JP Morgan: Chinese stocks can still rise! Increase positions in May, then wait patiently!

摩根大通认为,除盈利改善外,股东回报改善、资本市场改革、房地产市场支持政策、海外投资者乐观预期、外资回流等利好因素均支持中国股市反弹。

AH 股最近的强劲反弹,令华尔街大行纷纷重新审视中国股市的前景,美银美林称 “最糟糕” 的时期已经过去,高盛继续唱多中国股市,预测乐观情况下中国上市企业估值提升可能高达 40%。

摩根大通更是喊话华尔街,5 月份大举加仓中国股票,然后耐心等待经济加速复苏。

摩根大通的 Wendy Liu 分析师团队在上周公布的报告中写道:

根据 EPFR 数据,截至 3 月底,全球、全球(美国除外)、新兴市场、亚洲 (日本除外) 基金对中国的股票持仓分别低于其各自 MSCI 基准指数的 1.8%/4.8%/3.3%/7%。

EPFR 数据显示,这四类基金每次将其相对于 MSCI 基准的低配状态减少 25 个基点,中国股市就会有 2840 亿元人民币 (约合 392 亿美元) 的净流入。

今年 2 月至 4 月,MSCI 中国指数实现了自开放以来最佳的三个月回报率,市盈率从 3 月底的 8.9 倍重新估值至目前的 9.7 倍,增幅高达 9.3%。

摩根大通表示,中国已经处于复苏的早期阶段,且政府政策和市场动态显示出积极的迹象,而其他国家则更多地面临复苏晚期的挑战。该机构预计,中国下一个扩张周期高峰可能在 2025 年上半年到来。

随着经济加速恢复,摩根大通预计,MSCI 中国指数的远期市盈率也会增长,进一步推动该指数的 EPS(每股收益)在 2024-2025 年期间增长。

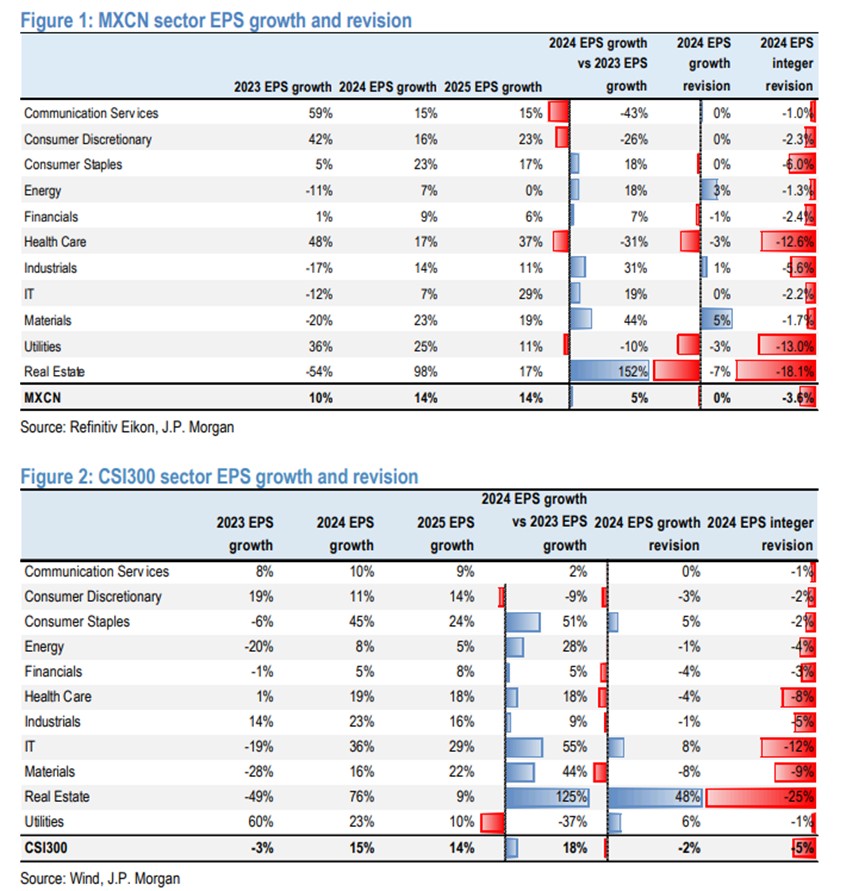

摩根大通预测,MSCI中国指数和沪深300指数在2024年的EPS年增长率将分别从2023年的10%和-3%增长至14%和15%。

除了盈利改善之外,摩根大通指出,股东回报改善、资本市场改革、房地产市场支持政策、投资者乐观预期、外资回流等利好因素均将支持中国股市反弹。

摩根大通建议关注 2024 年第一季度企业盈利和房地产数据。根据 IBES 数据,MSCI 中国指数的 11 个 GICS 行业中,有 5 个行业的 EPS 扭转去年的下降态势,在一季度实现正增长。该机构对沪深 300 指数走势也有类似的预测。

摩根大通基准预测显示,MSCI 中国指数和沪深 300 指数将在 2024 年年底分别将上升至 66 和 3900,也就是说,对于沪深 300 指数而言,年内还有近 7% 的上涨空间。

值得注意的是,摩根大通报告指出,中国房地产市场已经从增长期转向了调整期,尽管挑战重重,改善型住房需求仍可能会支持房地产市场直至 2026-2027 年。

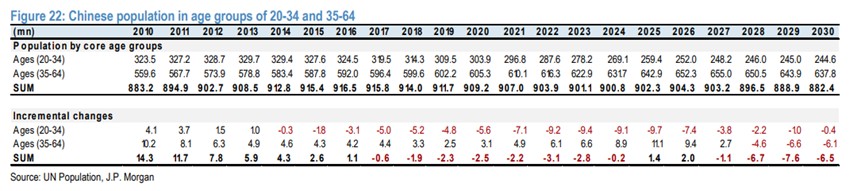

报告指出,根据联合国的人口数据预测,到 2025 年,中国 35 至 65 岁年龄段的人口将从 2023 年的 6.229 亿增加到 6.429 亿。

随着 35 至 65 岁年龄段人口的增加,预计将带来相对稳定的升级需求,这部分人群可能会寻求更好的居住条件,从而推动改善型住房市场。

中国存在一定量的未售出的建成住宅和在建住宅库存。改善型需求的增加可以帮助消化这些库存,为房地产市场提供一段时间的支撑。摩根大通预测,改善型住房需求可能会支持房地产市场直至 2026-2027 年。

另根据联合国人口数据中国置业主群体将在 2024、2025、2026 和 2027 年分别增加 890 万、1110 万、940 万和 270 万,这将在过渡期内支撑房地产去库存。