SoftBank's net loss for the 23rd fiscal year decreased by 76.5% year-on-year, achieving profitability for two consecutive quarters!

人工智能投资热潮下,软银 2023 财年亏损大幅收窄,得益于去年中旬上市的 Arm,软银净资产创下历史最高纪录。

人工智能的滚滚浪潮,正在把软银从科技股投资泥潭中拉出来——连续两个季度实现盈利,去年全年亏损大幅收窄。

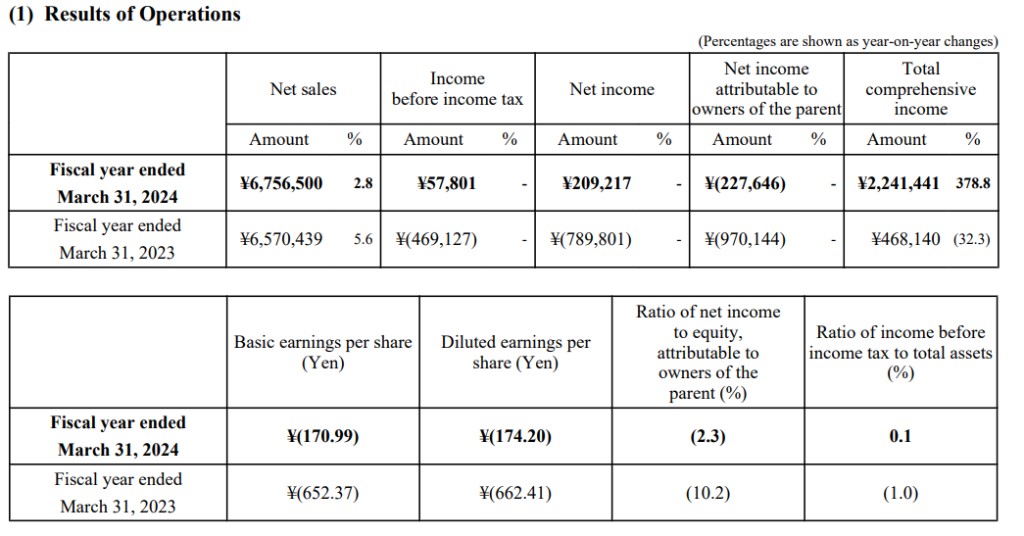

软银周一公布财报显示,软银 2023 财年(截至 2024 年 3 月 31 日)全年销售净额同比增长 2.8% 至 6.76 万亿日元(约合 433.8 亿美元),但不及市场预估的 6.81 万亿日元;全年归属母公司股东净亏损 2276.5 亿日元,同比减少 76.5%,且好于市场预估亏损 2830.9 亿日元。稀释后的每股亏损为 174.2 日元,去年每股亏损为 662.41 日元。全年股息 44 日元,符合市场预期。

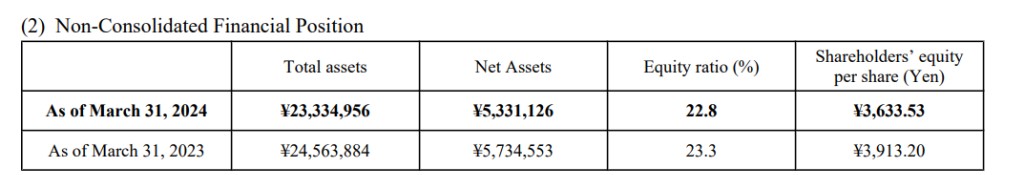

截至 2024 年 3 月 31 日,软银净资产达到 5331.1 亿日元,创下历史最高纪录。据软银 CFO 后藤芳光在财报发布会上表示,这主要得益于去年中旬上市的 Arm。

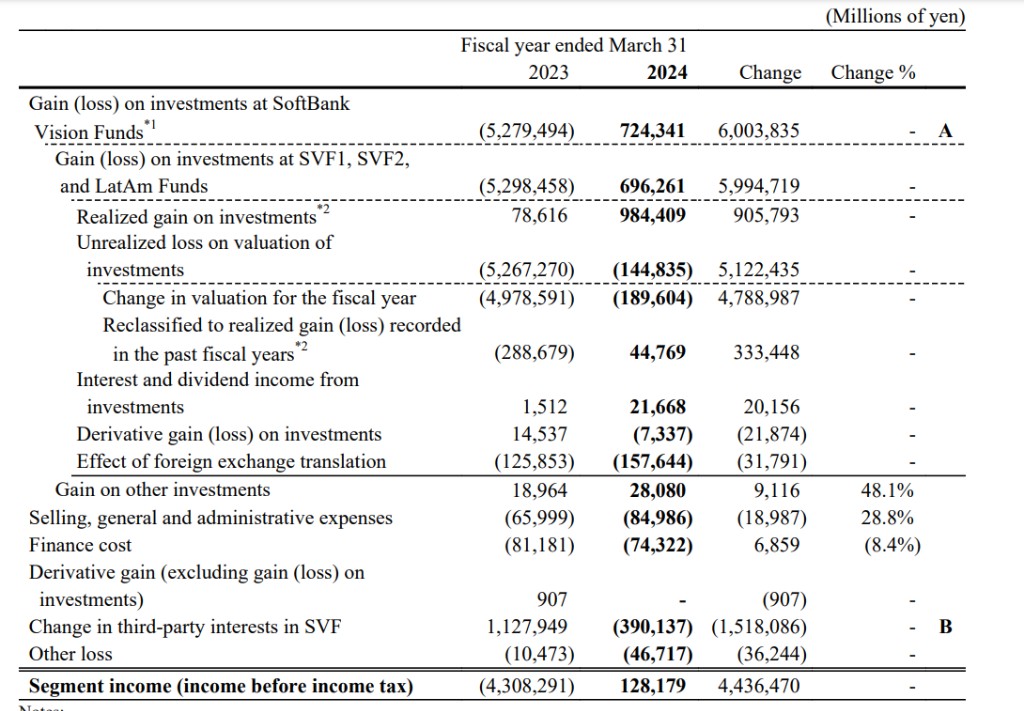

软银愿景基金部门全年投资利润(包括投资 Arm)为 7243.4 亿日元,去年亏损 5.28 万亿日元;部门全年利润 1281.8 亿日元,去年亏损 4.3 万亿日元,但不及市场预估 3620 亿日元。

从单季度来看,软银第四季度销售额为 1754.6 亿日元,同比增长 3.5%,归属母公司股东净利润 2310.8 亿日元,为连续第二个季度盈利,2022 年同期亏损 576.3 亿日元。

其中,软银愿景基金部门第四季度投资亏损 575.3 亿日元,同比下降 76%,此前已连续三个季度实现盈利;第四季度愿景基金亏损 967.4 亿日元,不及市场预估的盈利 1851.4 亿日元,2022 年同期亏损 2975.4 亿日元。

Arm,软银的希望

多年以来,软银创始人孙正义一直在谈论 AI 和机器人技术的潜力,但软银仍然踏空了生成式 AI 的投资,没有成为 OpenAI 等当红初创 AI 公司的创始人。不过,生成式 AI 的积极前景推动软银旗下设计公司 Arm 的市值飙升至 1100 亿美元。

Arm 于 2023 年 9 月 4 日在美股纳斯达克全球精选市场上市。此次 IPO 中,Arm 出售了 1.03 亿股美国存托股 (ADS),相当于已发行普通股的 10%,并获得了 51.2 亿美元收益,出售收益并未计入集团综合损益表。

财报还显示,2023 财年,软银通过使用阿里巴巴股票的预付远期合约筹集了 43.9 亿美元。

软银投资阿里巴巴股票已实现和未实现的估值损失为 9599 亿日元,被衍生收益 15174 亿日元所抵消,该衍生收益来自使用阿里巴巴股票的预付远期合约,单独记录为 “衍生收益(不包括投资损益)”。

软银第四季度的净利润有所改善,主要是因为软银通过阿里巴巴筹集的资金缓解了愿景基金价值减记的一些影响。