Coinbase's first-quarter report exceeded expectations, with ETF driving institutional trading volume to a record high

机构交易量同比上涨 115% 至 3120 亿次,但能否延续高位仍是个谜。

得益于比特币价格反弹和现货 ETF 上市,美国最大加密货币交易所一季度业绩同比翻番,净利同比转亏为盈,远超预期。

5 月 2 日周四美股盘后,Coinbase 公布了 2024 财年一季度业绩报告。财报显示,公司一季度营收实现 16.4 亿美元,预期 13.4 亿美元,同比增长 113%。在 7.37 亿美元持有加密资产未实现收益的加持下,Coinbase 一季度实现净利润 11.8 亿美元,连续第二个季度实现盈利,同比转亏为盈,去年同期为亏损 7890 万美元。

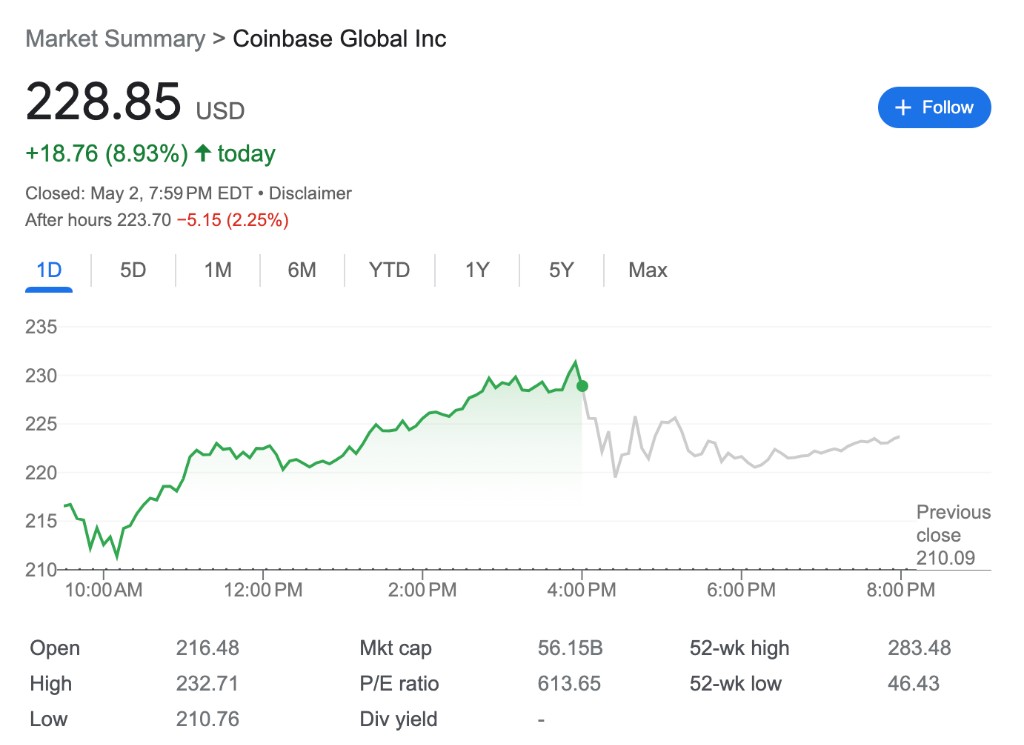

财报公布后,Coinbase 盘后股价涨 2.25%。今年以来,公司股价累计上涨超 45%。

交易收入涨两倍、托管收入翻番

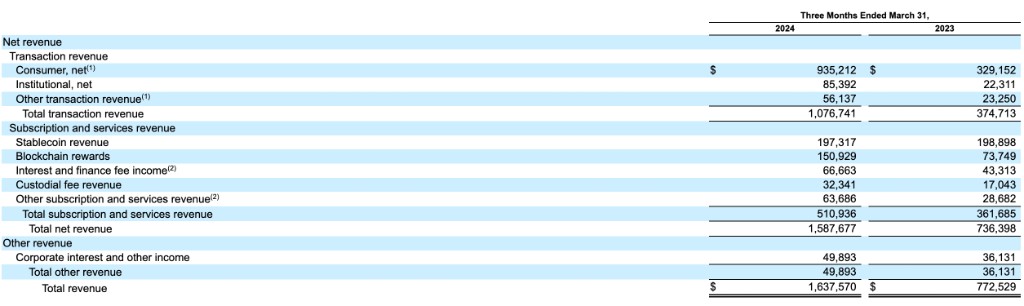

分营收类型来看,作为主要营收来源,Coinbase 本季度的消费者交易收入为 9.35 亿美元,较上年同期增长了 100% 以上,总交易收入几乎达到去年同期的两倍,达到 10.8 亿美元。

其次,订阅和服务收入本季度达到 5.11 亿美元。其中,一季度托管收入上升至 3230 万美元,较去年同期几乎翻了一番。据悉,Coinbase 为 11 家比特币 ETF 发行人中的 8 家提供比特币托管服务。

包括公司利息在内的其他收入一季度录得 4989 万美元,同比上涨 38%。

比特币 ETF 推动交易量和服务需求暴涨

今年年初,美国证券交易委员会(SEC)史上首次批准比特币现货 ETF,此后获批上市的 11 只 ETF 刺激了大量机构投资者的涌入,筹集了超过 500 亿美元的资金。

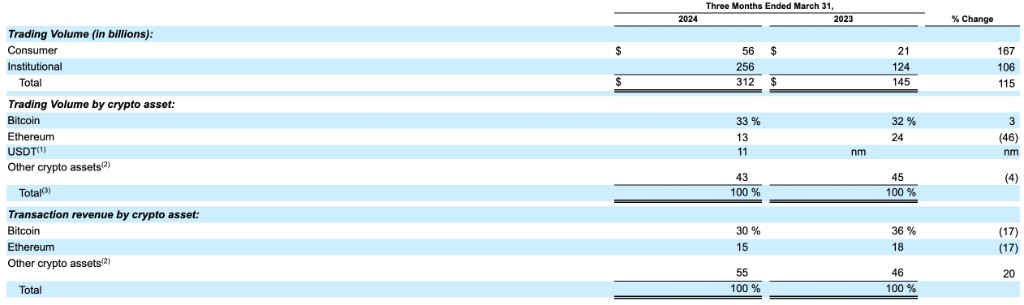

得益于 ETF 发行对交易行为的刺激,作为交易所交易基金的托管合作伙伴,Coinbase Prime 一季度交易量创历史新高,同比上涨 115% 至 3120 亿次,一季度营收也由去年同期的 2230 万美元暴涨至 8540 万美元,同期贷款激增至 7.97 亿美元。

比特币价格水涨船高,在今年 3 月创下 7.3 万美元/枚的历史新高,这进一步推高了 Coinbase Prime 的营收。

公司在财报中表示,:

“一般来说,我们平台上的交易量主要受加密资产价格、加密市值、加密资产波动性、宏观经济状况以及我们在加密市场现货交易量总量中所占份额的影响。在加密资产价格高企和加密资产波动的时期,我们的平台上的交易量也相应高。”

财报数据显示,一季度,与加密货币交易量密切相关的两项指标均录得增长:加密资产波动性增加了 12%,加密货币总市值增加了 94%。

并且,由于交易量的增长超过了加密货币市场现货交易总量的增长,Coinbase 的市场份额有所增加——在业务集中的美国市场,公司交易量在一季度增长了 78%。

不过,随着对交易热潮逐渐降温,Coinbase 的平台交易量能否延续高位仍是个谜。

Raymond James 分析师在本周的一份报告中表示:

“随着资金流入速度的放缓,比特币的价格达到顶峰,自 3 月中旬以来一直在小幅走低,”

“事实上,Coinbase 平台上的交易量已经远低于 3 月初的水平。”