Financial Report Preview | Is Palantir Riding the "AI Wave" and Continuing to Soar in Stock Price?

Palantir Technologies 将于北京时间周二晨间公布第一季度财报。投资者关注该公司商业收入增长情况,以及人工智能 (AI) 业务的可持续性。预计第一季度商业部门总收入将达到 2.904 亿美元,高于去年同期。Palantir 商业业务的强劲增长可能增强投资者对该公司拓展能力的信心。

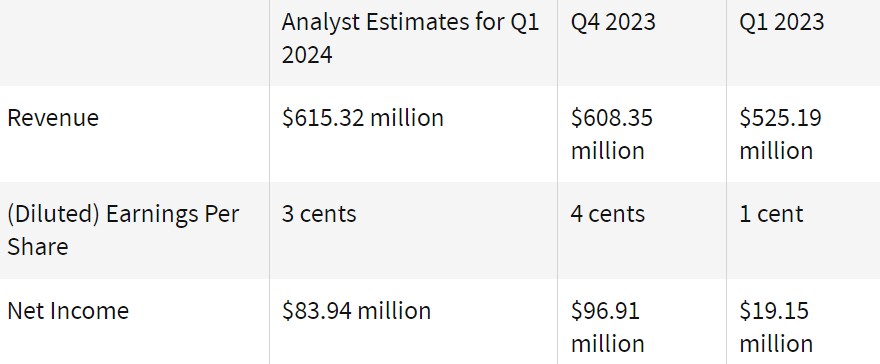

智通财经获悉,Palantir Technologies(PLTR.US) 将于北京时间周二晨间公布第一季度财报,投资者可能会关注该公司的商业收入增长情况,以及这家大数据分析软件制造商能否证明其人工智能 (AI) 业务的增长是可持续的。根据 Visible Alpha 编制的估计,分析师预计 Palantir 在 2024 年第一季度的收入将达到 6.1532 亿美元,高于上年同期;预计净利润为 8394 万美元,合每股 3 美分,高于上年同期的 1915 万美元和每股 1 美分。

关键指标:商业收入增长

投资者将关注 Palantir 商业部门的持续增长。由于对其人工智能平台的商业需求激增,该公司公布的 2023 年最后一个季度的收益好于预期。2023 年全年,商业收入约占 Palantir 总收入的 45%,其余部分由政府业务收入所贡献。今年 3 月,Palantir 宣布与美国陆军签订了一份价值 1.784 亿美元的合同。

Palantir 首席执行官亚历克斯·卡普在 2 月份给股东的一封信中写道:“我们的美国商业业务仍然是我们增长的重要推动力,我们预计这一趋势将持续下去。”

2023 年最后一个季度,Palantir 在美国的商业收入飙升至 1.31 亿美元,同比增长 70%。根据 Visible Alpha 编制的估计,分析师预计 Palantir 第一季度的商业部门总收入将达到 2.904 亿美元,高于 2023 年第四季度的 2.84 亿美元和去年同期的 2.361 亿美元。

Palantir 商业业务的强劲增长可能会增强投资者对该公司向政府客户以外拓展能力的信心。高盛分析师表示,他们认为,随着 Palantir 在数据拼接方面的优势与客户的人工智能项目交叉,围绕该股的关键争论将是其业务增长的持久性。

商业焦点:保持人工智能发展势头

投资者将在业绩会议上关注该公司高管评论,以判断人工智能的势头是否能维持 Palantir 的增长。在人工智能需求激增的背景下,人们对 Palantir 的潜力充满热情,Palantir 的股价因此上涨。一些分析师表示,它是一个关键的有利因素,而另一些人则认为,它在人工智能炒作方面被高估了。

Wedbush 的分析师称 Palantir 是 “人工智能中的梅西”——以足球明星莱昂内尔·梅西 (Lionel Messi) 为比喻。他们说:“每十年都有那么几次,科技公司如此领先于竞争对手,处于未来增长的最佳时机。”

相比之下,杰富瑞分析师表示,该股对人工智能潜力的 “夸大” 了,他们写道,该公司此前 “低估了 Palantir 商业和政府业务放缓的严重程度,这导致需求复苏时间超过预期,可能会在 2024 年之前继续限制增长”。

Palantir 股价上周五上涨 3.46%,至 23.33 美元;自 2024 年初以来,已经上涨了 31% 以上。