CITIC Securities Q1 revenue and profit both declined, but the amount of equity underwriting still ranks first in the industry | Financial Report News

受益于成本管控加强和收入结构优化,中信证券 Q1 加权平均净资产收益率达到 1.88%。

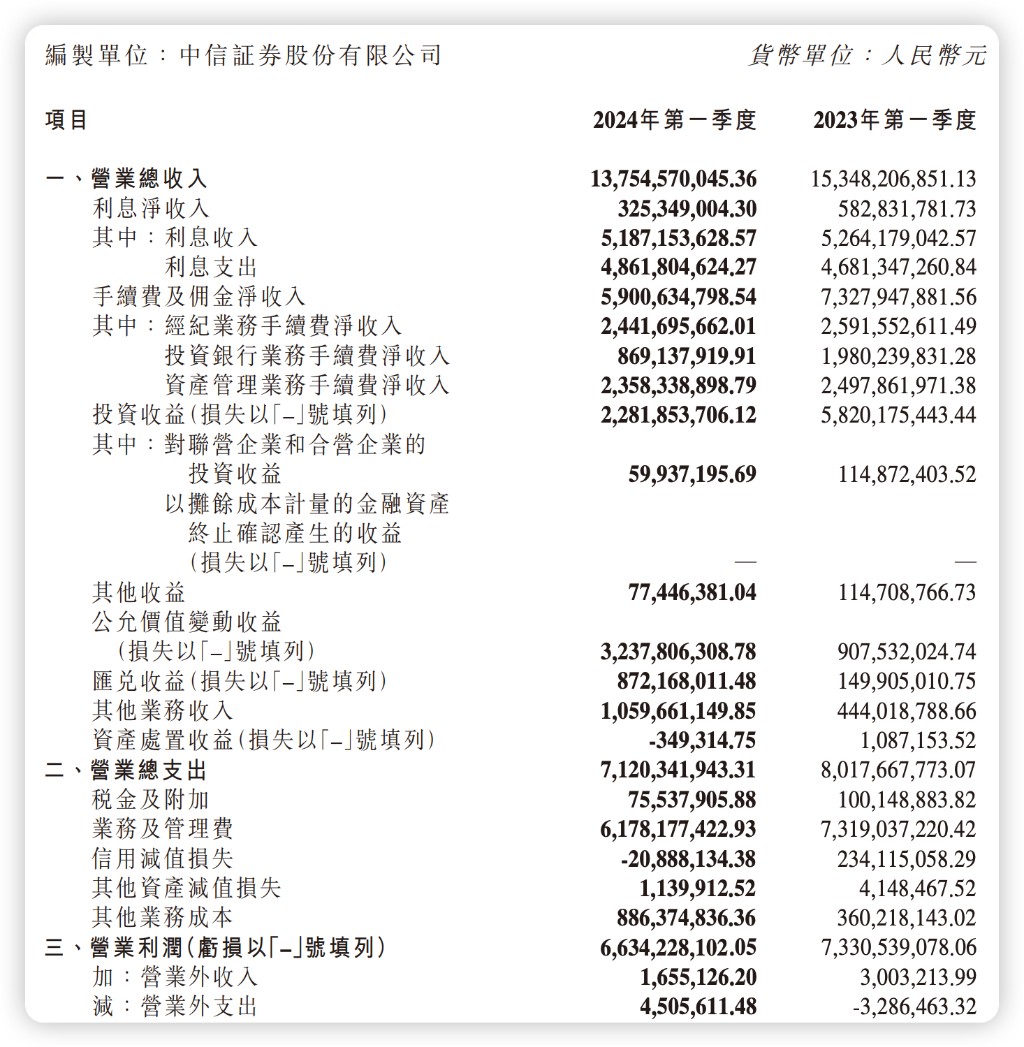

2024 年 4 月 26 日,中信证券发布 2024 年第一季度业绩报告。报告期内,公司实现营业收入人民币 137.55 亿元,同比下降 10.38%;归属于母公司股东的净利润为人民币 49.59 亿元,同比下降 8.47%。

从各项业务来看,中信证券经纪业务表现稳健,经纪业务方面,市场交投活跃,日均股基交易量同比增长 21.38%,中信证券代理买卖证券业务实现净收入 24.42 亿元,同比下降 5.78%,但降幅小于行业平均。

投资银行业务方面,股权融资市场有所回暖,公司把握机遇,完成多个大型 IPO 项目,股权主承销金额位居行业第一。债券融资承销规模 540 亿元,市场份额提升至 5.3%。并购重组、新三板等业务也取得突破,投行业务手续费净收入 8.69 亿元。

财富管理转型稳步推进,资产管理业务规模持续增长,一季度末受托资金规模 1.62 万亿元,较上年末增长 3.7%。大集合产品改造、养老金 FOF 等重点工作有序推进,主动管理规模占比提升至 51%。受益于规模增长,Q1 资管业务收入 23.58 亿元,同比增长 5.62%。

FICC 业务,公司审慎应对市场波动,优化投资结构,实现投资收益 22.82 亿元。固定收益投资抓住利率债投资机会,收益同比大幅提升;权益投资上,公司减持部分高估值头部公司,获利了结。此外,公允价值变动收益 32.38 亿元,主要系交易性金融工具浮盈增加。

财报还显示,中信证券资产负债表保持稳健,资产总额 15673.30 亿元,较上年末增长 7.84%。归属于母公司股东权益合计 2809.01 亿元,较上年末增长 4.49%。公司资产流动性充裕,流动资产占比达到 94.16%。货币资金 3343.49 亿元,结算备付金 468.96 亿元。

截至 3 月末,中信证券母公司口径净资本 1480.08 亿元,风险覆盖率 254.27%,流动性覆盖率 303.12%,净稳定资金率 146.31%,各项风险控制指标均优于监管标准。

成本管控方面,受益于成本管控加强和收入结构优化,中信证券 Q1 加权平均净资产收益率达到 1.88%。