US Stock Options | Tesla's trading volume surged to 2 million contracts! Nvidia, GME, NVAX are hot

上周五最火合约:当日到期、执行价 170 美元的特斯拉 put 成交 18 万张。游戏驿站 GME 期权成交接近翻倍至 40 万张,看涨期权占比 73.5%。诺瓦瓦克斯医药股价接近翻倍,期权成交大涨至 28 万张,看跌期权占比 63.7%。

上周五,美股科技股涨跌不一,芯片股反弹,中概股回落。

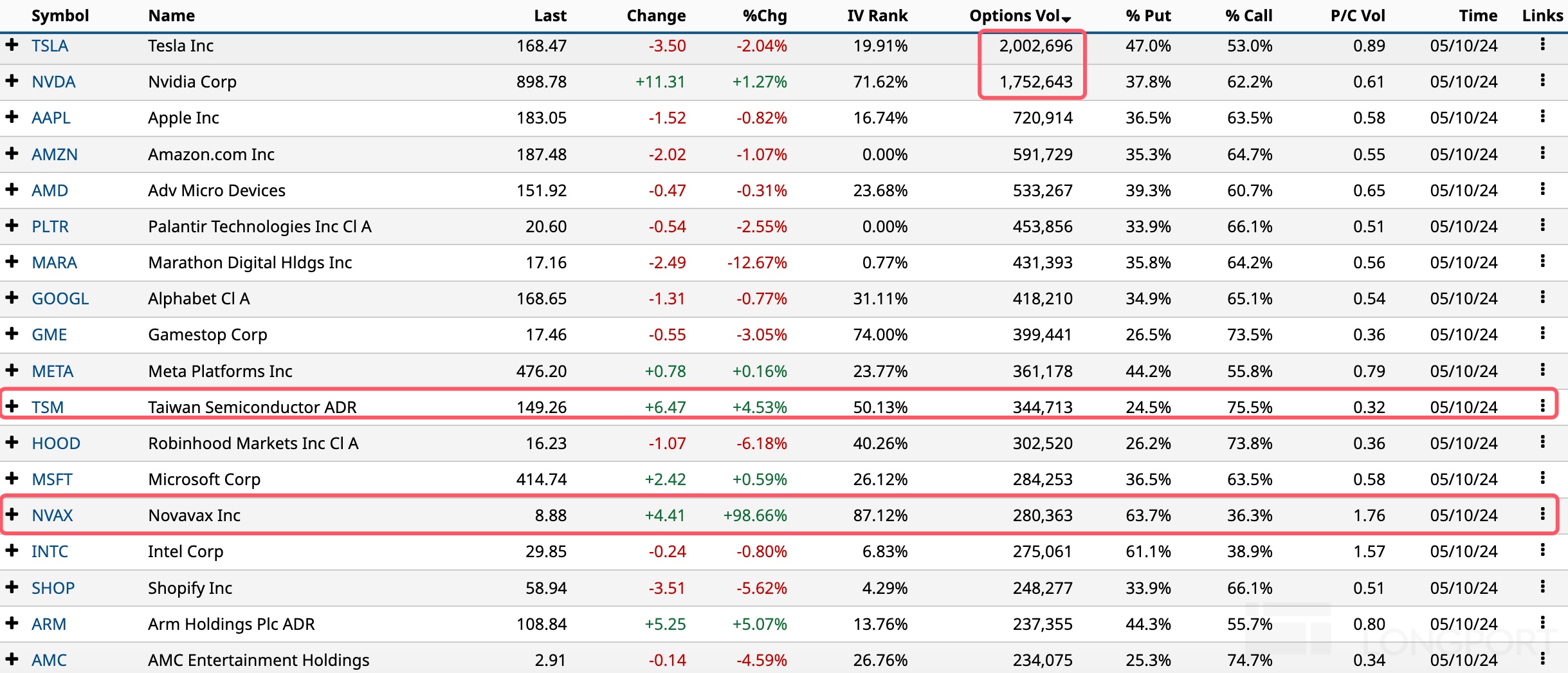

美股期权成交概览

上周五前十大美股期权成交:特斯拉、英伟达、苹果、亚马逊、AMD、Palantir、Marathon Digital、谷歌 A、GME、Meta。

其中:

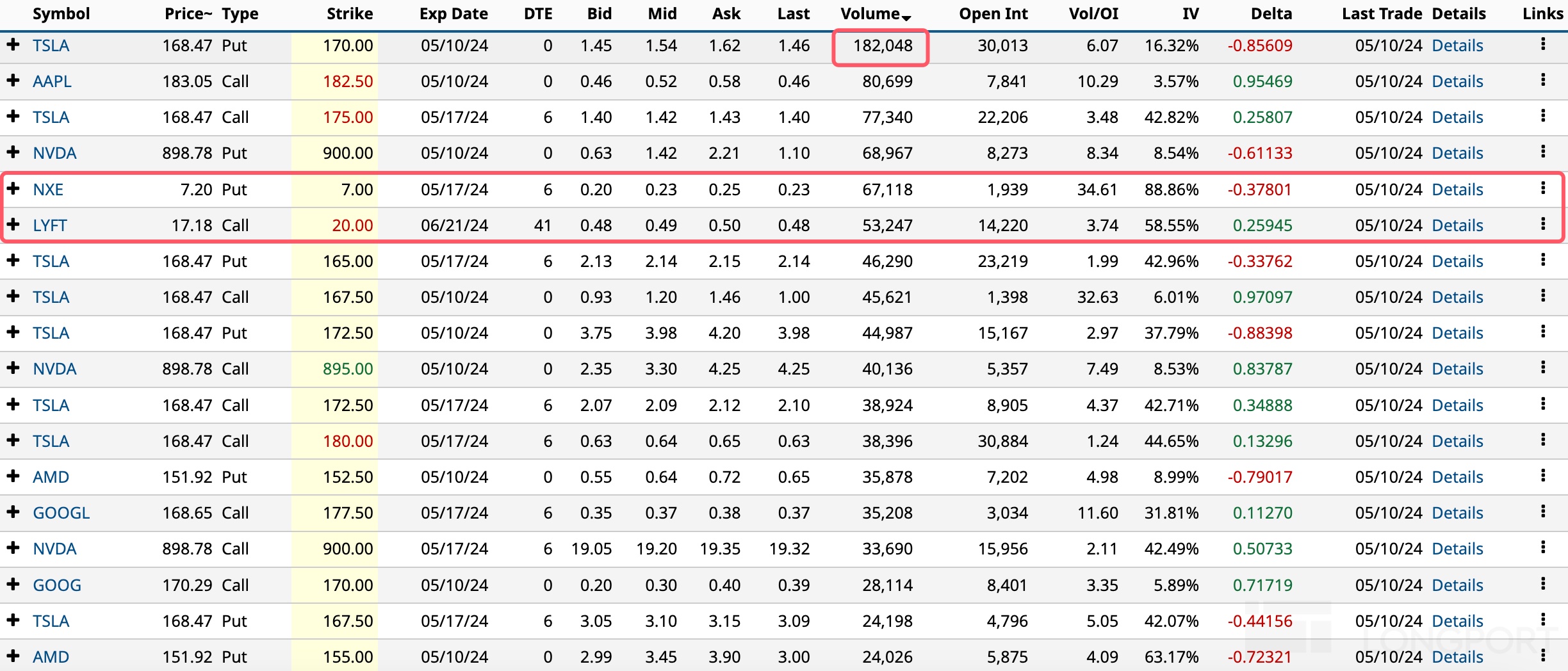

特斯拉跌 2%,期权成交大涨至 200 万张,看涨期权占比 53%。当日到期、执行价 170 美元的看跌期权成交 18 万张,5 月 17 日到期、执行价 175 美元的看涨期权成交近 8 万张。

英伟达涨超 1%,期权成交大涨至 175 万张,看涨期权占比 62.2%。当日到期、执行价 900 美元的看涨期权成交近 7 万张。

苹果跌近 1%,期权成交跌至 72 万张,看涨期权占比 63.5%。执行价 182.5 美元的看涨期权成交 8 万张。

亚马逊跌超 1%,期权成交大跌至 59 万张,看涨期权占比 64.7%。

AMD 微跌,期权成交涨至 53 万张,看涨期权占比六成。执行价 152.5 美元的看跌期权成交 3.5 万张,执行价 155 美元的看跌期权成交超 2 万张。

Palantir 跌 2.5%,期权成交涨至 45 万张,看涨期权占比 66%。

Marathon Digital 大跌 13%,期权成交大涨至 43 万张,看涨期权占比 64%。

谷歌 A 跌近 1%,期权成交大涨至 42 万张,看涨期权占比 65%。

游戏驿站 GME 跌 3%,期权成交接近翻倍至 40 万张,看涨期权占比 73.5%。

Meta 微涨,期权成交涨至 36 万张,看涨期权占比 55.8%。

台积电涨超 4%,期权成交涨至 34 万张,看涨期权占比 75.5%。

诺瓦瓦克斯医药股价接近翻倍,期权成交大涨至 28 万张,看跌期权占比 63.7%。

Nexgen Energy 合约异动,5 月 17 日到期、执行价 7 美元的看跌期权成交近 7 万张。

Lyft 合约异动,6 月 21 日到期、执行价 20 美元的看涨期权成交超 5 万张。