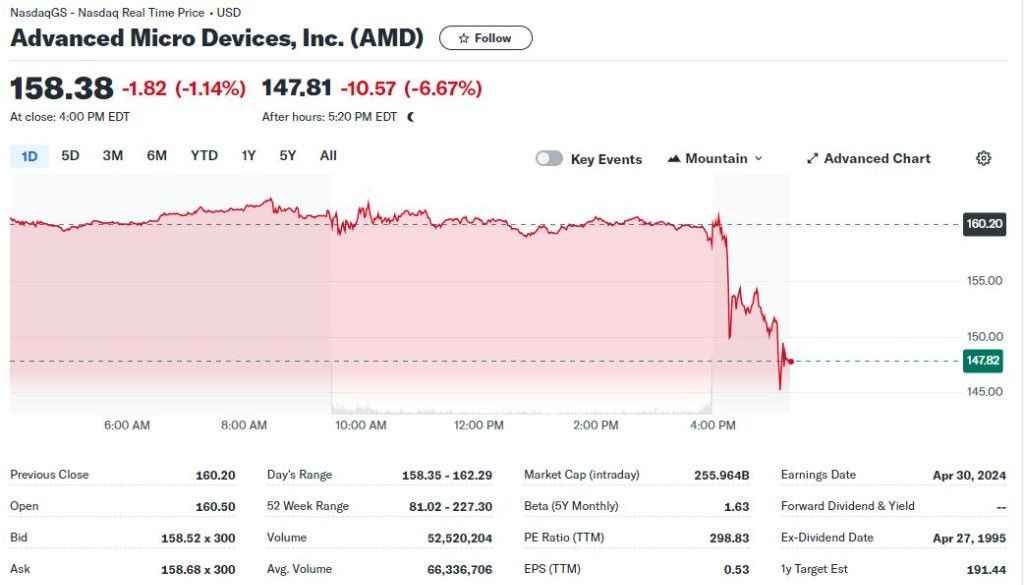

AMD's first-quarter report and guidance are not bad, but the sales outlook for AI chips does not meet the market's high expectations, leading to a 9% drop after hours | Financial Report Insights

AMD 一季报好于预期,营收同比增 2%,毛利率进一步扩大,包含 AI 芯片销售的数据中心收入、以及与 PC 市场改善紧密相连的客户端收入都同比激增 80%,而且数据中心收入创新高,但对二季度的营收指引 “没有制造兴奋度”,对 AI 加速器芯片的年销量预期上调后仅为 40 亿美元,远逊竞争对手英伟达,盘后股价跌幅加深。

4 月 30 日周二美股盘后,在 AI 芯片领域奋起直追英伟达、在 CPU 领域不断从英特尔手中攻城略地的半导体巨头 AMD 发布了 2024 年第一季度财报。

尽管公司一季报好于预期,包含 AI 芯片销售的数据中心收入、以及与 PC 市场改善紧密相连的客户端收入都同比激增 80%,但其对二季度的营收指引符合预期 “没有制造兴奋度”,对 AI 加速器芯片的年销量预期上调后仅为 40 亿美元,远逊竞争对手英伟达,盘后股价跌幅加深至 9%。

周二 AMD 收跌超 1%,止步四日连涨并脱离两周高位,今年以来累涨 7.4%,小幅跑赢纳指的累涨超 4%,但逊于费城半导体指数的年内累涨近 12%。

在人工智能增长的前景推动下,过去一年 AMD 累涨超 76%,而竞争对手英伟达则大涨近 200%。由于市场担心 MI300 AI 芯片的年销售额,AMD 已较 3 月初的峰值 211.38 美元回落了 25%。

在近期 32 位覆盖该股的分析师中,有 25 人评级 “买入”,7 人评级 “持有”,无人建议 “卖出”,代表华尔街依旧态度乐观,平均目标价 204.15 美元暗示还有近 29% 的涨幅空间。

AMD一季度营收同比增 2%,毛利率进一步扩大,上调 AI芯片年度销售预测

得益于人工智能和个人电脑 PC 的销量增长,AMD 的收入和盈利都同比扩张。

财报显示,AMD 一季度营收较上年同期的 53.5 亿美元增 2% 至 54.7 亿美元,略高于市场预期的 54.5 亿美元,但环比低于去年四季度的 61.7 亿美元。

调整后 EPS 为每股收益 0.62 美元,高于市场预期的 0.61 美元和去年一季度的 0.60 美元。在 GAAP 项下,一季度净利润 1.23 亿美元或每股收益 0.07 美元,去年同期为净亏损 1.39 亿美元或每股亏损 0.09 美元。

不过,有网友对 AI 芯片销售给 AMD 净利润提供的助力并不觉得满意。

公司一季度 GAAP 项下的毛利率同比上升 3 个百分点至 47%,非 GAAP 的毛利率上升 2 个百分点至 52%,非 GAAP 的运营利润为 11 亿美元,净利润为 10 亿美元,盈利能力继续加强。

业绩指引方面,AMD 预计今年二季度营收约为 57 亿美元,上下浮动 3 亿美元,区间中点等于同比增长约 6%、环比增约 4%,持平市场预期的 57.2 亿美元,非 GAAP 的毛利率将进一步增至 53%。

公司首席财务官称将继续推动收入增长和利润率提高,同时投资未来的巨大人工智能机会。

但有分析指出,仅仅发布一份略超预期的财报以及符合预期的营收指引,对期待AI迅速提供业绩助力的投资者来说是不够的,这才令 AMD 盘后股价跌幅不断扩大。

AMD 董事长兼首席执行官苏姿丰(Lisa Su)将今年 MI300 AI 加速器芯片的年销售额预测从年初的 35 亿美元上调至 40 亿美元,而此前市场认为 60 亿美元都是保守数字,失望情绪可能也参与加速盘后股价下挫。相比之下,英伟达一季度数据中心销售额达到 184 亿美元。

苏姿丰称,一季度 AMD 赢得了服务器 CPU 芯片的市场份额,“由于人工智能服务器的蓬勃发展,AMD 看到了对其 CPU 的需求改善迹象”。

今年一季度还是 MI300 AI 加速器推出后的首个完整销售季度,“供应紧俏且产品供不应求”。这款 AI 芯片已被微软、Meta 和甲骨文等超过 100 家企业和人工智能客户采用,自 2023 年四季度推出以来,该 AI 芯片的销量已超过 10 亿美元:

“对于整个行业来说,这是一个令人难以置信又激动人心的时刻,因为人工智能的广泛部署正在推动更为广泛市场对更多计算的需求。我们在扩大数据中心业务、以及在我们的产品组合中启用人工智能功能等方面执行得都非常好。”

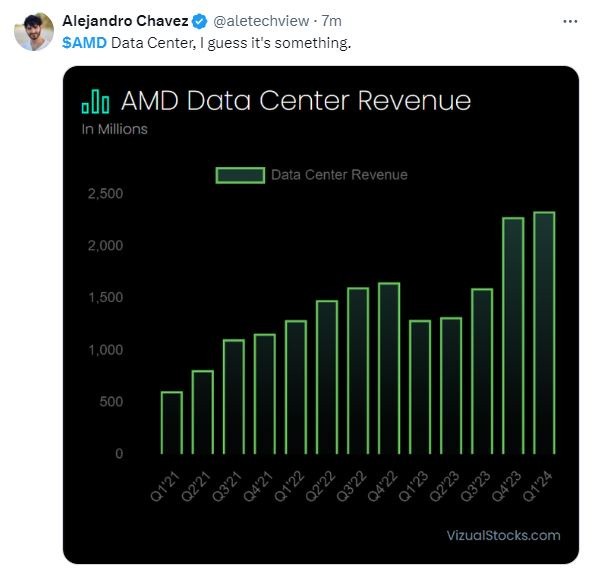

数据中心和 PC客户端收入都同比激增 80%,数据中心营收创新高且加速增长

苏姿丰评价称:“第一季度业绩强劲,在 MI300 AI 加速器出货量增长以及锐龙 Ryzen 和 EPYC 处理器的采用等推动下,公司的数据中心逾客户端业务均实现了同比增长超过 80%。”

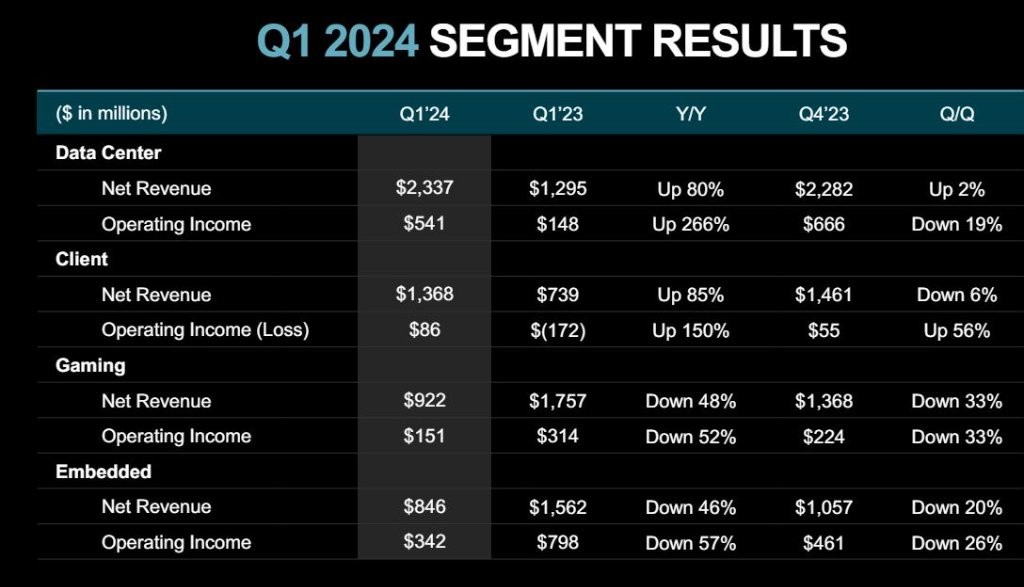

分业务来看,包含全新 AI 芯片的数据中心事业部一季度收入较上年同期的 13 亿美元大幅增长 80% 至 23 亿美元,创下该业务部门的历史最高纪录,高于市场预期的 22.7 亿美元,也明显好于去年四季度的收入同比增速 38%,代表去年底推出的人工智能 MI300 芯片功劳卓著。

有分析称,去年四季度和今年一季度的 AMD 数据中心收入增长得 “相当可观”。

公司称,在 AMD Instinct™ GPU 和第四代 EPYC™ CPU 增长的推动下,数据中心收入不仅创新高且同比大涨,环比也增长了 2%,好于市场预期的环比持平,主要受益于 AMD Instinct GPU 的销售推动。不过,该部门的收入部分被服务器 CPU 销售的季节性下降所抵消。

包括个人电脑 PC 销售的客户端事业部一季度收入同比增长 85% 至 14 亿美元,高于预期的 12.9 亿美元,主要得益于锐龙 8000 系列 CPU 的销售,但收入环比下降 6%。

去年四季度的客户端事业部收入曾同比增长 62% 至 15 亿美元。今年一季度 PC 市场开始复苏,据 IDC 统计,全球 PC 出货量当季增长了 1.5%,是经历两年下滑后首次实现增长。

但 AMD 的游戏事业部收入同比骤降 48%、环比下滑 33% 至 9.22 亿美元,显著低于市场预期的 9.64 亿美元,主要由于半定制收入减少和 AMD Radeon™ GPU 销量下降。客户继续管理库存水平,令嵌入式事业部的收入同比下降 46%、环比下降 20% 至 8.46 亿美元,逊于预期的 9.41 亿美元。

为什么重要和关注什么?

瑞穗分析师 Jordan Klein 表示,AMD 拥有通过财报重塑芯片行业投资情绪的 “最大机会”,此前其股价较 3 月份的峰值处于 “绝对自由落体” 颓势中,财报可能带动其他芯片股反弹。

投资者最关注的两个关键指标是:人工智能加速器 MI300等 AI芯片的销量指引与 PC市场表现。AMD 和英特尔还推出了 AI 电脑,即在本地而非通过网络便可运行生成式人工智能应用程序。

除了基于 AI 的资本支出之外,华尔街还希望 AMD 能提供进军数据中心人工智能市场的战略图景。年初 AMD 曾将 2024 年 MI300 芯片的收入预期从 20 亿美元上调至略超 35 亿美元,但低于市场普遍预期的 60 亿美元。AMD 曾称 MI300 芯片直接对标英伟达最畅销的 H100 系列加速器。

华尔街怎么看?

有分析称,AMD 企图利用 MI300 GPU 芯片来颠覆英伟达在数据中心 AI 市场的主导地位,但在英伟达推出下一代最强 Blackwell 平台且定价低于市场预期之后,AMD 的战略面临较大阻碍。

不过,凭借 Zen 4 架构和 MI300 芯片的强大护城河,华尔街对 AMD 不乏信心。瑞银认为今年 MI300 的销量在 50 亿至 60 亿美元都属于保守估计。Susquehanna 也认为今年销量会突破 50 亿美元,“我们相信 AMD 已经积累了足够的 MI300 预定和积压订单来支持其收入指引上调”。

美国银行表示,“仍然看好服务于云基础设施市场的供应商”,并称 AMD 将与英伟达、博通、迈威尔科技(Marvell Technology)和美光科技一道成为 “人工智能受益五巨头”:

“AMD 在今年下半年复苏的故事完好无损,人工智能和非 AI 服务器的数据中心增长都是催化剂。经过长期库存消化后,嵌入式业务也会从今年上半年的低谷中崛起。非人工智能领域将出现广泛的周期性复苏,服务器 CPU 库存将在去年出货量骤降 33% 后恢复正常。”

Bernstein 认为,AMD 年初展望的今年 MI300 销量显著弱于市场预期,可能是客户订单因高带宽内存供应问题被推迟引发的,但这不能反映最终需求不振,也不会是结构性的问题,MI300 作为英伟达强大替代品的能力没有变化:

“去年底的很多讨论都集中于 AMD 在人工智能硬件市场上仅次于英伟达的潜力。市场机会看起来很广阔,但 AMD 必须迅速行动才能将这个利好趋势资本化,因为英伟达没有停滞不前。MI300 勉强能与 H100 竞争,但英伟达正在推出 H200,下半年还将推出 Blackwell 芯片。”