Bitcoin prices are experiencing sharp fluctuations, with the influence of ETF buyers on the rise

比特币价格剧烈波动表明 ETF 买家对加密资产的影响力正在上升。上周,美国非农就业报告导致市场对美联储降息的预期升温,提高了比特币等风险资产的吸引力。比特币的价格波动更符合传统投资者的观点。此外,比特币 ETF 的新发展吸引了华尔街的参与,比特币交易与其他风险资产一致。比特币价格在 5 月 3 日上涨约 7%,推动了其他加密货币的上涨。然而,投资者对利率维持高位的担忧导致比特币现货 ETF 资金撤出。比特币的价格波动可能反映了全球宏观环境中的一些风险。

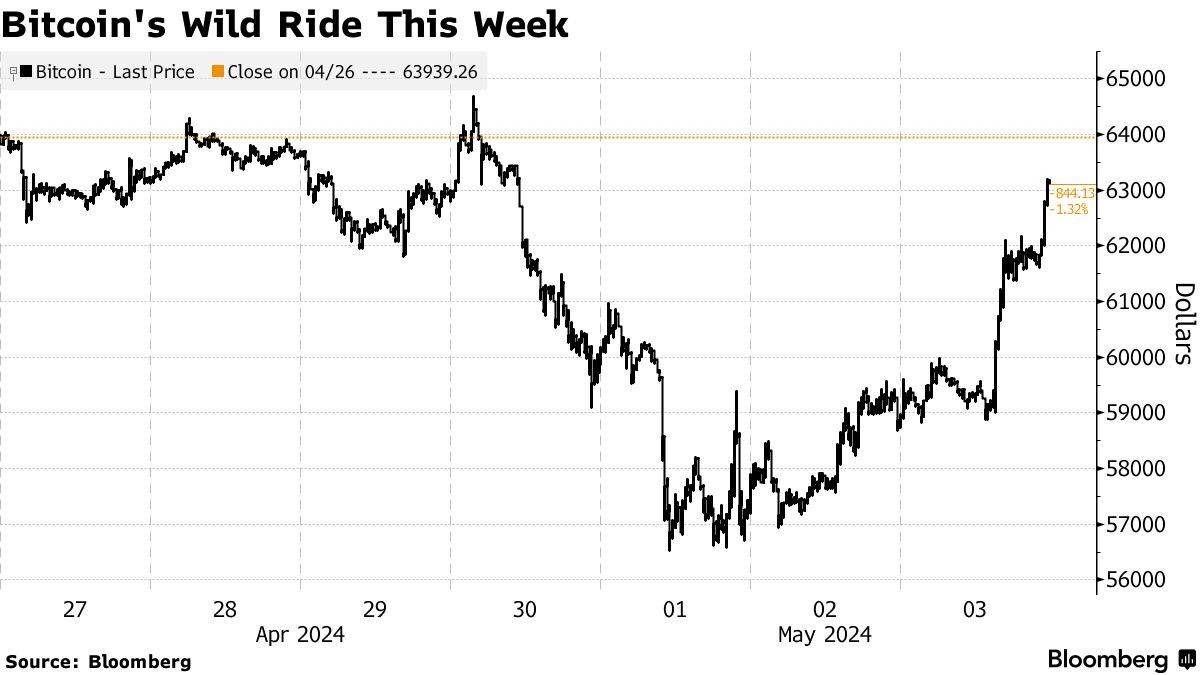

智通财经 APP 获悉,上周五疲软的美国 4 月非农就业报告引发市场对美联储降息的预期升温,并提高了包括比特币在内的风险资产的吸引力。比特币因此在上周五上涨,并抹去了上周早些时候的大部分跌幅——原因是市场担心美联储立场愈发强硬,且投资者对比特币现货 ETF 的需求正在消退。

比特币在上周剧烈的价格波动表明似乎更符合传统投资者的观点,即 ETF 买家对这种加密资产的影响力正在上升。对此,FRNT Financial 首席执行官 Stéphane Ouellette 上周表示:“本周的情况告诉我们,比特币 ETF 的新发展基本上以一种我们从未见过的方式打开了华尔街对比特币市场的参与。在此之前,比特币与其他资产类别没有任何明显的额相关性。而本周,尤其是周二晚在美联储政策会议前出现的抛售表明,比特币的交易与其他风险资产一致,这一点非常明显。”

数据显示,比特币在 5 月 3 日上涨约 7%,至至 62,937 美元,并推动以太币、Solana 等小型加密货币甚至狗狗币 (Dogecoin) 等 meme 币的价格上涨。而在 5 月 1 日,比特币跌至 56,527 美元,是大约两个月来的最低水平。

由于对利率将在更长时间内维持高位的担忧,上周三,投资者从 12 只比特币现货 ETF 中净撤出 5.64 亿美元,这是比特币现货 ETF 在 1 月获批之后的最大资金撤出规模。比特币从 3 月创下的近 7.4 万亿美元的纪录高位下跌,显示出一些交易员的担忧,他们 “可能看到了美联储或普通投资者尚未看到的全球宏观环境中的一些风险”。