US Stock Options | Apple, Tesla, Nvidia all traded over 2 million contracts! GME surges

上周五最火合约:5 月 3 日到期、执行价 180 美元的特斯拉 call,成交 15 万张。5 月 10 日到期、执行价 190 美元的苹果 call 成交近 13 万张。游戏驿站 GME 期权成交暴涨至 43 万张,看涨期权占比 84%。阿里期权成交 27 万张,看涨期权占比 78%。

上周五,非农就业引爆降息预期,美股全周翻盘。

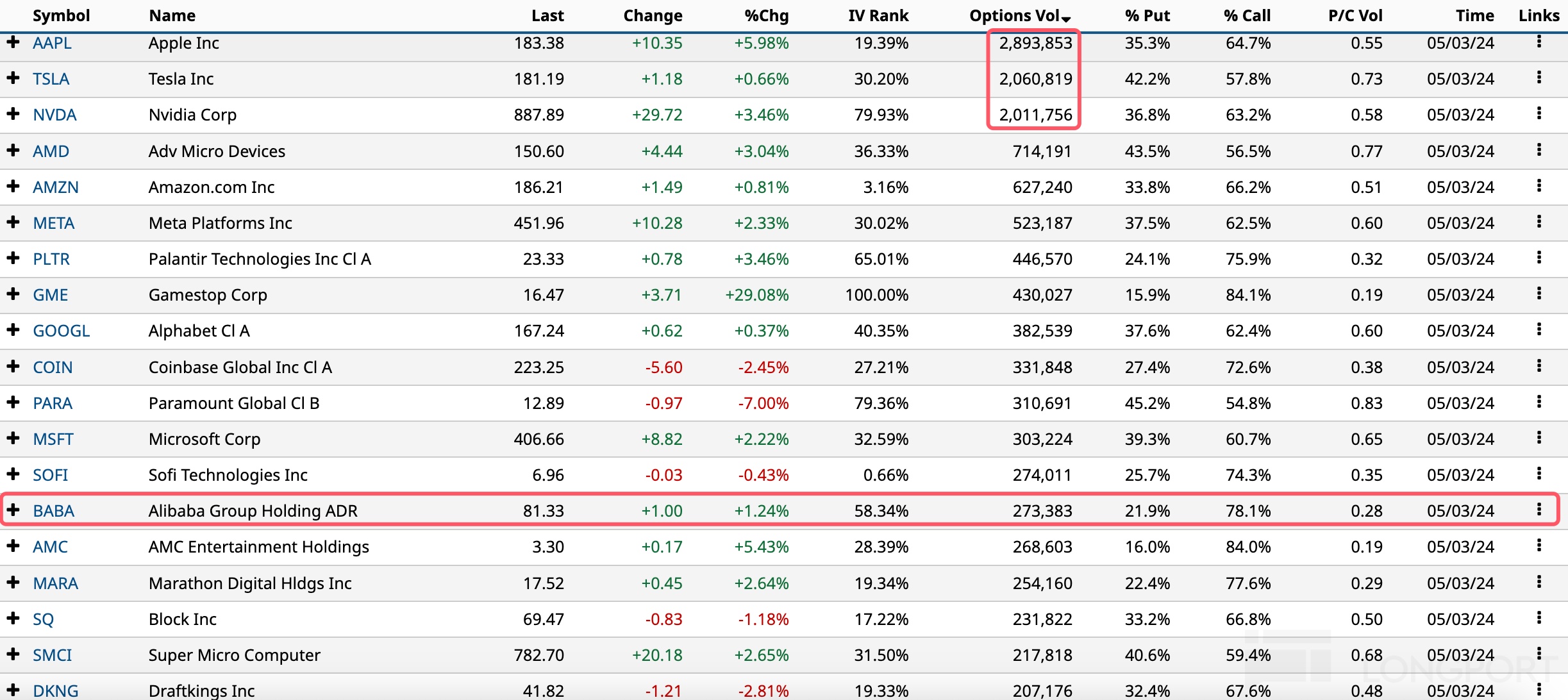

美股期权成交概览

上周五前十大美股期权成交:苹果、特斯拉、英伟达、AMD、亚马逊、Meta、Palantir、GME、谷歌 A、Coinbase。

其中:

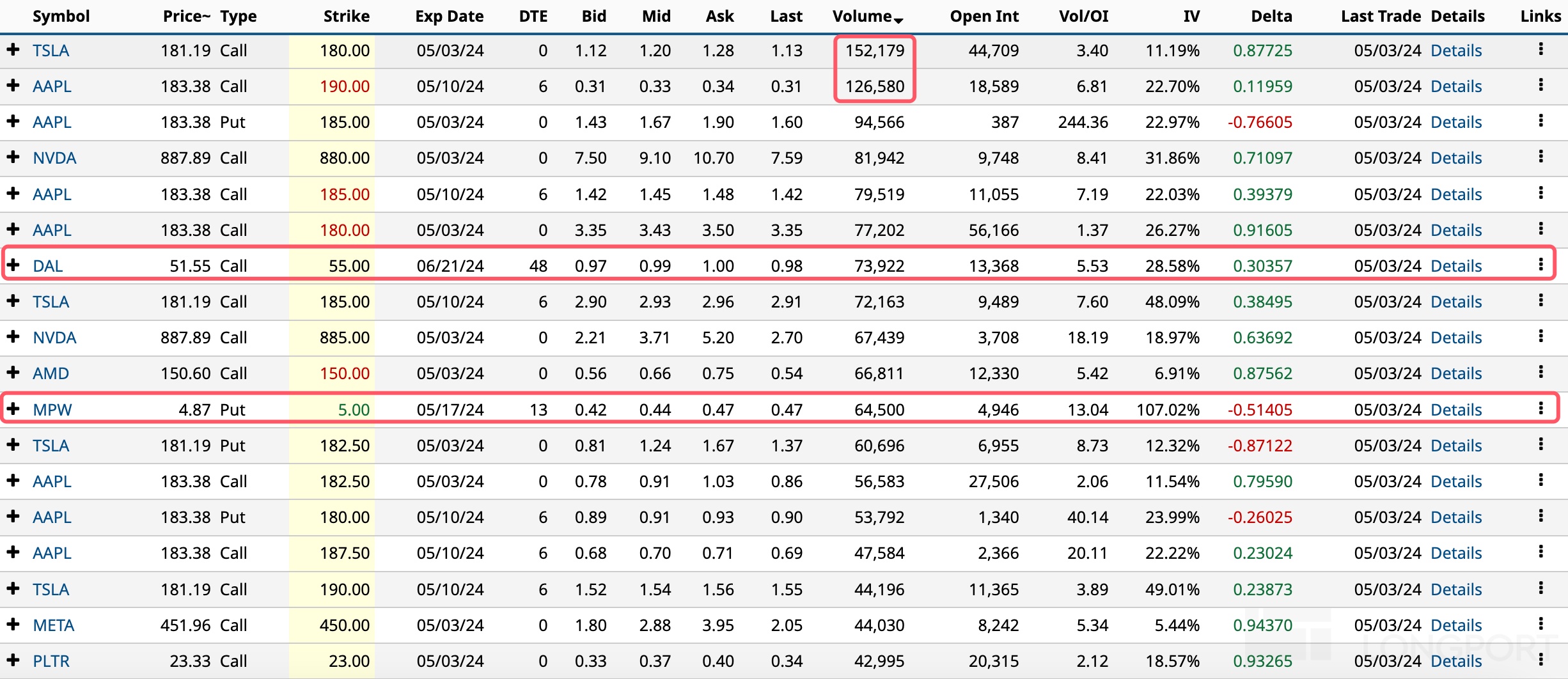

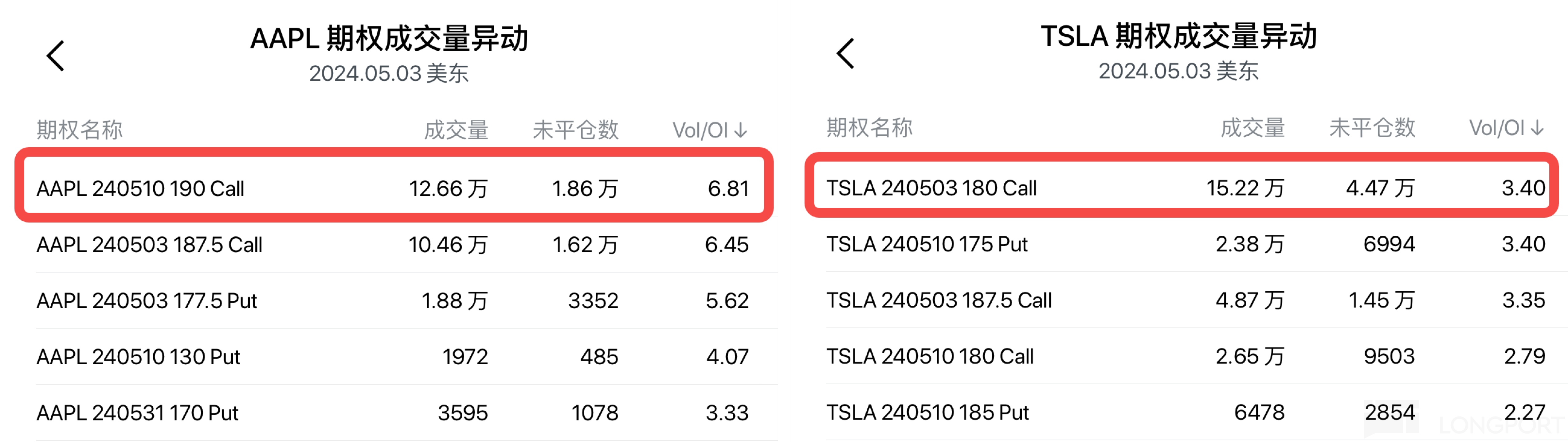

苹果大涨 6%,期权成交涨至 289 万张,看涨期权占比 65%。5 月 10 日到期、执行价 190 美元的看涨期权成交近 13 万张,5 月 3 日到期、执行价 185 美元的看涨期权成交超 9 万张。

特斯拉涨近 1%,期权成交 206 万张,看涨期权占比 57.8%。5 月 3 日到期、执行价 180 美元的看涨期权成交 15 万张。

英伟达涨超 3%,期权成交 201 万张,看涨期权占比 63%。执行价 880 美元的看涨期权成交超 8 万张。

AMD 涨超 3%,期权成交 71 万张,看涨期权占比 56.5%。执行价 150 美元的看涨期权成交近 7 万张。

亚马逊涨近 1%,期权成交 63 万张,看涨期权占比 66%。

Meta 涨超 2%,期权成交 52 万张,看涨期权占比 62.5%。执行价 450 美元的看涨期权成交超 4 万张。

Palantir 涨超 3%,期权成交 45 万张,看涨期权占比 76%。执行价 23 美元的看涨期权成交超 4 万张。

游戏驿站 GME 大涨 29%,期权成交暴涨至 43 万张,看涨期权占比 84%。

谷歌 A 微涨,期权成交 38 万张,看涨期权占比 62.4%。

Coinbase 跌近 3%,期权成交 33 万张,看涨期权占比 72.6%。

阿里涨超 1%,期权成交 27 万张,看涨期权占比 78%。

达美航空合约异动,6 月 21 日到期、执行价 55 美元的看涨期权成交超 7 万张。

MPW 合约异动,5 月 17 日到期、执行价 5 美元的看跌期权成交超 6 万张。