NVIDIA fully resurrected! Surged over 6% on Friday, skyrocketed 15% for the whole week, semiconductor sector is booming again

英伟达本周的累计涨幅创下 11 个月最大,虽然尚未公布财报,但 “胜似公布”,表现抢眼,比本周财报公布后暴涨的科技巨头如特斯拉和谷歌母公司 Alphabet 还要多。本周整个 AI 竞赛的 “卖水人” 半导体板块都在上涨。

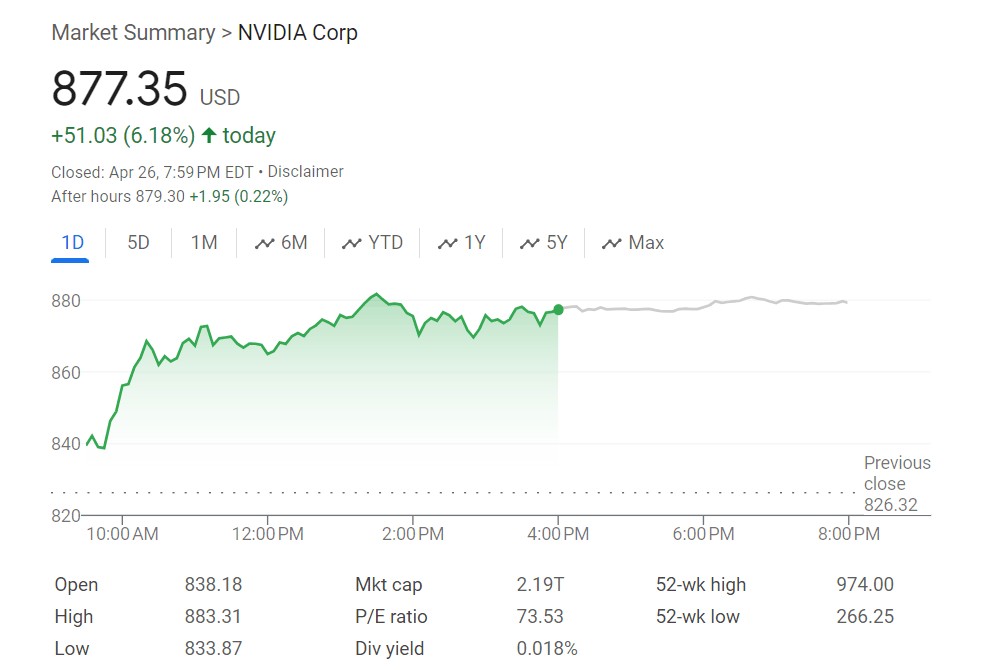

周五,英伟达延续周四的上涨,连涨两日,并且涨势加速,当日收涨超 6%,令本周的累计涨幅达到 15%,创下去年 5 月以来的 11 个月最大单周上涨,当时其公布财报显示 AI 芯片需求远超预期,单周涨幅达到超过 24%。

本周,英伟达市值增加了近 2900 亿美元,仅周五一天市值涨幅就出来一个英特尔。

回顾上周五,由于超微电脑打破此前提供初步业绩的惯例,叠加 ASML、台积电财报不及预期,引发投资者担心,怀疑市场芯片股、AI 概念股的热情是否已经过于高涨,市场恐慌情绪波及英伟达,英伟达单日罕见暴跌 10%,创 2020 年新冠疫情爆发初期以来最大单日跌幅,盘中市值跌至 1.9 万亿美元,创两个月新低。

本周的满血复活,意味着英伟达几乎抹去了上周的所有跌幅,仅用 5 个交易日,就从近期低点大反弹了 17%。英伟达股价收于 877 美元,创下 4 月 12 日以来最高。

本周,Meta、谷歌母公司 Alphabet、微软公司等公布财报,均豪赌 AI,承诺进行大规模的人工智能投资。

分析师们认为,未来属于人工智能。如果世界上最大的公司每家都投入百亿美元规模到这个领域,英伟达一定是最大赢家:

- 美国银行的分析师们点评称,来自主要美国超大型公司,如谷歌、微软和 Meta 的一季度报告表明,2024 年资本支出存在显著上行空间,主要由人工智能基础设施的建设推动。

- 业内人士说,如果看看所有的巨头的预算和资本支出,都集中在哪里?那肯定是英伟达,因为他们有最好的芯片。

也正是上述英伟达的 “躺赢” 逻辑,虽然其本周尚未公布财报,但 “胜似公布”,表现抢眼,比本周财报公布后暴涨的科技巨头如特斯拉(14%+)和谷歌母公司 Alphabet(11%+)还要多。

而大型科技公司们的表现就存在不定数了。例如,一季度业绩同样强劲,Alphabet 和微软大涨,而 Meta 重创。华尔街见闻网站提到,这背后的原因是,AI 投资已经开始为谷歌和微软带来巨大的效益,但对 Meta 的业绩而言更像是一个沉重的包袱,开启加速 “烧钱” 步伐,AI 变现之路任重道远。

本周不只是英伟达,整个 AI 竞赛的 “卖水人” 半导体板块都在上涨。芯片股周四总体逆市上涨后周五加速上行,费城半导体指数和半导体行业 ETF SOXX 分别收涨 2.6% 和 2.1%,连涨五日且五日跑赢美股大盘,两日刷新 4 月 16 日上周二以来收盘高位,本周分别累涨约 10% 和 9.3%,抹平上周至少 9% 的跌幅。与之相比,标普 500 指数本周累计上涨 2.6%,纳指 100 累计上涨近 4%。