AI server "one-stop" capability is unique! Morgan Stanley: The market still underestimates Foxconn

大摩认为,鸿海独特的 CMMS 模式有望提升 AI 服务器业务利润,预计 2025 年的 AI 服务器收入和利润将分别同比增长 30% 和 126%,此外 iPhone 组装业务也持续性好于预期。

代工龙头鸿海(富士康母公司),或将成为 AI 浪潮中下一个脱颖而出的明星。

尽管鸿海台股股价今年以来大涨 62%,但摩根士丹利指出,其 AI 服务器相关的潜力未被市场充分认识,表现逊于纬创资通、广达电脑、技嘉科技等 AI 服务器 ODM 同行。

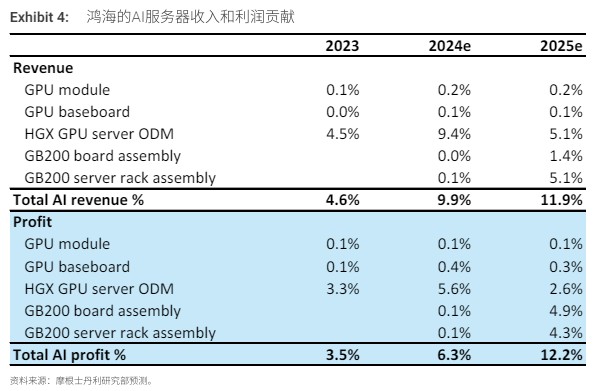

大摩指出,鸿海近期凭借独创的 CMMS 模式赢得 AI 服务器项目,预计 2025 年该项目将贡献 12% 的利润,利润总额同比增长 20%。

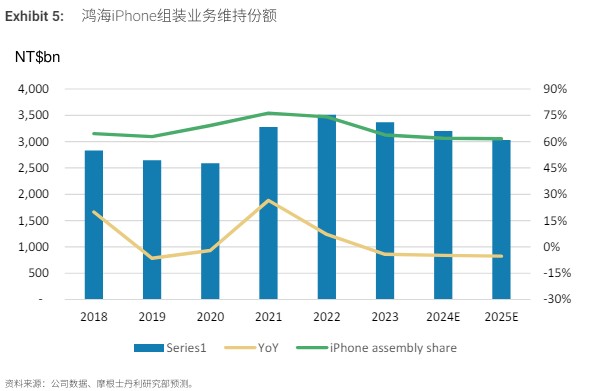

另一方面,iPhone 组装业务持续性好于预期,即将推出的新款 iPhone 中可能加入 AI 功能,有望因置换需求而带来出货量增长,大摩预计鸿海今明两年的 iPhone 组装份额将保持在 60% 左右。

鉴于鸿海 2025 年盈利同比增长前景更为强劲,大摩重申对鸿海的超配评级,并将目标价上调至新台币 210 元,较目前有 23.5% 上涨空间,对应 15.6 倍 2025 年前瞻 PE,目前鸿海 12 个月前瞻 PE 为 12.6 倍,低于同行 15-20 倍的 PE。

CMMS 模式有望提升 AI 服务器业务利润

大摩认为,鸿海利用其 CMMS(零组件模块化快速出货与服务)经营模式,赢得了英伟达 GB200DGX/MGXNVL72/36 旗舰项目的电路板组装项目和服务器机架集成工作。

鸿海提供的差异化 CMMS(零组件模块化快速出货与服务)经营模式,除了服务器组装/机架集成外,还负责 GB200NVL72/36 服务器机架的主要电路板组装(计算板、交换机托盘、智能网卡、DPU 等)。

这将使鸿海能够通过提供各种类型的电路板组装产生增量利润,在处理 GB200 服务器机架组装工作方面,鸿海拥有更强的技术诀窍和组装专业能力,从而在 AI 服务器 ODM 同行中脱颖而出,这也有助于增加相关的利润贡献。

大摩预计,随着 GB200 相关服务器机架出货量攀升(DGX 将于 2025 年上半年出货,MGX 将于 2025 年中期出货),鸿海 2025 年的 AI 服务器收入和利润将分别同比增长 30% 和 126%。

我们预计鸿海明年的 AI 业务收入将达到 256 亿美元(同比增长 30%),其中 46% 来自英伟达 HGXGPU 服务器,54% 来自 GB200NVL72/36 服务器机架解决方案。

得益于其 CMMS 模式,我们预计鸿海明年的 AI 业务利润将同比增长 126%,达到 18 亿美元,其中 40% 来自高附加值的电路板组装,35% 来自大规模的 GB200 机架集成工作。

根据大摩测算,2025 年鸿海将从 AI 服务器业务中获得 18.33 亿美元的利润,占总利润的 12%。其中,由于附加值较高,与 GB200 相关的电路板组装将占相关利润的 40%,其次是与 GB200 相关的机架组装工作,占 35%(得益于收入规模的扩大)。

iPhone 组装业务持续性好于预期

另一方面,大摩认为,即将推出的新款 iPhone 中可能加入 AI 功能,有望因置换需求而带来出货量增长,今明两年鸿海的供应份额将维持在 60% 左右。

从 2023 年 1 月到 2024 年 2 月,与服务器 ODM 同行相比,鸿海股价表现不佳,其中一个重要原因是市场担心其 iPhone 组装业务会因立讯精密的份额增长和 iPhone 出货量饱和而失去动力。

基于鸿海今年保持了 iPhone 组装份额和整体 iPhone 出货量前景,管理层最近表示,其消费品业务今年同比有望持平,这比市场担心的同比可能下降 10-15% 要好得多。

我们现在预计鸿海今明两年的 iPhone 组装份额将保持在 60% 左右⸺立讯精密的份额增长主要来自于和硕相关资产的转让。我们的 iPhone 出货量预期与覆盖苹果的分析师 ErikWoodring 的预测一致,即今年同比下降 6%,2025 年同比增长 9%。因此,iPhone 组装收入将相当稳定,今年预计为新台币 32010 亿元,明年为新台币 30320 亿元,同比降幅分别为 4.9% 和 5.3%。

此外,大摩还提醒关于近期股价催化因素:1) 5 月 14 日的 2024 年一季度业绩电话会议上报告 AI 服务器业务最新动态;2) 6 月 4-7 日的中国台北国际电脑展,英伟达 GB200 服务器机架演示;3) 6 月 10-14 日的苹果全球开发者大会,潜在的 AI 功能介绍。