,与 OpenAI 合作的 Reddit 一度涨 17% 至历史第二高,游戏驿站大跌 20% 令散户抱团股承压。中概股指跑赢美股大盘,房多多跳涨 311% 盘中熔断,海底捞美股 IPO 首日涨 53% 后收涨 14%。欧美国债收益率本周后期 V 型翻转,周五齐涨脱离一个月低位。美油月内首次升破 80 美元,布油上逼 84 美元且三周来首次单周累涨。美元周跌 0.8% 徘徊一个月低位。期金首次收高于 2400 美元,白银盘中涨超 6%,周内伦镍涨超 11%、铜锡涨 6%。

美国咨商会领先经济指标在 4 月环比下滑 0.6%,弱于预期和前值的回落 0.3%。有分析称,这是该指数连续两个月回落,表明 “美国经济增长面临严重阻力”。消费者对商业状况的前景恶化、新订单疲软以及新屋建造许可减少等因素都加剧了降幅。

欧元区 4 月通胀同比增长 2.4%,与 3 月持平,增强了欧洲央行最早 6 月开始降息的市场预期。有分析称,今年欧洲通胀降幅将快于此前预估,因红海冲突造成的影响比预期要小。欧盟委员会称明年下半年通胀重返 2% 的目标,多位央行票委赞扬通胀缓解进程。

美联储理事、票委鲍曼重申,如果美国通胀降温停滞或走势反转,将愿意支持加息,由于其对重新加息持开放态度,推动美债收益率涨幅迅速扩大至日高。

道指新高且收盘首次升破 4万点,谷歌三日新高,房多多大涨 311%,海底捞盘中涨 53%

5 月 17 日周五,美股三大指数集体小幅高开,但开盘半小时,科技股居多的纳指率先转跌。标普 500 指数大盘无法持续站稳 5300 点上方,在开盘 40 分钟转跌。

午盘前,除道指外的主要指数均在涨跌之间徘徊,尾盘时标普重新转涨,纳指接近收复全部跌幅,蓝筹股汇聚的道指尾盘涨幅扩大,史上首次收高于 4 万点,但小盘股转跌无缘 2100 点。

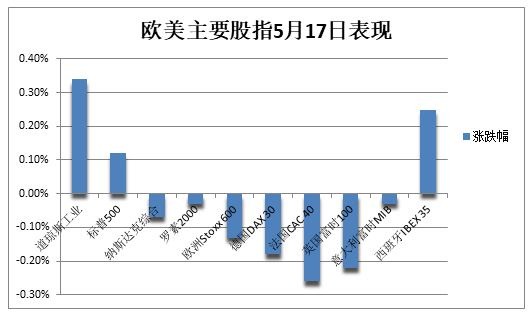

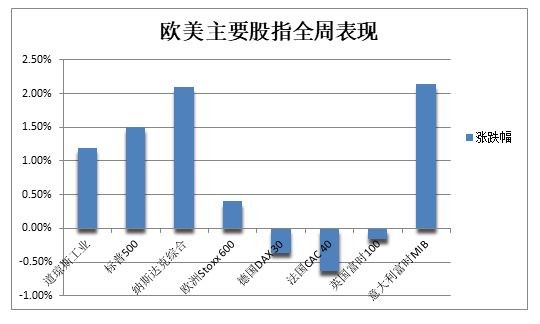

截至收盘,道指创历史新高,全周累涨 1.2% 且连涨五周。标普和纳指均逼近周三所创的历史新高,全周分别累涨 1.5% 和 2.1%,且均自 2 月份以来首次连涨四周:

标普 500 指数收涨 6.17 点,涨幅 0.12%,报 5303.27 点。道指收涨 134.21 点,涨幅 0.34%,报 40003.59 点。纳指收跌 12.35 点,跌幅 0.07%,报 16685.97 点。

纳指 100 微跌,衡量纳指 100 科技业成份股表现的纳斯达克科技市值加权指数(NDXTMC)跌 0.27%,从历史最高连跌两日,但本周分别累涨 2.1% 和 3.1%。

罗素 2000 小盘股指数跌 0.03%,本周累涨 1.7%,“恐慌指数” VIX 跌 3.5% 不足 12,逼近 2019 年 11 月 27 日收盘位 11.75,本周累跌 4.54%。

美股指数单周累涨,道指周五创新高且收盘首次升破 4 万点 本周信息技术和房地产板块领涨大盘,分别累涨 3% 和 2.5%。紧随其后是分别累涨 1.8% 和 1.7% 的医疗保健和通讯服务板块。非必需消费品和工业板块最差。不过,周五科技板块跌 0.5%。

工业板块在本周唯一收跌,科技和金融股表现亮眼

摩根士丹利认为美国经济软着陆仍是最可能实现的场景,但将发生概率从 80% 降至 50%,预期标普大盘到年底下跌 15% 至 4500 点。该行与贝莱德都预计美联储将在 9 月开启降息,今年或降息三次。巴克莱预警潜在的滞胀和地缘政治风险或令投资者措手不及。

明星科技股多数上涨。“元宇宙” Meta 跌 0.3%,亚马逊涨 0.6% 仍徘徊月内低位,苹果转涨至近四个月高位,微软转跌 0.2% 从一个月新高连跌两日。奈飞涨 1.7% 至一个月新高。谷歌 A 涨超 1%,连涨五日且连续三天创历史收盘新高。特斯拉涨 1.5%。

芯片股多数下挫,但 AMD 涨超 1%,连涨四日至一个月最高。费城半导体指数高开低走,转跌 0.7% 并失守 5000 点关口,从两个月高位连跌两日,但离 3 月上旬所创历史新高不远,且本周累涨 3.6%。英伟达跌约 2%,继续脱离约两个月高位,但本周涨 2.9% 并连涨四周;英伟达两倍做多 ETF 跌约 4%;英特尔跌 0.6% 脱离三周高位;Arm 跌超 3%,利好财报后应用材料高开 2.5% 但转跌近 1%。

AI概念股涨跌各异。Palantir 和 C3.ai 涨近 1%,SoundHound.ai 转跌 1%,甲骨文涨超 1%,连涨四日至近六周最高,BigBear.ai 跌超 3%,超微电脑和 Snowflake 跌近 2%,硅谷人工智能基础设施硬件独角兽 Astera Labs 跌 0.7%,阿里巴巴 ADR 最高涨超 4%,延续昨日涨 7% 的表现。

消息面上,有报道称 Snowflake 洽谈以超过 10 亿美元收购谷歌和 Meta 研究员们创办的大语言模型初创公司 Reka AI。英伟达支持的 AI 云供应初创公司 Coreweave 从黑石、凯雷集团和贝莱德等投资者中筹集 75 亿美元以推动人工智能计算。苹果或计划明年推出明显更薄且更贵的 iPhone。

微软计划下个月将《使命召唤》最新游戏纳入订阅服务,对视频游戏销售策略进行重大调整。英国反垄断机构不再调查微软与法国初创公司 Mistral AI 的合作,但欧盟要求微软在月底前提供 Bing 搜索引擎生成式 AI 功能所产生风险的充分信息。

中概股指跑赢美股大盘,但尾盘涨幅收窄。ETF KWEB 涨 0.3%,CQQQ 涨 0.2%,纳斯达克金龙中国指数(HXC)涨 1.7% 后收涨 0.4%,盘中曾升破 7000 点,至去年 9 月以来的八个月最高。

热门个股中,京东涨近 3%,百度跌近 2%,拼多多和阿里巴巴涨约 2%;腾讯 ADR 跌 0.4%,B 站涨 2.5%,蔚来涨 0.3%,理想汽车跌超 1%,计划 2026 年推出首款飞行汽车的小鹏汽车涨 0.4%。海底捞旗下特海国际(HDL)美国 IPO 首日盘中最高涨 53%,收涨 14%。法拉第未来涨 136% 后暴跌并触发熔断,收跌超 38%,本周仍累涨超 2100%。

中国人民银行出台三项房地产金融政策稳楼市,令贝壳美股盘前一度涨超 9%、房多多涨超 450%。开盘后,贝壳涨 7% 后收涨近 2%,连涨七日至 14 个月最高;房多多一度大涨 412% 并触发熔断,创 2020 年 6 月以来最大涨幅,最终收涨 311% 至八个月最高。

其他变动较大的个股包括:

散户集中的 “美国贴吧” Reddit 涨超 17% 后收超 10%,创 3 月下旬上市后的第三高纪录,与 OpenAI 达成合作协议,内容将被引入 ChatGPT 等产品中,后者可利用论坛数据训练 AI 模型。

散户抱团概念股热情消退,游戏驿站跌近 20%,本周涨幅从 271% 大幅收窄至 27%,计划增发最多 4500 万股 A 类股,称财务状况未出现重大变化,但一季度初步销售额下滑且不及预期。AMC 院线周五跌超 5%,单周涨幅也从 308% 收窄至 51%。

主打乡村风和怀旧商品的美国餐厅 Cracker Barrel Old Country Store 跌超 14%,至 2012 年初以来的十二年新低,将大幅削减 80% 的股息分红以支持转型计划。

企业技术堆栈 IT 公司 DXC Technology Company 低开 21% 后收跌 17%,创 2020 年 9 月以来的近四年新低,尽管财年四季度的业绩超预期,但下季度盈利和收入指引不佳。

美国最大零售商沃尔玛涨超 1%至历史最高,昨日曾因财报利好而大涨 7%,作为成分股支撑道指上涨。网红互联网券商 Robinhood 涨 12%,美银转而看涨、将评级提升两档至买入。

安达保险涨 3.6%,连续两日创历史新高,最近两日累涨 8.4%,在 “股神” 巴菲特旗下伯克希尔哈撒韦披露持仓的情况下,创 2020 年以来最大两天涨幅。

欧股周五普跌,泛欧 Stoxx 600 指数从历史新高连跌两日,受工业和科技股拖累,周三曾结束九日连涨,但本周累涨 0.4% 且连涨两周。瑞士奢侈品集团厉峰涨超 5%,全年销售额创新高。

德国股指全周累跌 0.4%,脱离周三所创的盘中历史最高。法国股指全周跌 0.6%,英国股指全周跌 0.2%,但负债较深的欧元区外围国家意大利与西班牙的股指全周均涨 2%。

欧美国债收益率本周后期 V型走势,周五齐涨并脱离一个月低位

美联储理事鹰派发言,令对货币政策更敏感的两年期美债收益率在美股午盘涨幅扩大至日高,升 4 个基点至 4.83%,重返 4.80% 上方,收复周三以来跌幅。10 年期基债收益率升 5 个基点至 4.42%,升破 4.40% 关口,收复周三来过半跌幅,与短债收益率均脱离一个半月低位。

全周,两年期美债收益率累计下行 4.4 个基点,10 年期基债收益率累计下行 8.4 个基点,在过去三周中有两周累跌。30 年期长债收益率全周累计下行 8.5 个基点并连跌三周,期间跌去 22 个基点。有分析称,这是因为美国经济领先指标暗示增长面临严重阻力。

最近几周,美联储官员对开启降息态度谨慎,称仍在等待更多表明通胀持续放缓的证据。金融市场普遍认为夏季结束前不会降息,首次降息将发生在 9 月且今年多次降息。巴克莱资本等华尔街最大的一群债券空头建议,逢高卖出 10 年期美国国债。

欧债收益率周五走高,摆脱周三所创的一个月低点,本周在发布美国 CPI 通胀后与美债收益率均出现 V 型走势,基本抹去周三以来跌幅。欧元区基准的 2 年期与 10 年期德债收益率尾盘均升约 6 个基点。10 年期英债收益率升 5 个基点,与意债一道在本周累跌 4 个基点。

美油月内首次升破 80美元,布油上逼 84美元且三周来首个单周累涨,天然气跃升

美国和中国等消费大国的经济指标增强了需求端改善的希望,国际油价日内涨幅扩大:

WTI 6 月原油期货收涨 0.83 美元,涨幅 1.05%,报 80.06 美元/桶至 4 月 30 日来最高,月内首次站上 80 美元整数位心理关口,全周累涨 2.3% 且连涨两周。

布伦特 7 月原油期货收涨 0.71 美元,涨幅 0.85%,报 83.98 美元/桶至 4 月 30 日来最高,全周累涨 1.4%,为三周来首次单周累涨。

美油月内首次升破 80 美元至两周高位

有分析称,中国经济数据和刺激措施、美国商用石油库存连降两周,以及俄罗斯的石油基础设施又一次遇袭,均有助于提振短期油价。后续重点关注 6 月 1 日的 OPEC+ 产量会议。

而美国通胀数据放缓,强化了美联储在不久将来开始降息的理由,导致美元兑其他主要货币贬值,也有利于油价。摩根士丹利还认为,今年全球石油需求的增长速度将高于历史趋势。

此外,在夏季需求高峰之前的库存紧张支撑了天然气价格。美国 6 月天然气期货周五涨超 5%、全周累涨超 16%。欧洲基准的 TTF 荷兰天然气期货周五涨近 2% 且连涨四日、全周涨超 3%。

美元抹去日内涨幅,单周跌 0.8%徘徊一个月低位,日元与人民币小幅走低

衡量兑六种主要货币的一篮子美元指数 DXY 在欧股时段涨 0.3% 至 104.80,美股尾盘转跌并重返 104.45,接近昨日所创的一个月最低,本周累跌 0.8%,5 月已累跌 1.7%。

有分析称,这是因为在通胀降温和美国经济疲软的迹象下,市场对美联储从 9 月起降息的押注升温,年内或降息 47 个基点。

欧元和英镑兑美元小幅抬升,均徘徊在近两个月高位。日本央行维持购债规模不变,日元兑美元小幅走低至 155.66,脱离一周多高位,维持 1990 年日本资产泡沫破裂以来的低位水平。离岸人民币兑美元下跌百点并失守 7.23 元,抹去周三以来大部分升幅。

主流加密货币普涨。市值最大的龙头比特币涨 2% 并升破 6.64 万美元,至 4 月 22 日以来的近四周最高。第二大的以太坊涨超 4% 并重返 3000 美元关口上方,创两周高位。

期金与纽约铜创收盘历史最高,白银创十一年高位站上 31美元,伦镍单周涨超 11%

由于欧美央行的降息预期改善,金价连涨两周且本周累涨近 2%,银价本周大涨 11%,面临持续结构型供应赤字的铂金本周涨近 9% 并触及一年高点。

COMEX 6 月期金周五收涨 31.90 美元,涨幅 1.3%,收报 2417.40 美元/盎司,创历史收盘最高。7 月期银收涨 1.38 美元,涨幅 4.6%,收报 31.26 美元/盎司,创 2013 年 2 月 8 日来收盘最高。

周五现货白银最高涨 6.4% 至 31.51 美元/盎司,期银最高涨 6.3% 至 31.77 美元/盎司,均为十多年来首次突破每盎司 30 美元,日内不断突破 2013 年 2 月以来最高,带动 iShares 白银 ETF 涨 6.4% 同创十一年最高。夜盘中,沪银期货主力合约突破 8000 元/千克,涨超 5%。

现货黄金最高涨 1.8% 或涨超 42 美元,不仅升破 2400 美元整数位心理关口,还上逼 2420 美元,创 4 月 12 日以来的一个月盘中新高,当时金价曾以逾 2431 美元创下历史最高。

在避险需求、供应链干扰,以及金融和工业需求旺盛的背景下,银价涨势比黄金还要迅猛。年初至今白银累涨超 31%,超过累涨 17% 的黄金,成为今年表现最佳的主要大宗商品之一。

伦敦工业基本金属普涨:

经济风向标 “铜博士” 周五收涨 2.3%,站稳 1 万美元整数位心理关口上方,全周累涨 6.6%。7 月 COMEX 纽约期铜收涨 3.6% 至 5.05 美元/磅,创历史收盘最高。

由于全球第三大镍产地发生骚乱影响产量,伦镍周五涨近 1300 美元或涨 6.5%,接连升破 2 万和 2.1 万美元两道关口,全周涨超 11%。

伦铝涨 1% 并升破 2600 美元,全周涨 3.2%。伦锌涨 2.4% 并升破 3000 美元,全周涨 3.5%。周五微跌的伦铅全周涨 2.8%。伦锡涨 1.6% 升破 3.4 万美元,全周涨 6.7%。

此外,国内期货主力合约在夜盘多数上涨,纯碱收涨约 4.8%,LPG 涨约 2.4%,苯乙烯涨约 2.2%,铁矿石涨 0.4%。氧化铝夜盘涨超 4.2%,沪镍涨超 3.4%,沪银收涨超 6%,沪金涨 1.6%。