Vanke Q1 revenue was 61.59 billion, with a net loss of 362 million, turning a year-on-year loss | Financial Report Insights

万科一季度收入 615.9 亿元,同比下降 10%,其中房地产开发业务合同销售金额 579.8 亿元,同比下降 42.8%。

4 月 29 日周一港股盘后,中国房地产龙头万科披露一季报。受行业环境影响,万科一季度业绩承压,但多元化布局持续深化,经营性业务表现亮眼,资产负债结构保持稳健。

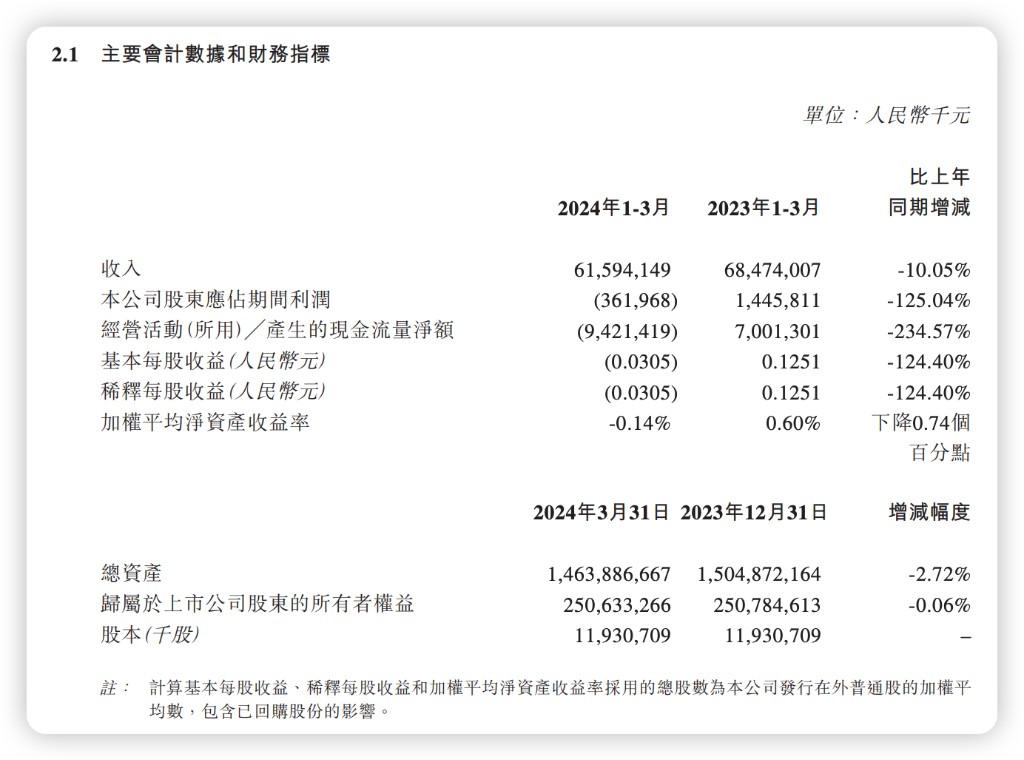

财报显示,万科 Q1 实现营业收入 615.9 亿元,同比下降 10%;归属于上市公司股东的净利润为-3.6 亿元,同比下降 125.0%,上年同期为盈利 14.46 亿元。

万科表示,业绩下滑主要受房地产开发业务结算规模下降和毛利率下滑影响。

从各业务条线来看,作为主要收入来源的房地产开发业务,一季度合同销售金额 579.8 亿元,同比下降 42.8%;结算金额 466.7 亿元,同比下降 13.8%。毛利率为 10.5%,同比下降 6.7 个百分点。

截至报告期末,万科在建面积 5675.7 万平米,规划中项目 3169 万平米。一季度,万科实现新开工及复工计容面积 170.0 万平方米,完成全年计划的 15.9%;实现竣工计容面积 265.8 万平方米,完成全年计划的 12.0%。

租赁住宅业务上季度实现营收 8.33 亿元,同比增长 7.3%。新拓展房源 7121 间,长租公寓累计开业数量 17.95 万间,出租率为 93.9%。已有 10.82 万间纳入保障性租赁住房。

物流仓储业务上季实现营收 9.7 亿元,同比增长 1%。其中高标库营业收入人 5.3 亿元,同比下降 5.4%,冷链营业收入(不含供应链业务收入)4.3 亿元,同比增长 10.1%。

商业开发与运营业务上季实现营业收入 23.8 亿元(含非并表收入, 不含轻资产管理项目收入), 同比增长 2.3%, 其中印力管理的商业项目营业收入为 14.3 亿元,同比增长 4.8%。

万科也在财报中披露了其目前的财务状况。扣除预收款后,万科负债率为 64.9%,净负债率 59.3%,现金可覆盖一年内到期有息负债。一季度新增融资成本 3.33%。

报告期内,万科实现大宗资产交易回款 42 亿元,其中上海七宝万科广场实现 50% 股权交易,交易金额 23.84 亿元。

经营性业务通过 REITs 实现资产盘活。中金印力消费基础设施封闭式基础设施证券投资基金(中金印力消费 REIT)将于 4 月 30 日在深圳证券交易所挂牌上市, 募集资金净额为 32.6 亿元。深铁集团通过战略配售认购基金募集份额总额的 29.75%。

万科还在财报中表示,目前正积极拥抱经营性物业贷等融资工具,全面融入城市房地产融资协调机制,推动融资模式转型,对于住建融资协调机制白名单项目会积极申报,应报尽报。

今日,市场传闻地产政策会出现方向性变化,地产股集体大涨,万科 A 盘中涨停,涨幅达 10.04%,这是万科 A 过去一年半时间里,首次罕见涨停,市值也由此重回 900 亿元大关。其在港股更是大涨 18.99%,创下七年半以来最大单日涨幅。

万科多支债券也涨幅强劲。其中,“22 万科 04”、“21 万科 04”、“22 万科 06” 涨超 6%。