Charlie Munger is gone, the most regrettable Berkshire Hathaway shareholders meeting

股东大会将于北京时间 5 月 4 日晚间举行。

一年一度的投资圈盛宴又要开幕了。

北京时间 5 月 4 日晚间,投资界人士将再次聚焦美国中部小城奥马哈,在这里,“股神” 沃伦·巴菲特的伯克希尔·哈撒韦公司将举行股东周年大会,巴菲特(Warren Buffett)和继任者格雷格·阿贝尔将会和参会者畅谈,接受来自分析师、股东、媒体等的提问。

但遗憾的是,今年的股东大会,缺少了查理芒格,芒格在 2023 年 11 月 28 日去世了,享年 99 岁。

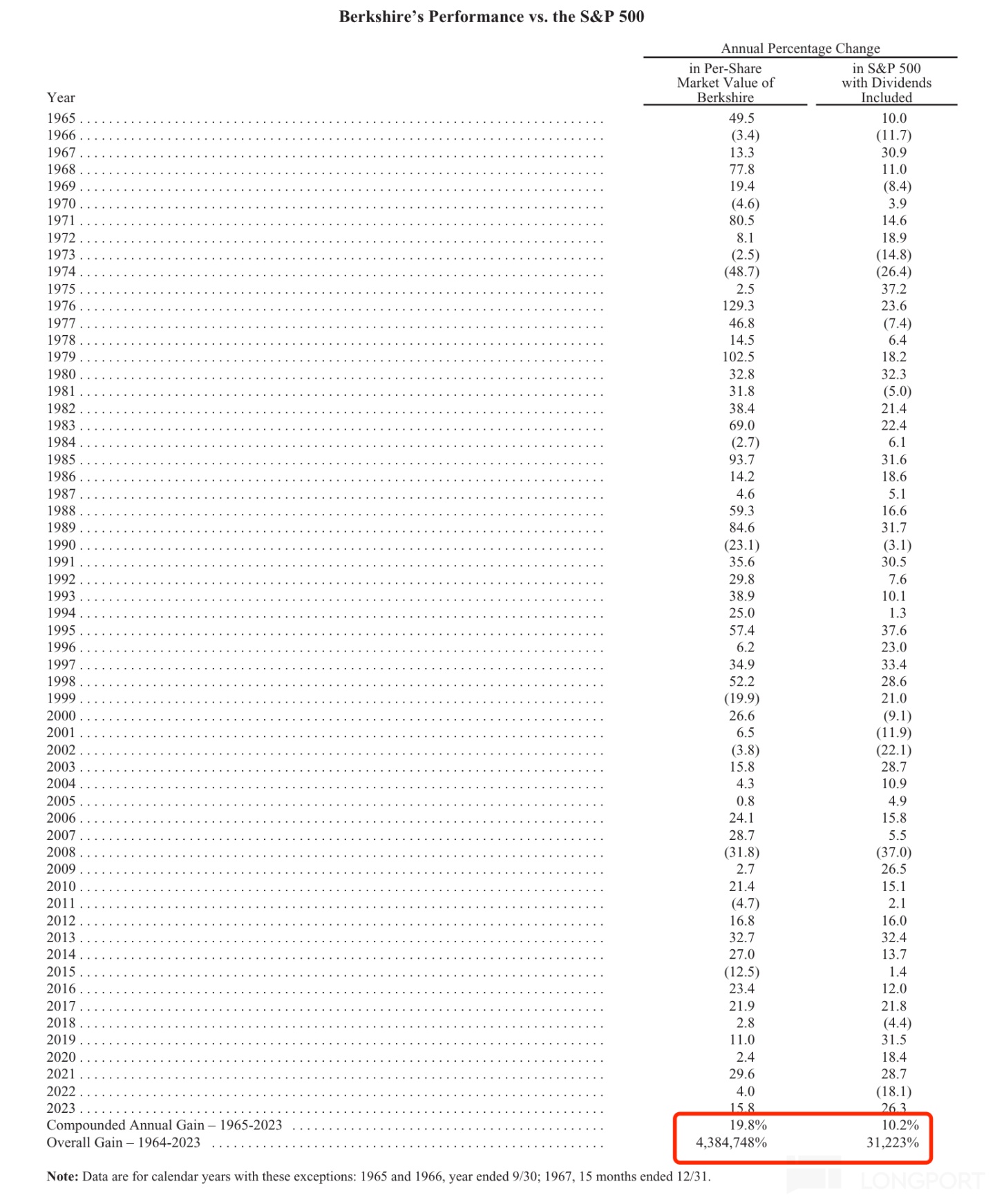

在过去的 60 多年时间里,巴菲特和芒格联手缔造了全世界最大的投资公司。截至 2023 年 12 月 31 日,伯克希尔以每年 19.8% 的速度增长(标普 500 指数为 10.2%),总回报率高达 4.38 万倍(标普 500 指数为 312 倍)。

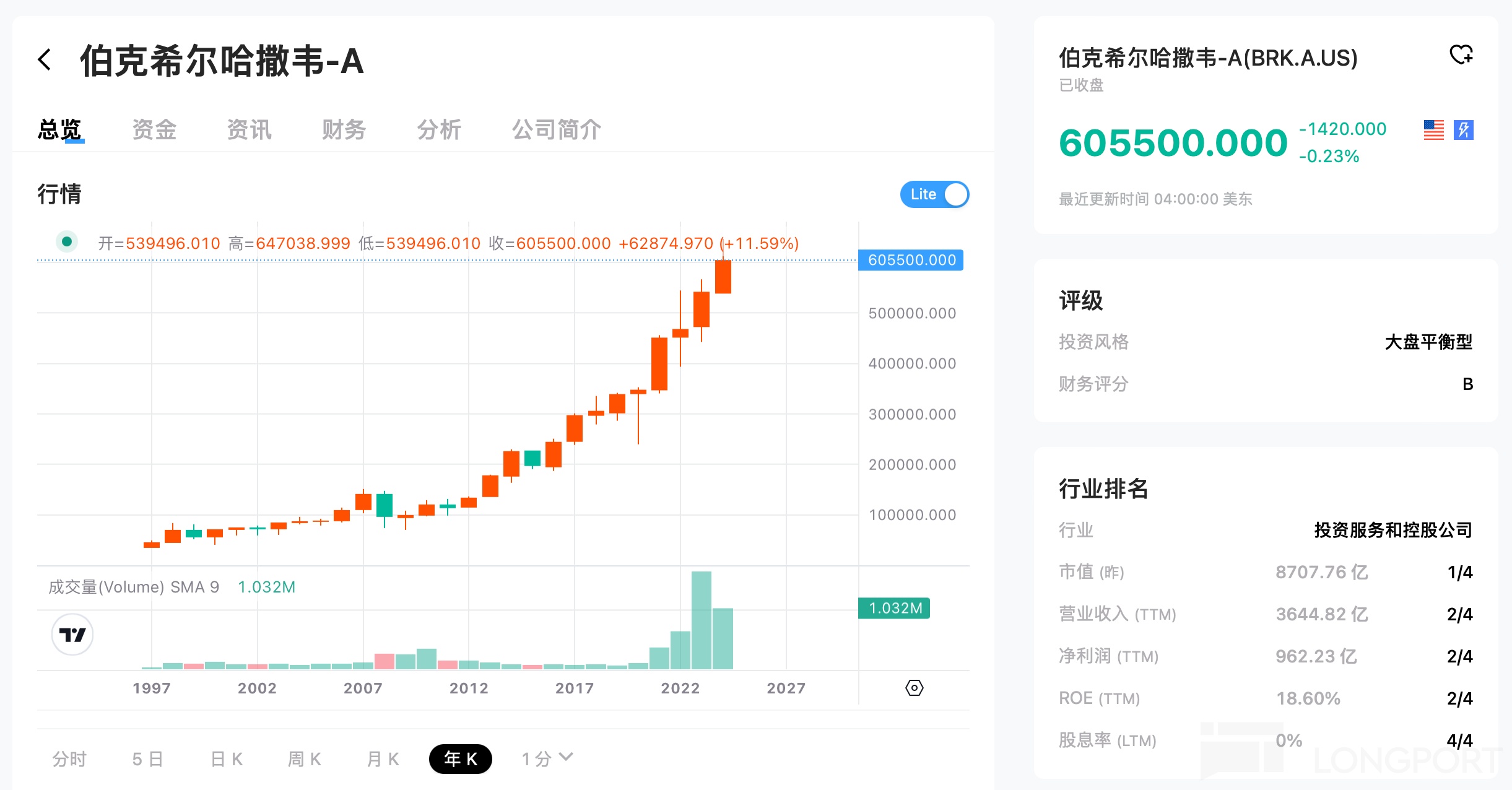

连续 9 年上涨的伯克希尔 A 类股,目前股价超过了 60 万美元,是世界上单价最高的股票:

2024 年股东大会可能会讨论的议题:

对地缘政治的看法:比如芒格在 2022 年表示了对地缘政治对担忧。芒格在 2022 年表示了对地缘政治的看法:我认为我们面临着一个可能是有史以来最严重的全球问题。世界行走在发动核战争的边缘。我们有很多需要担心的事情。世界从来都不是一个完全安全的地方,现在也不是。

巴菲特继任者讲话:沃伦·巴菲特已经 93 岁,芒格也已去世。今年的股东信上,他终于明确了接班人归属:格雷格·阿贝尔。投资者们想知道继任者的投资计划或风格。

对 AI 的看法:这两年是科技行业突飞猛进对两年,特别是 AI 行业日新月异的革新。

回购股票:伯克希尔哈撒韦拥有大量现金,回购股票一直是公司的一项选择。投资者们可能会问巴菲特是否会回购更多股票,以及回购股票的标准是什么。

投资策略:伯克希尔哈撒韦以其价值投资策略而闻名。投资者们可能会问巴菲特当前的经济环境下,公司将如何进行投资。

通货膨胀: 通货膨胀率正在上升,这可能会对伯克希尔哈撒韦的许多业务产生影响。投资者们可能会问巴菲特公司将如何应对通货膨胀。

最近市场行情:股市最近出现波动,投资者们可能会问巴菲特对股市的看法,以及他认为投资者应该如何应对。